What is Crypto Staking?

Staking cryptocurrency means that you're locking up your digital assets to support

the functioning of a blockchain network. Staking is at the core of a Proof-of-Stake

(PoS) mechanism, whereby the network validates transactions and produces new

blocks based on how much cryptocurrency a participant is willing to stake or

commit.

The PoS model is a departure from earlier Proof-of-Work (PoW) models (as with

Bitcoin), whereby servers expend machines thousands of times more than current

computers on difficult mathematical calculations to validate transactions. PoS

models are typically more efficient and do not necessitate investing in expensive

mining equipment.

To the average user, staking presents two key benefits. First, the user earns passive

income simply by holding and staking their crypto. Secondly, they are contributing

to the security and efficiency of a blockchain network they trust in. Well-known

networks such as Cardano and Ethereum 2.0 have developed their entire

infrastructure around a staking model, and staking can be done by anyone willing to

commit assets and lock them up for a period of time.

Ultimately, the power of staking is that it opens the gates of blockchain participation

up to anyone. You do not need to be an expert, nor do you need to invest in any

hardware. If you own stakeable cryptocurrency, you can earn rewards while

supporting decentralised networks.

Understanding the Mechanics of Staking

Let's break down exactly how staking works from start to finish.

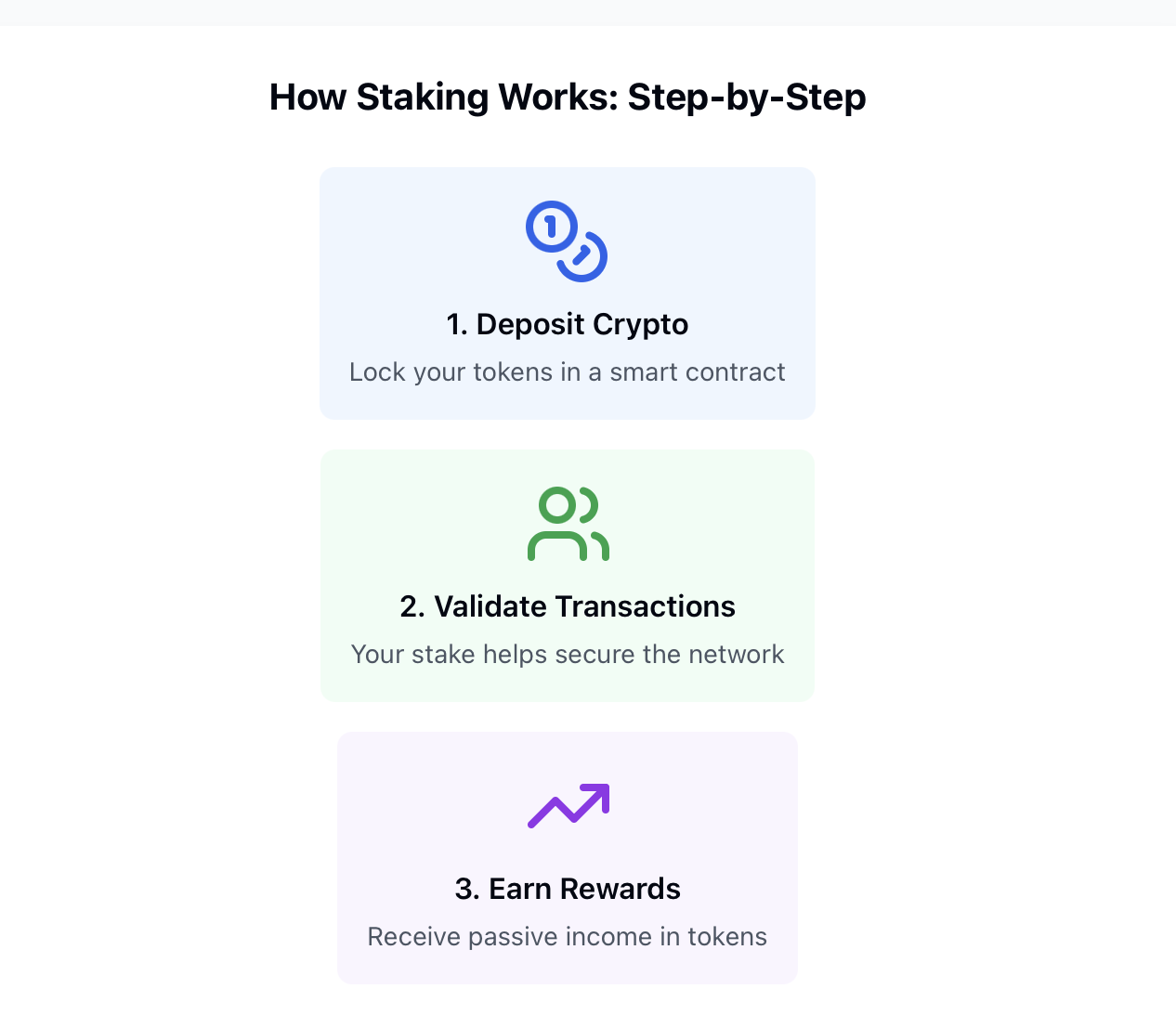

When staking your crypto, you are essentially depositing it into a smart contract or

protocol that uses that capital to validate transactions on the blockchain. The

process can be distilled into three primary steps: You deposit your crypto, that

crypto is used to validate transactions on the network, and you receive rewards for

your participation.

In most PoS networks, there are two classes of participants. Validators run the

actual nodes that process transactions and create new blocks. Validators must

possess a good deal of technical expertise and must frequently have a minimum

number of staked tokens. Delegators are the standard user who will assign their

staking power to a validator they wish to support. The validators will do the heavy

lifting of validating and creating new blocks, and the rewards will be shared

between the delegators and validators.

Rewards are not allocated on arbitrary schedules. They are calculated from the

number of tokens you stake, how long you have staked those tokens, the

performance of your chosen validator, and in many networks, there is likely a

lock-up period where your staked crypto cannot be withdrawn after being a token

that might be frozen for days, weeks, or months, depending on the network in

question. During that lock-up period, you cannot sell or transfer your staked

Crypto.

Take Tezos as an illustration. If you delegate your XTZ tokens to a validator, you

have to take into consideration the uptime, which is how reliable they are online,

the commission fee, which is how much they take (as a cut) from your rewards,

and their historical performance. If a validator goes offline often enough, it will

produce less in rewards, then less in your earnings.

Ethereum 2.0 is different. If you want to run your own validator, you need 32 ETH

and the skill set to run a node 24/7. Most casual investors delegate their ability to

run validation with a staking service, and while it's a tiny bit less return, it saves

time and energy consistently maintaining the technical piece.

In terms of reward distribution under each network, some have daily distributions,

others weekly, and so on. The percentage you receive (which is called the APY for

annual percentage yield) will vary depending on the total amount being staked

in the network, the inflation rate in the network, and also your validator

relationship.

Different Ways to Stake Crypto

Staking is not a one-size-fits-all solution. There are many different methods with

different pros and cons.

On-chain versus off-chain staking refers to where you are keeping your assets.

On-chain staking occurs on the blockchain itself and directly through a wallet or

native protocol. You have control over your own private keys and interact with the

whole network. Off-chain staking occurs through centralised exchanges. You can

stake your cryptocurrency, and the exchange handles everything for you while

controlling your crypto.

Delegated staking is the most common method for beginners since you are

basically delegating your stake to a validator who runs the node and processes the

transactions. Although you keep ownership of your tokens and usually can unstake

them (after your lockup period), the validator takes a commission from your

rewards. Cardano's entire staking system is built around delegation, making it

extremely user-friendly.

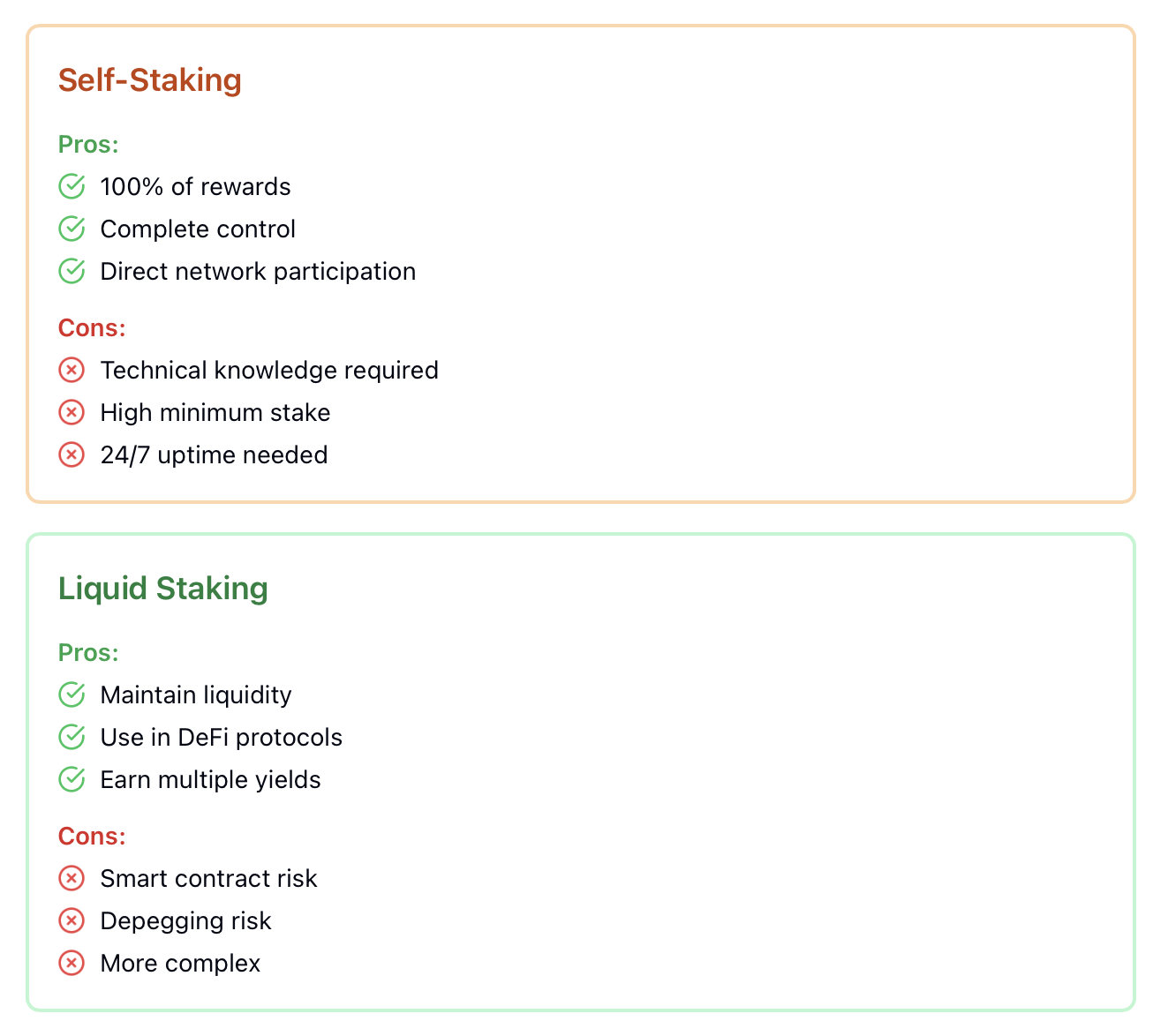

Self-staking means you are running your own validator node. This requires some

sort of technical skills, dedicated hardware that stays online, and in many cases, a

large minimum stake. The benefit is that you keep 100% of the rewards and have

complete control over your participation.

Liquid staking is the latest development. Sites like Lido and Rocket Pool allow you

to stake your crypto and get a derivative token. You stake ETH on Lido, for

example, and receive staked ETH (stETH) in return, which contains both your

staked ETH and any rewards. What makes it exciting is that now you can trade,

lend and deploy stETH to different DeFi protocols while still earning staking

rewards on your ETH.

Liquidity and yield at the same time. Cosmos has another spin on staking in the

form of delegated staking, where you stake your ATOM tokens to multiple

validators at once. Delegated staking also allows you to spread your risk over

different operators. Risk is involved in each of these situations. Exchange staking is

convenient; however, you do have to trust a third party with your assets.

Self-staking gives you the most control but requires a level of technical knowledge.

Liquid staking gives you flexibility, but it has smart contract risk and more layers

of complexity.

How Much Can You Earn?

Your earnings from staking can vary greatly depending on which network you select

and the market conditions.

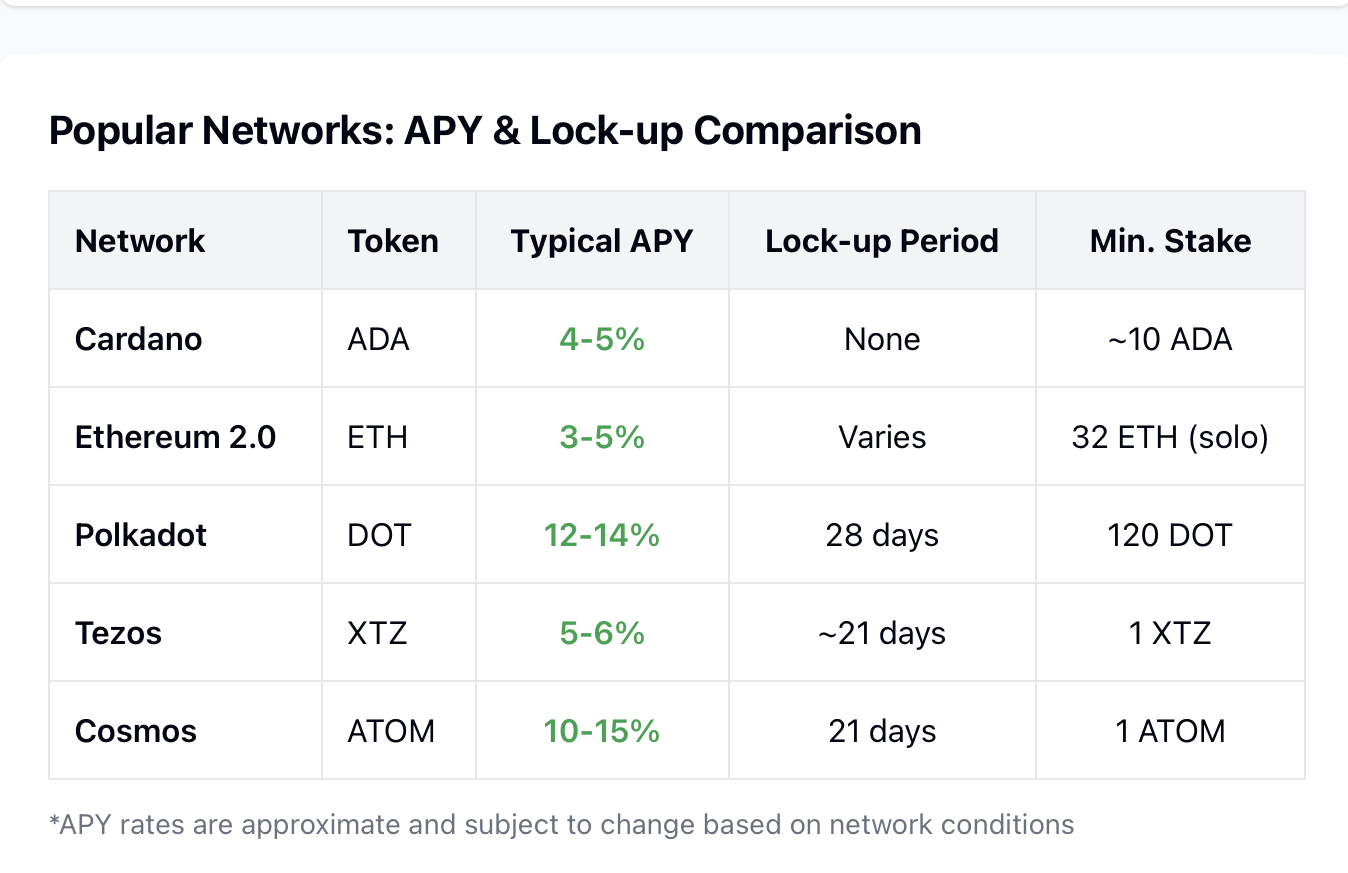

The annual percentage yield on staking commonly ranges from 4% to 20% on

popular proof-of-stake networks. Cardano (ADA) usually is consistent at around

4-5% APY; new and smaller networks may advertise much higher, 15% or more.

Polkadot (DOT) has typical yields around 12-14%, while Ethereum 2.0 yields

change from 3-5% depending on the total amount of ETH staked across the

network.

The actual per cent return varies based on a number of factors. Network inflation

drives the overall reward structure because most staking rewards come from

inflation of new token issuance. Higher inflation means greater rewards, but can

also mean lower token value over time. One other variable to factor in is validator

commissions on your earned rewards, which generally range from 0%-10%. Some

validators charge no fees; however, their uptime may be inconsistent. Other

validators may charge a premium fee, but they will be consistent in their uptime.

Lock-up duration also plays a role in staking rewards with some networks. A

commitment of a longer duration might merit greater yields as that reinforces

network stability. The total amount of staked tokens in the network also matters.

When fewer people stake, the individual staker receives more; when staking is

popular and more tokens are staked to lock up more value, the rewards are diluted

across a larger number of stakers.

Let's consider an example to make this more tangible. If, for example, you stake

1,000 ADA when the network offers 5% APY. Then after a year, assuming the

validator has a 2% commission structure, you would earn approximately 49 ADA

(1,000 × 0.05 = 50 ADA less the 2% commission). Effectively, you would have

earned passive income for doing mostly nothing except choosing a good validator.

The mechanics around Polkadot's rewards structure function differently due to its

nomination system. For instance, withdrawing rewards from high-performing

validators may earn you something closer to a 12% APY on DOT (instead of ADA).

Bear in mind that if your nominated validators are slashed for being poor

performers, you will not benefit from their poor decision-making.

Keep in mind, however, APY numbers are just estimates of what you could earn;

there are no guarantees. APY amounts can vary depending on what is happening on

the network, total stake, and market forces at play. For example, if a network

advertised a 15% APY today, that APY may drop to 10% tomorrow based on

increasing participation.

Finally, keep in mind - returns are paid out in the native token of the network, and

if you staked $1,000 worth of crypto and earned 10% APY over the course of a

year, you’d receive $100 worth of that crypto based on market rates. If the price of

that token drops by 20% over the year, then based on the price per token, your

returns are actually negative, even if you received staking rewards.

Understanding Staking Risks

Staking has its risks, and it's important to have the awareness that comes with

knowing the possible downfalls before you start staking your assets.

The most extreme technical risk is slashing penalties. Slashing refers to the protocol destroying a portion of the staked funds to penalise validators that misbehave by being offline too long, validating bad data, or trying to attack the protocol. For example, Ethereum 2.0 has harsh slashing criteria that could result in the loss of an entire 32 ETH stake for very bad behaviour. As a delegator, you share in that risk; if the validator you have delegated tokens to gets slashed, a percentage of your staked tokens will also be lost.

Another issue is market fluctuations. You might earn 10% more tokens instead of fiat when you stake, but if the price of the token falls 50% that same day, you've still lost money overall. In the crypto winter of 2022, many stakers saw the value of their portfolios decrease due to price fluctuation while they continued to accumulate more tokens through their staking rewards. Things become even worse due to the lock-up, as you will not be able to sell when the price falls.

Smart contract risks apply to liquid staking and staking through DeFi platforms, too. For example, a liquid staking platform like Lido uses smart contracts that could have flaws. If a bad actor finds a way to exploit a bug or flaw in the smart contract, the stakers will lose their assets. This has happened on several small staking platforms during the recent explosive growth of the DeFi segment of the crypto ecosystem.

Validator centralisation results in risk at the network level. A small number of validators would hold too much of the staking capital, meaning there is less centralisation and increased risk to coordinated attacks or censorship.

Liquidity, Capital is locked. If you stake for a period of time, let's say it is 28 days of unbonding, you will have to wait for 28 days once you terminate the staking because the cash could be at stake. Furthermore, if you had to get cash quickly and terminated the staking process and the platform allowed you to cash out, you would have to sell into the market, which usually is not at a good price.

The risk of staking manifested during the collapse of the Terra ecosystem in 2022. People were staking LUNA or using the Anchor Protocol for staking-like yields - now risk turned into catastrophe. Everything was lost when the algorithmic stablecoin collapsed and the entire ecosystem imploded.

While risk cannot be fully mitigated, it requires exploration and peace of mind. One would always want to select validators with a track record of good uptime and a good reputation in the community. In general, humans should not stake more capital than they can afford to have locked up. Another general rule for any staked network is to understand the circumstances that would invoke a slashing protocol. Finally, humans should never put all of their eggs in one basket by staking all of their crypto assets on one network or validator.

How to Start Staking

Thinking about staking? Here's your practical guide.

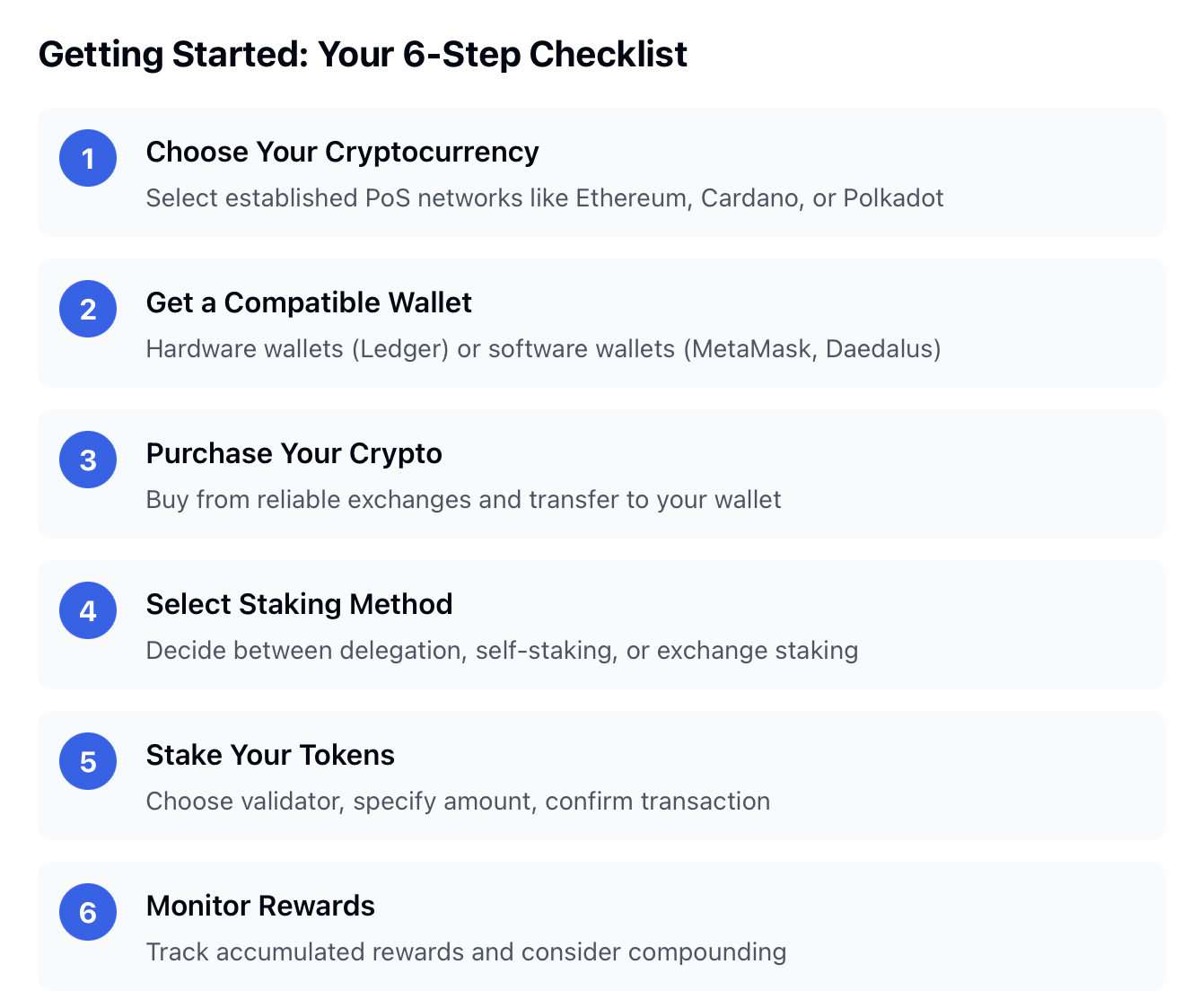

Step 1: Select your cryptocurrency. Keep in mind that not all crypto is stakeable. You can begin by sticking with established PoS networks like Ethereum, Cardano, Polkadot, Solana, or Tezos. Research the stake opportunities for each network, including lock-up periods and average returns.

Step 2: Get the wallet. If you are planning to stake with self-custody, you will need a wallet that is compatible with your network. Hardware wallets like Ledger Nano X offer the most security for committed stakers. For Software wallets, Ethereum uses MetaMask, Cardano uses Daedalus or Yoroi, and DOT uses Polkadot.js. Ensure the wallet you are using supports stakable functions and not just storage.

Step 3: Purchase your crypto. Buy your cryptocurrency of choice using a reliable exchange. After deciding on the crypto you wish to stake, transfer it to your wallet's dedicated address for each crypto. Don't stake directly from your exchange accounts unless you intentionally plan on using the staking service from the exchange.

Step 4: Decide on whether to delegate or self-stake your crypto. For most beginners, delegation is the best option. Once you've decided on your crypto, review the delegation validators available to you. Take note of their commission rates, uptime history, and community reputation. Most wallets will list validator stats in their interface.

Step 5: Stake your tokens. Review the staking interface in your wallet to either delegate or stake. Select a validator, specify the quantity of tokens to stake, and confirm the transaction. Make note of minimum staking amounts and lock-up times.

Step 6: Verify your rewards. Most wallets display your accumulated rewards in real-time whenever you log into the wallet. Some networks automatically compound your rewards, while others require you to manually claim the reward and restake it.

If you are a beginner, exchange staking is the easiest method through Binance, Coinbase or Kraken. With exchange staking, you can keep your crypto on the exchange, then just click "stake", and the "stake" button starts you earning rewards. The drawback is that you have less control and usually lower yields as the exchange takes its cut.

Cardano delegation is a great entry point for beginners because there are no lock-up periods, and you can switch validators at any time. Ethereum staking is more complex, which is why most utilise Lido or Rocket Pool as liquid staking options.

Always prioritise security. Enable two-factor authentication for all of your accounts. If you're using a hardware wallet, you should store your recovery phrase offline and in a secure location. Never share your private keys with anyone, and be sceptical of any platform claiming to offer unusually high returns from staking.

Staking in the DeFi Ecosystem

Liquid staking has changed the landscape of staking by removing the history of trade-offs between earning yields and liquidity. Traditionally, staking locks your assets in, earning rewards during this time, but you cannot do anything else with that capital until you unstake it. Liquid staking solves this problem by issuing a derivative token that represents your staked position.

You can freely transfer these derivative tokens, use them as collateral, or deploy them in other DeFi protocols, all while your original stake earns rewards. Overall, liquid staking transparently represents staked assets, and you can always sell those assets while they are still staked.

Lido is the biggest player in the space when it comes to Ethereum liquid staking. When you stake ETH on Lido, you will get stETH (staked ether or staked ETH) tokens issued to you in exchange. The stETH tokens grow in value according to the ETH rewards your stake is earning.

You could then deposit your stETH tokens into Curve Finance liquidity pools (to earn liquidity provider trading fees) or use them as collateral for borrowing in Aave (a lending/borrowing protocol) for other asset types. Holding your stETH (earning rewards) while having the ability to sell at any time (even while waiting months for the Ethereum unstaking period to end) is power.

Rocket Pool represents a decentralised alternative, and its derivative token is rETH. The main difference in Rocket Pool from Lido is the permissionless validator node system. Rocket Pool allows anyone to run a validator node with a minimum of 16 ETH instead of Ethereum's standard 32 ETH.

This results in an opportunity that compounds. Not only does your staked ETH earn staking yields, but your stETH can also earn trading fees from Curve pools. The moment you borrow stablecoins against your stETH and deploy them for yield elsewhere, an individual asset earns a variety of income streams at the same time.

Cosmos takes a different approach to staking through its Inter-Blockchain Communication protocol. You can stake ATOM and still take advantage of governance and validator functions across all chains connected to it, though this may not be entirely classified as "liquid staking."

The associated risks compound as well. You not only have common staking risk, but you also have smart contract risk from the liquid staking service, as well as some possibility of your derivative token depegging from the underlying asset, in addition to risk from being a multi-protocol position manager.

Additionally, we saw some de-pegging of stETH from ETH during the Ethereum merge due to market uncertainty, with stETH trading as low as 0.95 ETH/stETH. The individuals who panicked and sold locked in losses, while those who waited saw the peg return to 1:1.

Maximising Staking Rewards

Implementing a strategy for staking can enhance returns more than trying a passive approach.

Don't be afraid to aggressively compare networks and platforms. Staking rewards are continuously shifting based on participation in the network. Just because a network has 15% rewards today doesn't mean it will a month from now - you might see it drop to 8% rewards. This is why you should regularly check the staking rewards and don't feel guilty about switching networks if it makes sense.

You may not realise how important the validator you choose is. A network with a 99.9% uptime and 5% commission will outperform a network with 95% uptime and 0% commission. Missing blocks means missing rewards. For staking with a validator, you want one that runs a low-risk operation that has good uptime and a low-rate fee - preferably ones with some sort of track record, an active community (social media presence), and a transparent platform.

You will want to optimise your lock-up period! This can require stewing and balancing your liquidity needs against a higher yield. Some networks will allow users to earn tiered staking rewards (longer lock-ups will earn high rates). If your finances allow it - and you do not need to access your funds for any reason, you can take advantage of the tiered rewards and potentially earn several points higher in your APY.

You should compound your rewards whenever able. If a network does not auto-compound your rewards, it is important to claim and restake your new "earned rewards" consistently. The idea (power) behind compounding is - for example - if you stake 1,000 tokens at 10% APY for 1 year and earn monthly or compound your daily/monthly/quarterly staking rewards, it will yield much higher dollar value than if staking somewhere around 8% APY (simple staking).

Consider diversifying your stakes across validators. Several networks allow you to spread your stake across different validators. This is helpful to lessen the risk if one validator isn't producing the revenue you expected or is slashed. Polkadot's nominations indirectly motivate you to stake this way.

Tax loss harvesting can improve your after-tax returns. If you are staking a token that has depreciated in value, you can unstake to realise the loss for tax purposes, and then reinvest the same amount at a lower price basis.

Keep an eye on governance proposals. Some networks will compensate stakers to participate in governance voting. For example, Tezos bakers who vote on proposals can receive bonus rewards in addition to their regular staking yield.

Cardano takes out a lot of the work of optimisation since there is no lock-up period. For example, if you are not satisfied with your allocator and you think another is better, you can change every five days. It is worthwhile to look up the annual yield trends of various pools and change your stake as expected annualised yield allows.

The essential point is not to think of staking as a passive investment strategy like a savings account, where you set it and forget it. Instead, think of it as an active investing strategy that requires just an hour of your attention, once a month, to look at your stake pools, evaluate your accounts' validators' performance, and see if there are ways for you to earn more.

Tax and Compliance Considerations

Staking rewards are taxable, but the rules will vary significantly by country. In the United States, the IRS taxes staking rewards as ordinary income and taxes you for them from the moment you gain control over them. For instance, if you earn 10 tokens with a fair market value of $100, you now have a tax liability of $100 without even selling the tokens.

Later, when you sell those tokens or the price changes, you have a capital gain or capital loss. This double taxation surprises many stakeholders. H M Revenue & Customs [UK tax authority] has similar rules to the IRS. Staking rewards are miscellaneous income and are taxable as income tax when you receive them.

A capital gains tax applies later when you dispose of those tokens. Germany has a better model to work with than the US and UK. If you hold your crypto for more than 12 months, it is tax-free. This also applies to staking rewards. Thus, if you stake and transfer the rewards, you can hold those rewards for more than a year before you sell them, and you will have no tax responsibilities to the German tax authority.

Singapore doesn't tax individual capital gains and is a crypto-friendly jurisdiction. Staking rewards have not been specifically addressed in the laws surrounding taxation in Singapore, but as a general rule, staking rewards would be considered outside of a taxable event for an individual who is not engaged in the business of crypto trading.

Compliance requirements add another layer. Centralised staking platforms must follow. Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Expect to provide identification documents, proof of address, and potentially source of funds information when staking through exchanges.

Decentralised staking via self-custody wallets avoids KYC requirements, but you are legally required to report your income and gains on your tax returns. In essence, public blockchains are providing tax authorities with the potential to track your activity even when exchanges aren't reporting the necessary information.

You should document every staking transaction, keeping track of the date, amount, token price in your local currency, and staking validator. Crypto tax software such as CoinTracker or Koinly can automate these tracking tasks and produce tax reporting for compatible tax document formats in your country.

This level of detail is compounded with liquid staking and integration with DeFi. If you are staking ETH for stETH, then contributing stETH to a liquidity pool, you may create multiple taxable events. Reward claims, token swaps, and entering/exiting a position can trigger tax reporting.

If you're staking enough to justify the fee, it may be prudent to seek professional tax advice. The rules in this space are changing rapidly, and one misinterpretation could cost you penalties or deductions.

Avoid Staking Pitfalls

Even seasoned cryptocurrency participants can make a variety of staking errors that can potentially cost users money or opportunities to make money.

Beginning users' most common mistake is ignoring the length of lock-up periods. A user could stake their tokens, the price crashes, and at some point later, the user realises that they cannot sell their tokens for 21 days. By the time the user has unstaked, the price of their token has fallen another 30%.

Always be sure to understand the unbonding period before committing funds if it is inappropriate for you. If you need liquidity, just choose a network with no lock-up, like Cardano, or experiment with one of the liquid staking alternatives.

Chasing yield only will lead to your downfall. If a network is promising 50% APY on any one validator, there is most likely a serious issue with that network. Hyperinflation, low checks on the security of their assets, or low community participation could be a potential reason for such high APY. Generally, sustainable yield only happens in the 15% - 20% APY range. If you see anything higher 15% - 20% on anything applying to yield, you should be very sceptical.

Failing to research validators could put your entire stake at risk. That validator that has the catchy name with 00% commission might be just that. They could be new, and it’s already untested. And maybe they are running their infrastructure at a time when the network is congested, and their infrastructure crashes. A validator's downtime not only results in reduced rewards, but it could also risk actually penalty or slashing!

Failing to diversify staked assets could create an unnecessary concentration risk. A staked asset gives one validator control over your holdings. If that validator gets slashed, you will lose your entire stake. Place a stake with a reputable staked asset, and if there are other validated staking options, select a few and spread your risk.

Missing out on compounding can leave you with less money than you could have earned. If your network does not auto-compound, and you don't habitually claim and re-stake your rewards, you are missing out on the compounding effects of rewards over time.

Misunderstanding tax liabilities leads to issues during tax time. In most jurisdictions, staking rewards are taxable income, and the tax is due regardless of whether you sold the tokens. Start setting aside tax money whilst earning rewards.

In the early days of Ethereum 2.0, there were countless slashing events where users lost tokens due to configuration mistakes or double-signing attempts, and they were not bad actors; rather, they were mistakes and errors that cost users real money. If you are a delegator, your risk will never be zero, but it will be less than what it would be if you were a validator. In 2022, Ankr suffered a staking exploit, which showed that vulnerabilities at the platform level could structure a triggering event that affected users without there being an issue at the underlying blockchain layer.

The best way to protect yourself is through education. Spend time learning about specific risks, responsibilities and the underlying mechanisms of any network before staking. Read the validator policy, research past reputation in community forums, and test the protocol in learning for your own comfort, stake small amounts until you are confident. The crypto space rewards patience and punishes impulsive decisions.

Participating in PoS Network Decisions

Staking provides you with much more than rewards; it provides you with voting power with respect to governance of the network, so that you can help influence the future of the blockchain. Proof-of-Stake networks often have on-chain governance provisions, whereby stakers will vote on governance proposals that change protocol parameters, govern the treasury spending, and modify technical upgrades.

Voting weight is typically proportional to the staked amount, so larger stakers can influence governance proposals more than smaller stakers. For example, Tezos was the first network to successfully implement a robust on-chain governance model using an amendment process. Proposals are made as part of an amendment process that progresses through multiple stages, such as submitting a proposal, exploration vote, cool-off period, promotion vote, and adoption vote.

There are also token holders who delegated their stake; they have the opportunity to vote directly on proposals or delegate their vote to the baker (the validator that was selected). Past proposal topics have included reducing block times, inflation reduction, and protocol optimisations. Similarly, Cardano's Project Catalyst is one of the most ambitious decentralised funding systems in the blockchain ecosystem.

In Project Catalyst, ADA stakers vote on which projects will receive funding from the treasury for development. The community approves all project funding. On average, every single funding round has provided millions of dollars worth of tokens to community-approved projects. Again, voting power is proportional to staked ADA, which effectively gives even small ADA holders a voting influence in the development of the ecosystem.

Cosmos uses governance proposals for network upgrades, changes to parameters, and spending from community pools. ATOM stakers vote on various issues, including inflation adjustments and how to onboard new zones to the Cosmos Hub. Polkadot combines staking with governance through its council and democracy systems.

DOT holders vote on network upgrades, parachain slot auctions, and proposals from treasury. In its democracy system, there are further mechanisms like adaptive quorum biasing that change thresholds for voting based on turnout. Effectively participating requires being informed about proposals.

Most networks have active discussions on forums, Discord channels, and governance platforms where proposals are discussed or debated before voting opens. Delegating your vote blindly to your validator without being informed is simply giving up your power and influence to validate someone else's judgment. Power dynamics also matter.

In ecosystems where voting power is a direct function of stake size, whales (large holders) can easily overwhelm governance decisions. Some networks try to balance influence with quadratic voting or some other mechanism, but naked plutocracy (rule by wealth) is an ongoing challenge in many PoS ecosystems.

Your engagement will determine if the network shifts to a more decentralised version, or if it slowly centralises, if inflation remains low or begins to increase to finance development, and which technical pathways are undertaken. Staking is more than a passive income regime; you are participating in building decentralised digital infrastructure in a more active role.

Begin Your Crypto Staking Journey Now

Staking is one of the most straightforward ways to enter cryptocurrency to earn passive income while supporting networks you believe in. We have covered different aspects of staking from general PoS mechanics through risk assessment, from validator selection to optimising stake returns, and from compliance implications to opportunities to actively govern your stake.

Your homework. Do the right amount of diligence before using funds to stake. Be aware of risks and lock-up periods for the network you stake. Choose to delegate to validators that are reputable and have a proven track record. Keep track of your staking activity for tax purposes. And subscribe to the network after staking to pay attention to its current state beyond just staking rewards.

If you are new to staking, start with a small amount. Choose an easy place to start, such as Cardano, which has no lock-up period and an extremely easy delegation process. As you gain experience and confidence, you will encounter and evaluate more complex strategies such as liquid staking through Lido or multi-validator delegation on Polkadot.

The landscape of crypto rapidly changes, and staking continues to develop innovations like liquid staking derivatives, cross-channel staking, and more transparency in governance. What feels complicated today will soon become the norm as interfaces become easier, and the educational wave advances further.

Ready to turn your crypto holdings into a passive income stream? BTCDana provides the secure infrastructure and expert guidance you need to start staking with confidence. Don't let your assets sit idle when they could be working for you and strengthening the decentralised future of finance.