Introduction: Why the Risk-to-Reward Ratio is the Secret Weapon of Successful Traders

You're about to place a trade, and you have two options. Option A allows you to risk $100 with a possible return of $50. Option B also has $100 of risk but a possible return of $300. Which one looks better? If you chose option B, you have already grasped the fundamental principles of the risk-to-reward ratio.

The risk-to-reward ratio (RRR) is the simple comparison of what you could lose, compared to what you could gain on any trade. It is expressed as a ratio such as 1:2 or 1:3, where the first number represents your risk and the second your reward. So if you risked $10, and could make $30, your RRR would be 1:3.

So, why is the risk-to-reward ratio so important? Because being a successful trader isn't about always being right. It's about making sure when you're right, you make enough to cover your losses and still be profitable. Warren Buffett once said, "Risk comes from not knowing what you're doing." The risk-to-reward ratio gives you that knowledge before you ever take the trade.

Most beginner traders try to find winning trades. On the other hand, experienced traders think about the risk first. They know that you could have a 50% win rate, yet still be profitable if your average gains are larger than your average losses. This is the advantage of thinking about risk and reward.

The RRR is more than just a number you do the math with (although it is helpful) it's a shift in mindset. Instead of thinking "Will this trade make me money?" you start thinking "Is the reward worth the risk I am taking?" This change in thinking is what differentiates sustainable traders from gamblers.

The risk-to-reward ratio is applicable to all markets equally, whether you trade Forex, stocks, or CFDs. The risk-to-reward ratio is the first line of defence against the emotional roller coaster which causes most trading accounts to lose money.

Breaking It Down: How Do I Calculate a Risk-to-Reward Ratio (Step-by-Step)

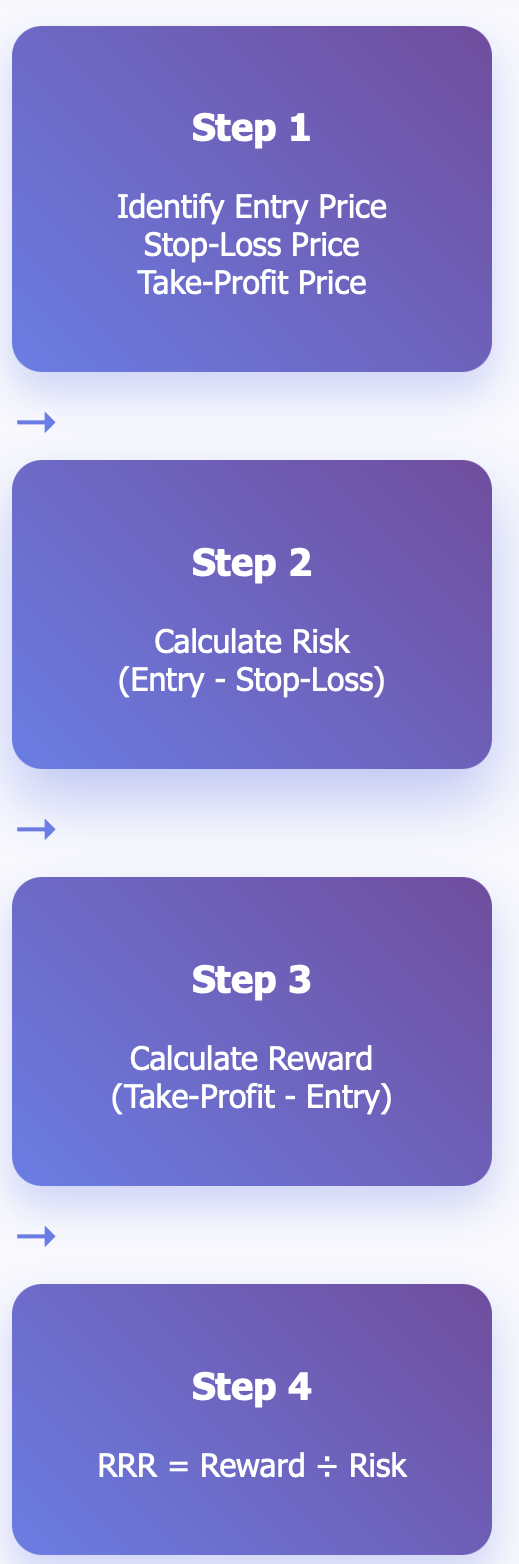

Don't worry, calculating the risk-to-reward ratio does not involve complex math! The formula is simple: RRR = Potential Reward ÷ Potential Risk. I'll walk you through it step-by-step.

Step 1: Identify Your Three Important Prices

Before you can even think about calculating anything, you will need to know three pieces of information:

-

Entry price (where you will buy or sell)

-

Stop-loss price (where you will exit if the trade is not going your way)

-

Take-profit price (where you will exit if the trade is going your way)

Step 2: Calculate Your Risk

Your risk is the difference between your entry price and your stop-loss price. For example, if you buy a stock for $100 and set your stop-loss at $95, then your risk is $5 per share.

Step 3: Calculate Your Reward

Your reward is the difference between your entry price and your take-profit level. Again using our example, if your take-profit is at $115, then your potential reward is $15 per share.

Step 4: Do the Math

Now just divide reward by risk: $15 ÷ $5 = 3. Your risk-to-reward ratio is 1:3, meaning that you are risking $1 to potentially profit $3.

Let's use a Forex example. You're trading EUR/USD and you want to buy at 1.1000 with a stop-loss at 1.0950 and take-profit at 1.1100. In this case, your risk is 50 pips (1.1000 - 1.0950) and your reward is 100 pips (1.1100 - 1.1000). So your risk-to-reward ratio is 1:2.

OK. So here's where the action comes in – it's preaching to the choir a little bit, but let me say it again. The important thing is to always calculate the RRR before you place the trade, not after. Emotions get involved once you are in a position. However, if you do the math beforehand, you will be able to follow your plan regardless of what the market does.

And remember, the RRR simply helps you quantify whether the trade is worth taking from a math perspective. Even if you believe the trade has a high probability of success, if the risk-to-reward is poor, it will be a bad bet in the long run.

What is the Ideal Risk-to-Reward Ratio? Myths vs. Reality

This is where many of the trading guides we read go wrong, as they might say that you should always be looking for a 1:3 risk-to-reward ratio or greater and that anything less isn’t really worth trading. This is absolute nonsense.

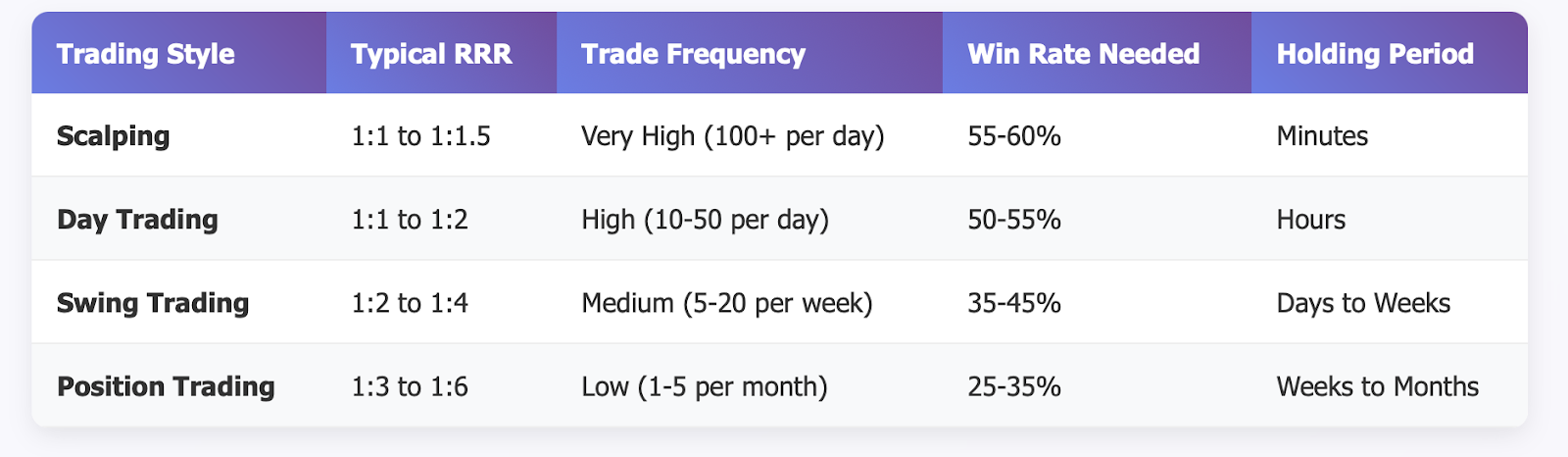

The fact of the matter is the "ideal" RRR is based on your trading style, the market you are trading, and your overall strategy. A scalper that trades dozens of times in a day may be perfectly content with a 1:1 ratio because they are taking quick, small profits. A swing trader that holds positions for weeks may require a 1:3 or greater to justify holding their capital longer.

Consider it like taking a test in school. Some students just need to hit 60% in order to pass and move on, they are efficient and do not waste time perfecting every answer. Others will not accept anything less than 95%. Both students can be successful, just different approaches and time management.

Day traders tend to work with tighter RRRs (1:1 to 1:2) because they are trading so often they can achieve the smaller individual wins. They also tend to have better ratios because they have way more trades to be profitable. Swing traders look for RRRs of 1:2 to 1:4, because they have limited number of opportunities; therefore, they need larger wins to justify holding longer.

The real secret isn't in the "perfect" ratio, but just being consistent with whatever ratio corresponds with your strategy. A trader using a 1:2 RRR consistently with a 60% win rate will outgain someone who randomly uses 1:1 ratios and 5:1 ratios based on how they feel about the trades.

Paul Tudor Jones, one of the most successful traders ever, has famously stated that his average winner is 3-4 times his average loser, but he also states that the secret is not in the numerical ratio, but cutting your losses and letting your winners run.

So, in conclusion? I would suggest starting with ratios that make mathematical sense with your rate of winning and rate of trades. If you win 50% of the time, a ratio of better than 1:1 will make you profitable. If you win 70% of the time, you can still use smaller ratios and still come out ahead.

Risk-to-Reward in Practice: Real-Life Trading Examples You Can Relate To

Let's get back to reality and use some relatable examples to illustrate this concept.

The Basketball Bet Example

You are a university student, and your buddy offers you a bet on tonight's basketball game. Amount at risk is $5 and if your team wins, your bet's value is $15 ($5 you put up plus $10 in profit). If your team loses, you lose the $5. You have a risk-to-reward ratio of 1:2. You are risking $5 for a potential pay-out of $10.

Even if you feel your team only has a 40% chance of winning, this could still be a mathematically logic bet. Think about it in the terms of doing 10 of these bets; if you won 4 times ($40) and lost 6 ($30), you would still be down $10. In other words, you actually lost more bets than you won, but you profited overall.

The Professional CFD Trade

Now, let's think about how a professional trader trades like this. Sarah is trading the S&P 500 CFD. She sees a strong support level and decides to buy. Her setup is:

-

Entry: 4,200

-

Stop-loss: 4,150 (risking 50 points)

-

Take-profit: 4,350 (looking for 150 points)

-

Risk-to-reward: 1:3

Sarah is aware the approach does not need to work 100% of the time. Over the long run, if she hits at just 35% with these trades, she will still be making money. Three hits would put her in a position of profit with 450 points (3 wins x 150 points per win), while seven misses would put her down 350 points (7 losses x 50 points per loss). That is a net gain of 100 points.

The Emotional Struggle : This is where it gets real. In both illustrations, the hardest part is not calculating the odds - it is following through. The student may see the game as deadlocked at halftime and, with less than 10 minutes to go, decides to take back his money. Sarah may see she has developed 75 points in equity and wants to close her trade early because a profit is a profit.

However, that type of thought process destroys the mathematical advantage. When you shorten your winners or let your losers run past your stop-loss, the risk-to-reward ratio of your trades will severely diminish from what you planned out. The basketball bettor could have 1:0.5 ratios (short wins, large losses), while Sarah could have reduced her 1:3 set up into a 1:1 ratio.

These examples demonstrate that whether you are wagering on sports or trading CFDs, the principle is the same. Plan your risk and reward before you start and then have the discipline to stick to it. The ratio only works if you stick to it.

Tools and Techniques: How to Implement RRR with Stop-Loss, Take-Profit, and Position Sizing

Knowing the risk-to-reward ratio is one thing, but knowing how to put it into practice using the appropriate tools and techniques is quite another. Let's transparent how to practically apply RRR in your trading.

Stop-Loss and Take-Profit: Your Safety Net, or Trading Life Jacket Your stop-loss order is not just designated for your stop loss-it is your stop loss insurance policy. Set your stop loss where you will concede you were wrong about the trade, not a percentage below your entry you set arbitrarily and years ago.

If you are sitting in a long position purchasing a stock because you believe it will bounce off a support level, set your stop-loss just below the support level. This allows your trade the ability to move in desired direction while protecting you from a major loss.

Take-profit levels work exactly the same way. Do not simply multiply your risk by three and declare the trade finished. Determine if there is a price level that may cause price to stall. It may be a previous high or a psychological level like $100, which will simply stop your gains. Your take-profit should always make sense according to what you have learnt from the price chart.

Position Sizing: Letting Your RRR Work for You this is where a lot of traders fail. They calculate an excellent 1:3 risk-to-reward ratio and then risk 10% of their account in the trade. The unlucky streak arrives and their account balance hits $0. Smart position sizing is only risking 1-2% of the account in a single trade whether you are confident, excited or upset.

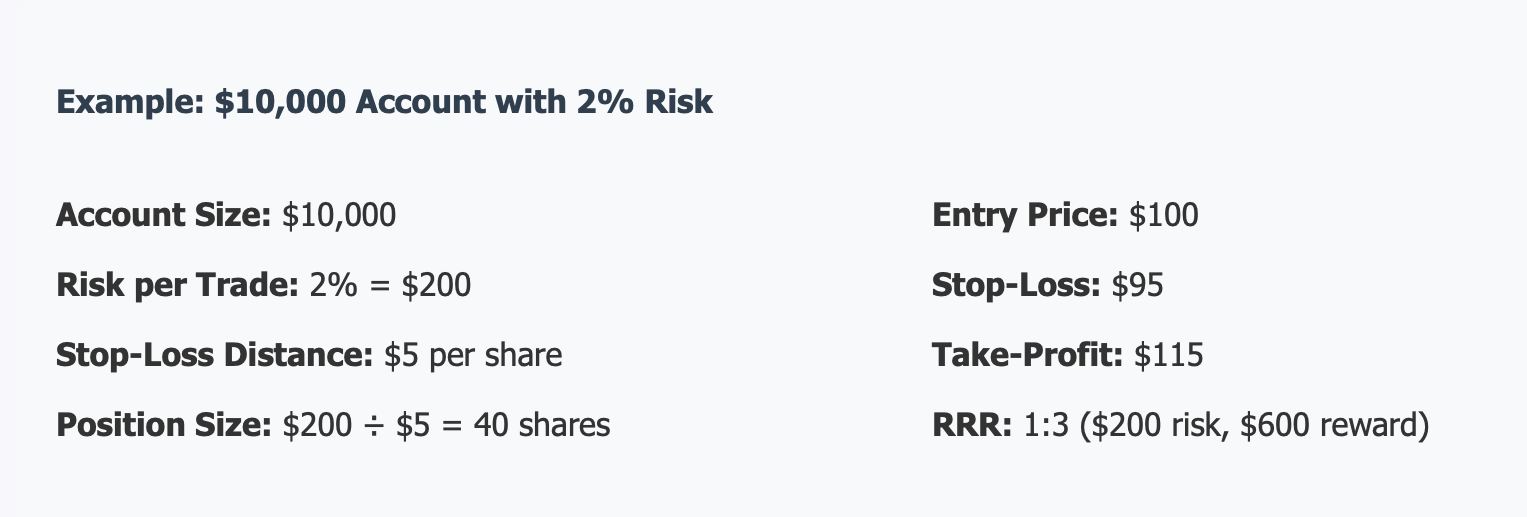

Let's imagine you have a $10,000 account and want to risk 2% per trade ($200). You find a stock setup that has a stop-loss of $5 from where you would enter. You would buy 40 shares ($200 ÷ $5). If your take profit is $15 away then you will make $600 if you are correct - which means you are earning a perfect 1:3 ratio and remaining in a controlled risk position.

Tools on the Trading Platforms

Most modern trading platforms already make this relatively easy. MetaTrader, TradingView, and similar platforms can automatically calculate your position size once you have established your entry, stop-loss, and take-profit. Some will even display your risk-to-reward ratio before you take the trade.

When searching for trading platforms, look for those that let you do the following:

-

Drag and drop your stop-loss and take-profit lines on charts

-

Calculate position sizes based on percentage risk

-

Automatically display RRR ratios

-

Set alerts based on when price approaches your levels

-

Putting the 2% Rule into Action

Here's an example of how all this comes together. You have a trading account of $5,000 and you are willing to risk 2% per trade (which would be $100). You find a potential Forex long trade on GBP/USD with a stop-loss of 30-pips and a take-profit target of 90-pips (which is a RRR of 1:3).

With a risk of $100 and a stop-loss of 30 pips, you can trade approximately 0.33 lots. If the trade is a winner, will you make roughly $300. If it doesn't work out, you lose your planned lost of $100 and look for the next opportunity.

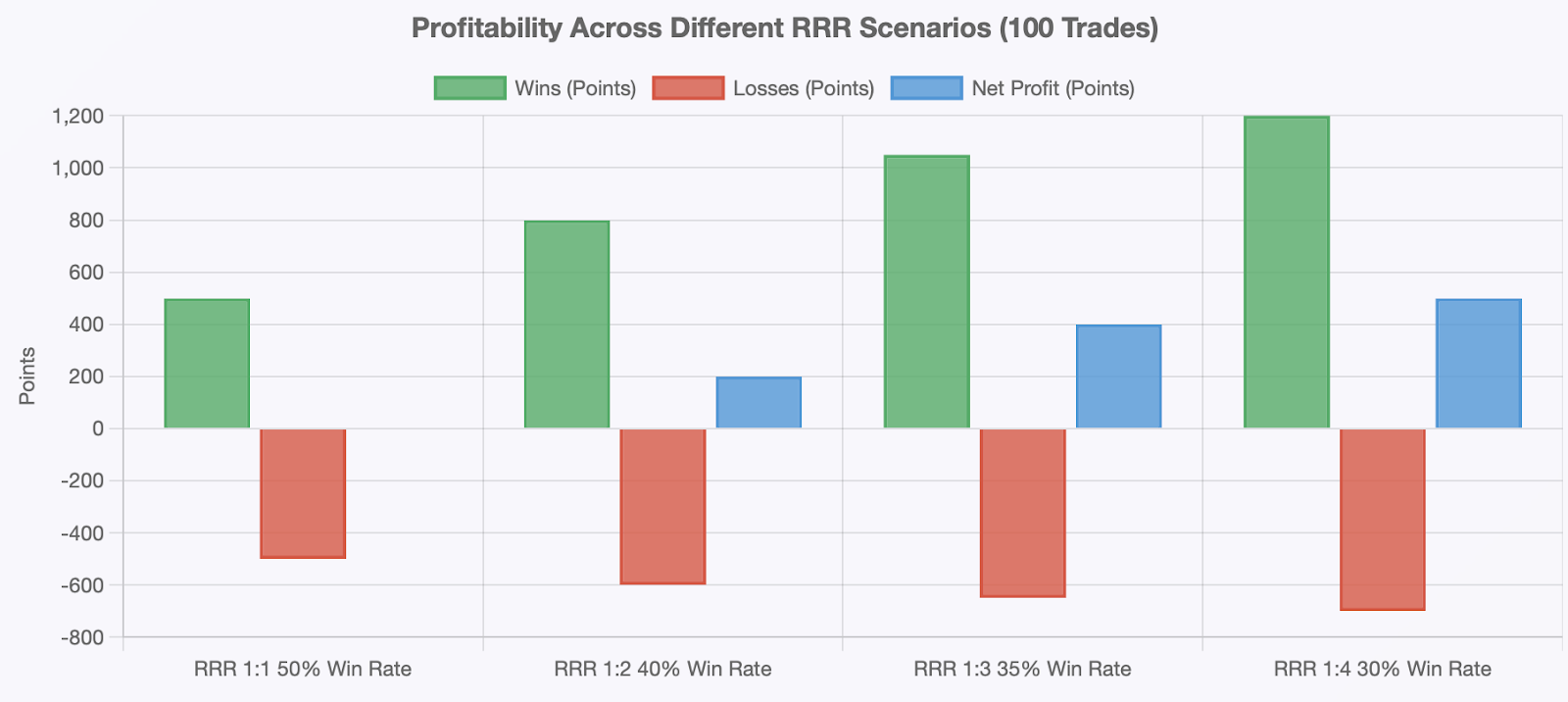

Consistency is the key. If you were to do this exact trade setup 100 times with a 40% win rate, you'd be positively surprised with the profits you'd make while losing more trades than you would win. The magic lies in having a favourable risk-to-reward ratio and propped up by the correct position sizing.

Avoid the Traps: Common RRR Mistakes Traders Make

Sometimes traders that have a good, clear understanding of RRR fall into traps that they could have avoided. Here are some of the common ones:

Mistake 1: Trekking after Way Too High of RRR

Some traders get fixated on RRR and consider only 1:5 or 1:10 to be acceptable risk-to-reward, as if they're trying to go for the home run every time at bat. Sure, home runs are great but a team wins a game by just getting on base. In general, trades that have very high RRR, very often have very low win rates.

You might happen on a setup that could provide 1:10, but if it has only a 5% win rate, you can quickly build a streak of losses that will test both your patience and your account. Most of the consistently profitable traders stick to 1:2 or 1:3 RRR plans, both of which generally offer a point of balance between long-term profit potential and realistic likelihood of success.

Mistake 2: Dismissing Win Rate

RRR does not exist in a vacuum. A 1:3 ratio looks great, but remember, you're only winning 20% of your trades. You need both parts of the equation; an ok risk-to-reward ratio, and a win rate that recalculates to something mathematically reasonable.

Consider dieting. You could try to lose 10 pounds in one week (great ratio of effort to result), but if it's such a extreme plan that you can only stick to it 10% of the time, you're worse off than a person with a smaller, more sustainable plan.

Mistake 3: Moving Your Stop-Loss

This is arguably the most dangerous mistake of them all. You set a stop-loss of $95, the stock drops to $96, and you think "if I just give it a little more room it will come back." So, you move your stop to $90, and you who had planned a 1:3 ratio, now have turned into 1:1.5, and risk a great deal more than you had wanted to.

Your stop-loss is not a suggestion, it is the price that you were wrong in your analysis, so if you move it on a trade you are changing the rules of the game while you're playing. It is best to follow your plan or not trade at all.

Mistake 4: Cashing Out Your Profits Early

On the other side of the coin, there are many traders that do the opposite-secutors (cut their winners short). They planned to achieve a $15 profit, but when they had a good trading day and were up $8, for example, they got scared and closed out the trade. This is just as detrimental to your risk-to-reward ratio as letting your losers run. If you are taking profits at 1/2 your target profits, and your 1:3 ratios turn into 1:1.50 ratios, combined with regular losses, you will be handicapping your odds of being profitable long-term.

Mistake 5: Forgetting About Spreads and Commissions

When many Brokers charge spreads and commissions to eat into your gains AND bloated losses and drawdowns. Even planning to trade with a 1:2 ratio but at the end of the day if everything is included, you're really at a 1:1.50 ratio, so you need to win more in order to be profitable.

This is even more pronounced for scalpers / day traders because they make many small trades. A $5 commission may not seem like a lot against a $500 profit, but certainly is a lot against a $20 profit.

The solution to all of these problems is straightforward but far from easy: discipline. Create a trading plan, back test it, and follow it to the letter. The moment you start making exceptions like "just this once," you are on a slippery slope to blown accounts and broken dreams.

Conclusion: How mastering the risk-to-reward ratio will change your trading forever!

Now that we have covered a lot of ground let's conclude with what counts. The risk-to-reward ratio is not just another trading indicator or mathematical formula, but a fundamental way you should think about every trade you make.

So always make sure you do the following three things; calculate your risk and reward before placing any trade, select ratios that make sense for your trading style and win rate, and lastly by following your trading plan regardless of the emotional signals you may feel you need to follow in the middle of the trade.

Both beginner and professional traders use RRR every day because it works for all markets and all time frames. The student correctly betting on basketball games with a few dollars, and the hedge fund manager correctly trading millions in currency, are using the same basic mathematical principle.

But the thing is, it is one thing to know about RRR and another to apply it every time. Start small and practice on demo accounts while you get the hang of it. Be comfortable enough to set stop-loss and take-profit levels not on arbitrary percentages but rather on logical levels.

Learn to walk away from trades that offer poor risk-to-reward ratios even when you really like them. At the end of the day, risk-to-reward ratios represent the difference between traders and gamblers. Gamblers are happy to blow their risk hoping the trade turns into a larger sum of money and ignore the math traders stacked the odds favourable mathematically and allow probability does its job over time.

You'll have your highs and lows within your trading journey ask any trader; however as long as you implement proper risk management practices through good RRR, you will be part of a small percentage of traders that actually have the chance to earn a living in the future from it. The difference between sustainable success and inevitable failure usually comes down to the one concept. If you can master it, you've made the most significant step toward becoming a profitable trader.

Ready to put these risk-to-reward strategies into practice? Visit btcdana.com for advanced trading tools, real-time market analysis, and educational resources that will take your trading to the next level.