1. Introduction: Why Algorithmic Trading Is Transforming the Forex Market

Forex is the biggest financial market out there, moving over $6 trillion every single day across different time zones. It’s open 24/7 from Sydney to New York, which makes it super liquid but also pretty complicated. Prices are influenced by central banks, interest rates, global news, and even random tweets, exciting, right? But it can get chaotic for traders.

Manual trading can be tough in this fast-paced environment. You blink, and you miss an entry; you hesitate, and emotions take over. Let’s face it, humans just can’t keep up with all that nonstop data. That’s why more traders are jumping on the algorithmic trading bandwagon.

With algorithmic trading, you set the rules, and computer programs do the rest. It can be as simple as buying when a moving average crosses or as complex as scanning multiple pairs and volatility conditions. Once you’ve got it programmed, the system keeps an eye on the market and executes trades instantly. Big institutions use it to handle thousands of trades in milliseconds, while retail traders stick to simpler versions for consistency. Think of it like a vending machine: you pick what you want, hit the button, and it delivers every time.

2. What’s Algorithmic Trading in Forex?

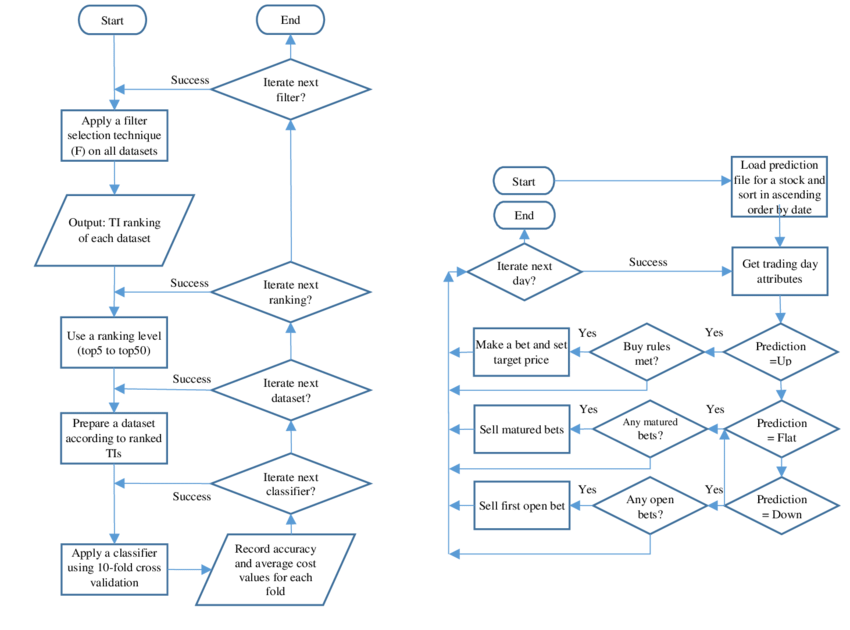

At its core, forex algorithmic trading is all about using computer programs and math models to place trades automatically. The basic idea? Rules plus automation. You set up a bunch of conditions, like price, time, size, and indicator signals, and the algorithm takes care of the rest without any emotional baggage.

Here’s the breakdown:

Core Principle:

-

Set your rules: if the price breaks yesterday’s high, buy. If RSI drops below 30, get ready to sell.

-

Feed them to the algorithm: whether it’s a simple script, a trading bot, or a custom-coded strategy.

-

Let the system do its thing: it’s constantly scanning without getting tired.

-

Execute automatically: trades happen instantly when your rules are met.

Types of Algorithms:

-

High-Frequency Trading (HFT): Executes tons of trades in milliseconds to snag tiny price differences.

-

Trend-Following Algorithms: Jump on uptrends and sell during downtrends, often using moving averages or breakout logic.

-

Arbitrage Algorithms: Take advantage of price gaps between related pairs (like EUR/USD and USD/JPY) or across different markets.

-

Market-Making Algorithms: Place both buy and sell orders to profit from the spread.

-

Mean Reversion: Bet that prices will bounce back to their average after wild spikes.

Big banks use arbitrage algorithms to grab differences in EUR/USD and USD/JPY pricing across venues. It’s like setting an alarm. Once you program it for 6:30 AM, it rings every time. In forex, once the price condition is met, the algorithm jumps into action without hesitation.

Comparison Table of Common Algorithmic Strategies:

3. How Algorithmic Trading Makes Forex More Efficient

Efficiency is the name of the game with algorithmic trading. That’s why both institutions and retail traders are all in on it.

-

Speed: Markets react to news in seconds. Algorithms jump in milliseconds, grabbing prices before they slip away. That’s how high-frequency trading cashes in on tiny price gaps.

-

Accuracy: Humans mess up, fat-finger orders, clicking buy instead of sell. Algorithms place exactly the order you told them to, every single time.

-

Discipline: Emotions can ruin traders. Algorithms don’t feel fear when prices drop or greed when they rise. They just stick to the rules, no questions asked.

-

Liquidity: Market-making algorithms keep buy and sell orders flowing, making it easier for everyone else to trade. This helps stabilize markets and cut down on volatility.

-

Cost Reduction: By minimizing slippage and optimizing order placement, algorithms help lower transaction costs. Over thousands of trades, even small savings add up.

High-frequency traders can pull off thousands of trades in a second, racking up forex trading efficiency. It’s like using Google Maps to find the quickest route. Instead of wandering around, you get the most efficient path.

Manual vs Algorithmic Trading Comparison:

4. Common Algorithmic Trading Strategies in Forex

Alright, let’s dive into some algorithmic strategies you might come across.

Trend Following: This one’s all about using moving averages or breakout logic to catch those big moves. It works best when there are strong macro themes pushing currencies around.

-

Pro tip: Think about funds jumping on USD/JPY when the BOJ hints at policy changes and the trend starts to pick up.

-

Beginner vibe: It’s like riding a bike downhill, once you get that momentum, you’re cruising until you hit a flat spot.

Arbitrage: This strategy looks for those tiny price differences between pairs or markets. You buy low in one place and sell high in another.

-

Pro tip: Picture funds taking advantage of the price differences between forex quotes in London and New York.

-

Beginner vibe: It’s like snagging apples for $1 at one store and flipping them for $1.05 at another.

Mean Reversion: This one assumes that prices will bounce back to their average. You can use tools like RSI, Bollinger Bands, or standard deviations.

-

It works well in calm, sideways markets, but watch out if a real trend kicks in.

News-Based Trading: Here, algorithms are on the lookout for news headlines or economic releases and react super fast.

-

Pro tip: Think high-frequency traders jumping on U.S. Nonfarm Payroll data in a flash.

-

Beginner vibe: It’s like setting your phone to buzz the moment exam results drop.

5. Risks and Challenges of Algorithmic Trading in Forex

Algorithmic trading is awesome, but it does come with its own set of risks.

-

Technical Risks: Bugs, server issues, or internet hiccups can lead to some bad trades. Always make sure to test things out first.

-

Market Risks: Unexpected events, like sudden moves from central banks, can throw a wrench in algorithms that depend on normal market conditions.

-

Regulatory Risks: Some markets have rules that limit high-frequency trading. Always double-check to stay compliant.

-

Human Dependence: Relying only on algorithms can be risky. You still need to use your judgment and keep an eye on things.

Pro tip: Remember the 2010 Flash Crash? It got worse because algorithms were feeding off each other.

Algorithmic Trading Risks Checklist:

-

Test in demo mode before going live.

-

Set limits for losses per trade and daily.

-

Keep an eye on your systems, don’t just set it and forget it.

-

Have a manual override ready.

6. How to Get Started with Algorithmic Forex Trading

Your starting point for forex automated trading really depends on your experience level.

-

Beginners: Check out the built-in automation features in trading platforms. Try out ready-made Expert Advisors for moving average crossovers or breakouts. Always test on demo before going live.

Beginner vibe: It’s like writing simple formulas in Excel, easy but super effective. -

Intermediate Traders: Start creating your own rule sets. Platforms like MetaTrader let you code up some simple systems. Backtest them over several years, then try them out with micro-lots.

-

Advanced Traders: Get into Python, R, or APIs to build your own custom algorithms. Mix in multiple indicators, risk controls, and even sentiment data. These setups can handle multi-currency portfolios automatically.

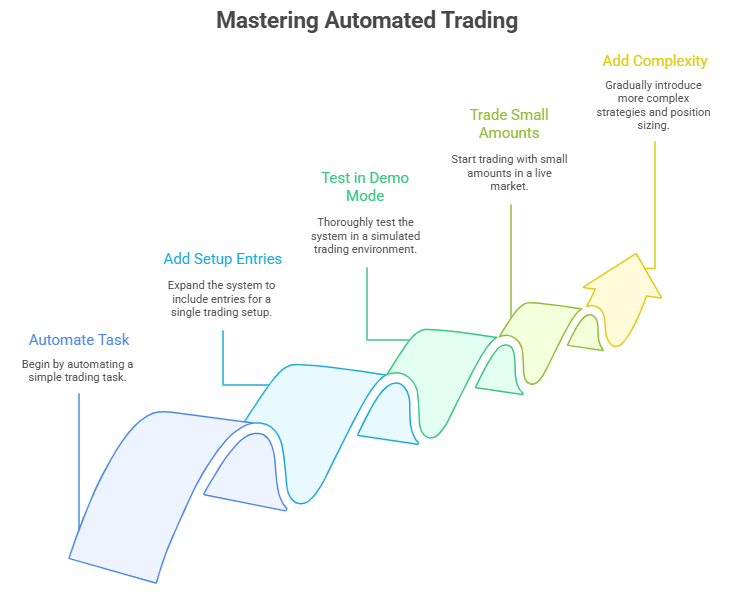

Learning Path:

-

Automate a single task (like placing stops).

-

Add entries for one setup.

-

Test it thoroughly in demo mode.

-

Trade small amounts live.

-

Gradually add complexity (like multiple strategies and position sizing).

Fund managers are already combining AI and quantitative models to optimize their multi-currency strategies.

7. Conclusion: The Future of Algorithmic Trading in Forex

Algorithmic trading is already a big deal in forex because it speeds things up, makes trading more accurate, and keeps it efficient. It helps traders stick to their plans and cut costs while opening up strategies like arbitrage, trend following, and mean reversion to more folks. But remember, algorithms aren’t magic. They need to be paired with solid risk management, regular check-ins, and a bit of human judgment. Without those, even the best system can flop.

Looking ahead to the future of forex trading, AI and big data are going to take algorithmic trading to the next level. Smarter algorithms will adapt to changes faster and pull in more data sources. But the winning formula will stay the same: clear rules, disciplined execution, and smart risk control.

Call to Action: If you’re curious about how algorithmic trading can make your forex journey smoother, check out btcdana.com for insights and tools to help you get started.