Introduction: What is Carry Trade in Forex?

So, you're thinking about how these forex traders can make tons of money while they sleep? Carry trading could be the key. A carry trade is a very simple but effective strategy when it comes to forex - borrowing money in a low interest currency and investing the money in a currency that has higher interest rates. In other words, taking the difference home with you.

To put this in perspective imagine: borrowing money from a credit card at 2% and depositing the same amount of money into a savings account at 5%. You would make 3% on the difference (plus fees). Essentially this is what carry traders are doing if you simply substitute currencies with bank accounts.

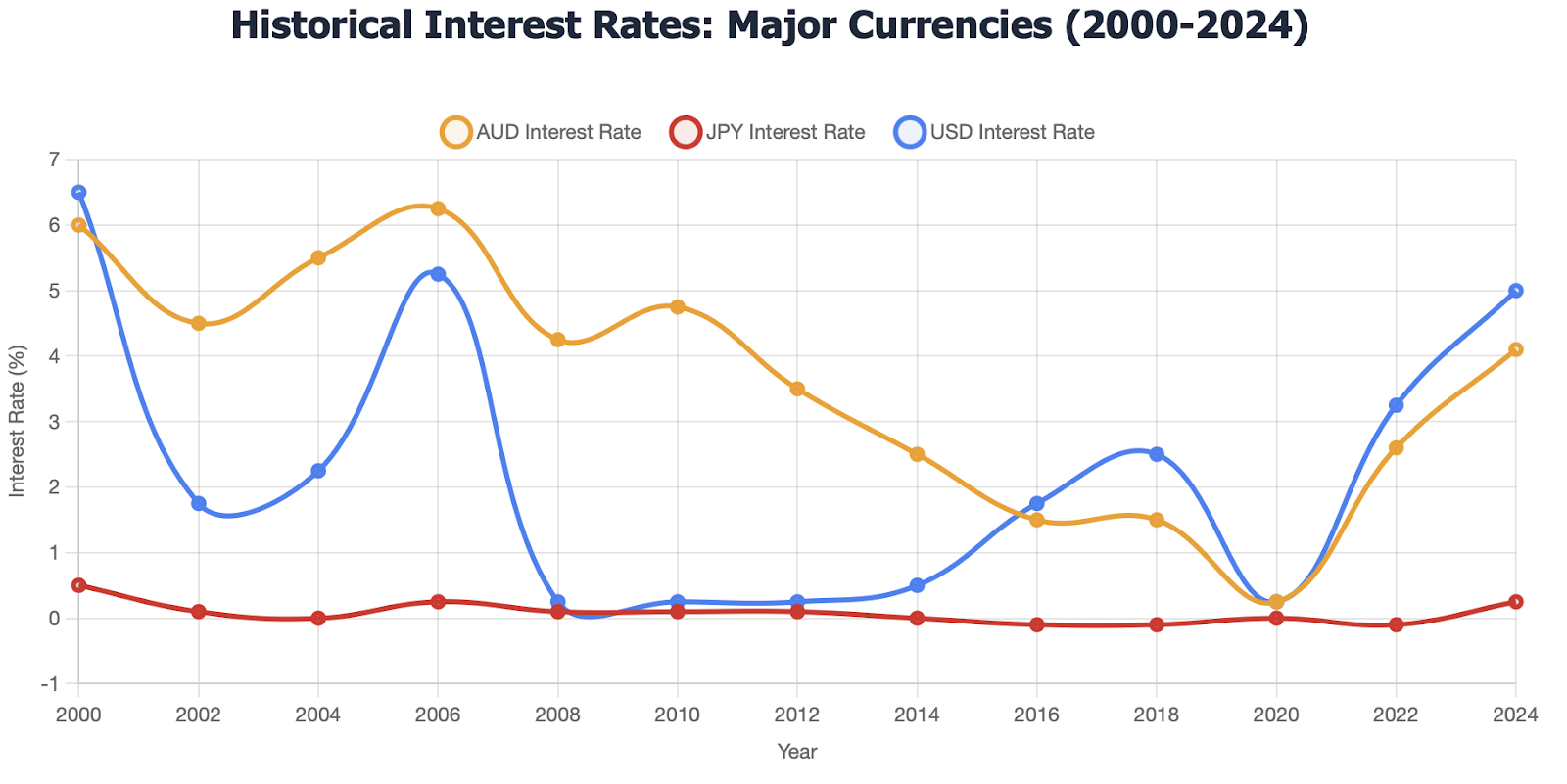

The strategy has historically been very successful throughout the 2000's while traders borrowed Japanese yen (close to zero interest) and borrowed a currency that had a higher return like the Australian dollar or New Zealand dollar. The yen carry trade was so popular it helped to shape global capital flows and even helped with investment bubbles in developing countries!

What makes the carry trade attractive is the fact that it's based on the fundamentals of economics rather than speculation. You aren't forecasting short term price movement or any pattern of price movement. What you are doing is taking advantage of a fundamental principle of economics; that is to say interest rate differentials provide the opportunity to profit from exposures to these differentials.

The beauty of the carry trade is the ability to generate income over the long term. Day traders try to make quick trades to gain profit from very short positions, carry traders will earn income by simply holding the position at profit from interest rate gaps from differences in countries.

How Carry Trade Works: The Mechanism

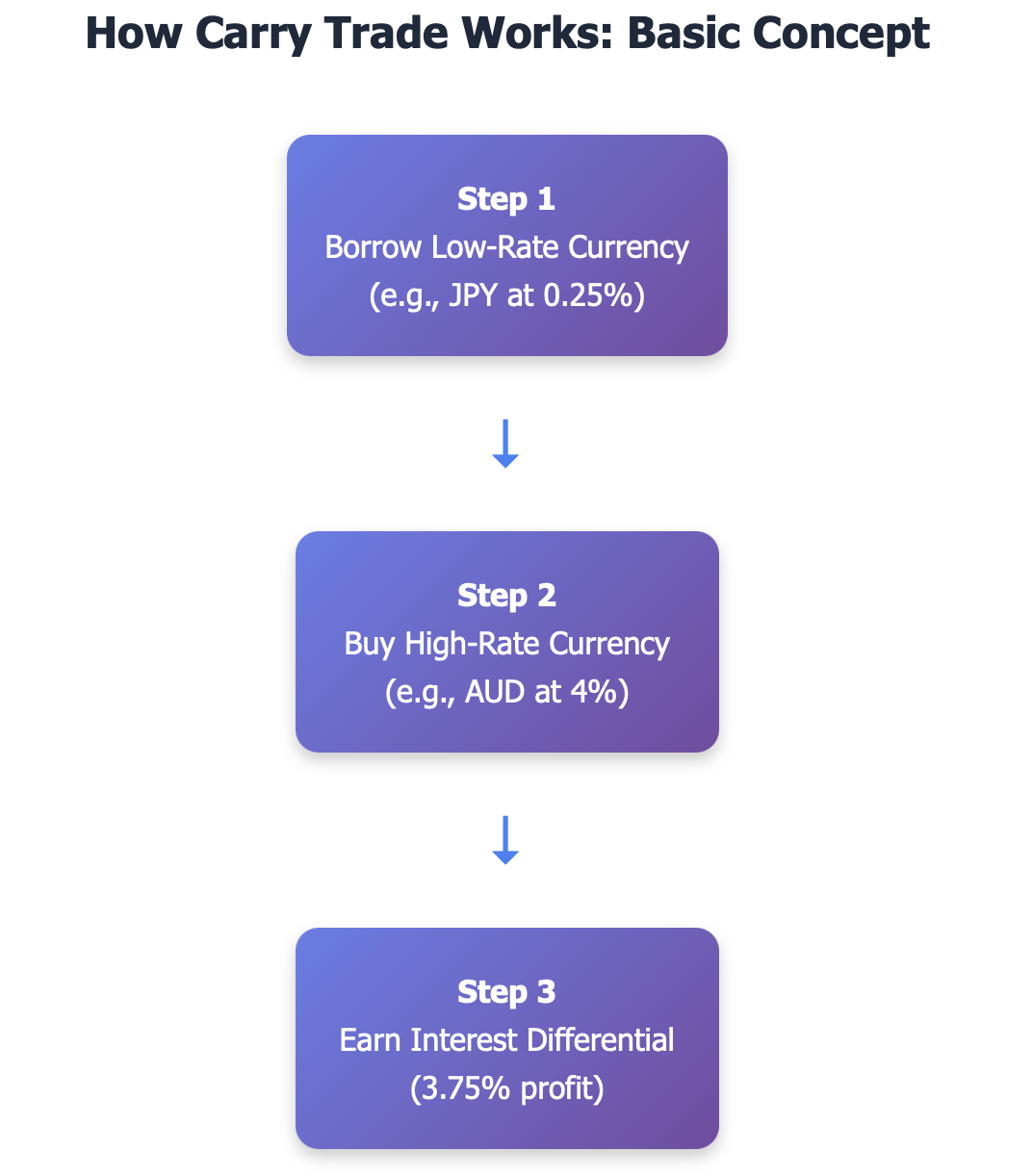

To understand carry trades proper requires an understanding of how the interest rates impact currency values. When you are long in forex, you are lending one currency and borrowing another. Each currency has an interest rate provided by its central bank which allows for the basis on which you can profit from a carry trade.

Let's start to breakdown with a practical example. Say that Japan's central bank has established rates at 0.25% while Australia's established rate is sitting at 4%. If you lent the USD and bought Japanese yen and purchased Australian Dollars you would be going long at a 3.75% interest payment alone.

This sets up what is commonly talked about in trading circles as "positive carry" where you earn money on the position even if the exchange rates don't move. For a clear contrast, negative carry means you pay money to hold the position because you borrow a high-rate currency so you can buy a low-rate currency.

But here's the kicker: carry traders can earn from two sources at the same time. For starters, the interest rate differential as discussed. Secondly, if the high-yield currency appreciates against the low-yield currency, then the trader would also be benefiting from profitable exchange-rate movement.

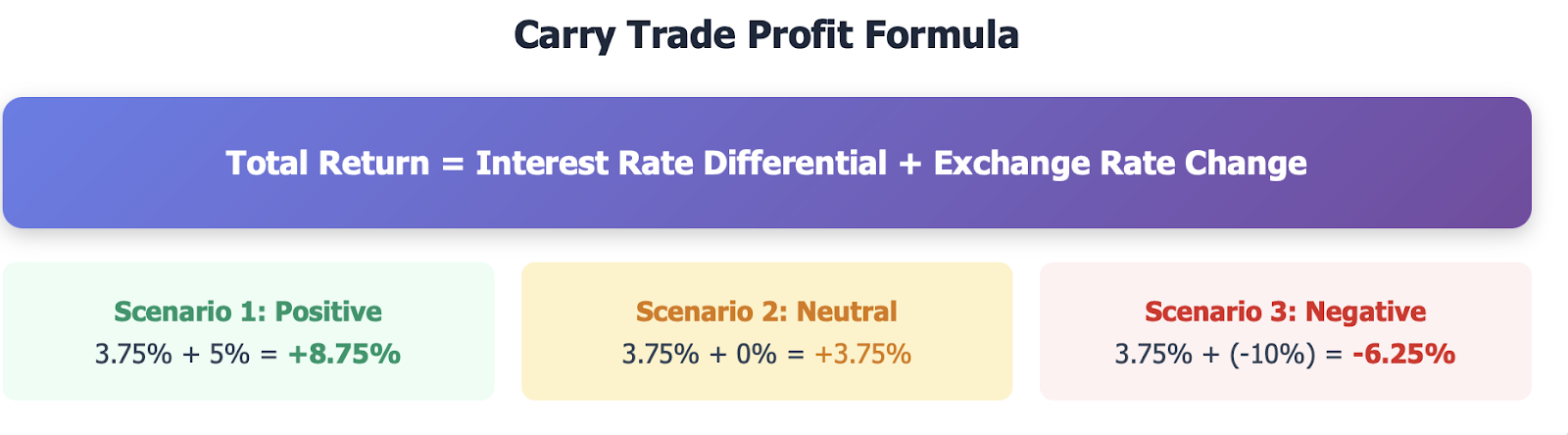

The profit formula looks this way: Total Return = Interest Rate Differential + Exchange Rate Change

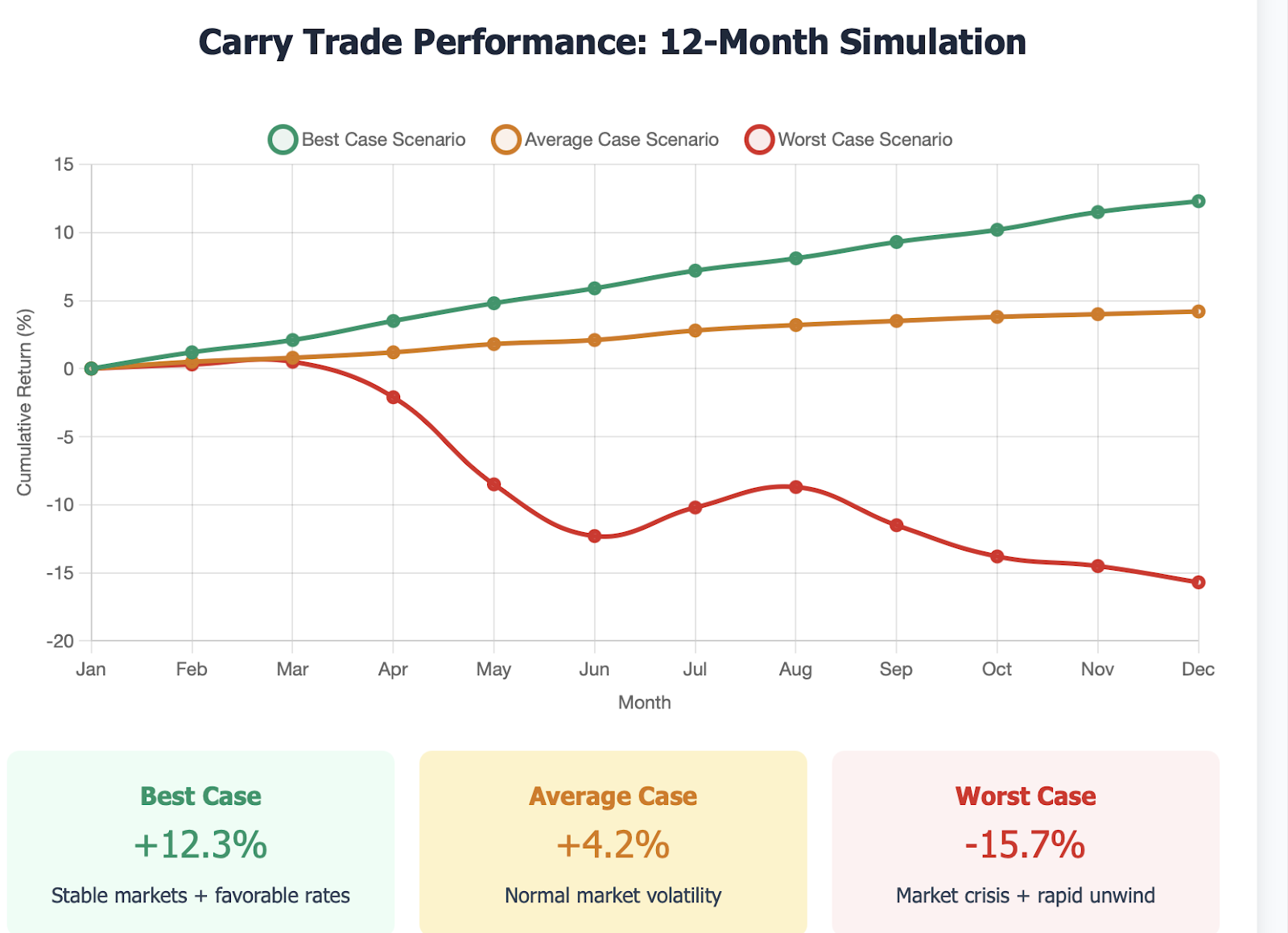

When market conditions remain stable, this can create well-above average returns for traders. The same effects regarding currency apply here as we saw in the mid 2000s with many carry trades returning annualized returns higher than 10% simply from combining interest income with market stable currency moves.

Negative consequences can arise quickly though. The 2008 financial crisis provided a perfect example of this risk. Market panic created a rush for investors to liquidate their carry trades and escape to safe-haven currency, like the yen. This rapid liquidation of carry trades created Greek numbers of momentum in yen rates, erasing years of carry trade profits in a matter of weeks.

The takeaway? Although interest rate differentials form the basis of the returns from a carry trade, any carry trade is ultimately influenced by exchange rate volatility, which can limit, or expand the returns on a carry trade. A successful carry trader must consider both when selecting trades and evaluating a carry trade opportunity.

The Pros and Cons of Carry Trade

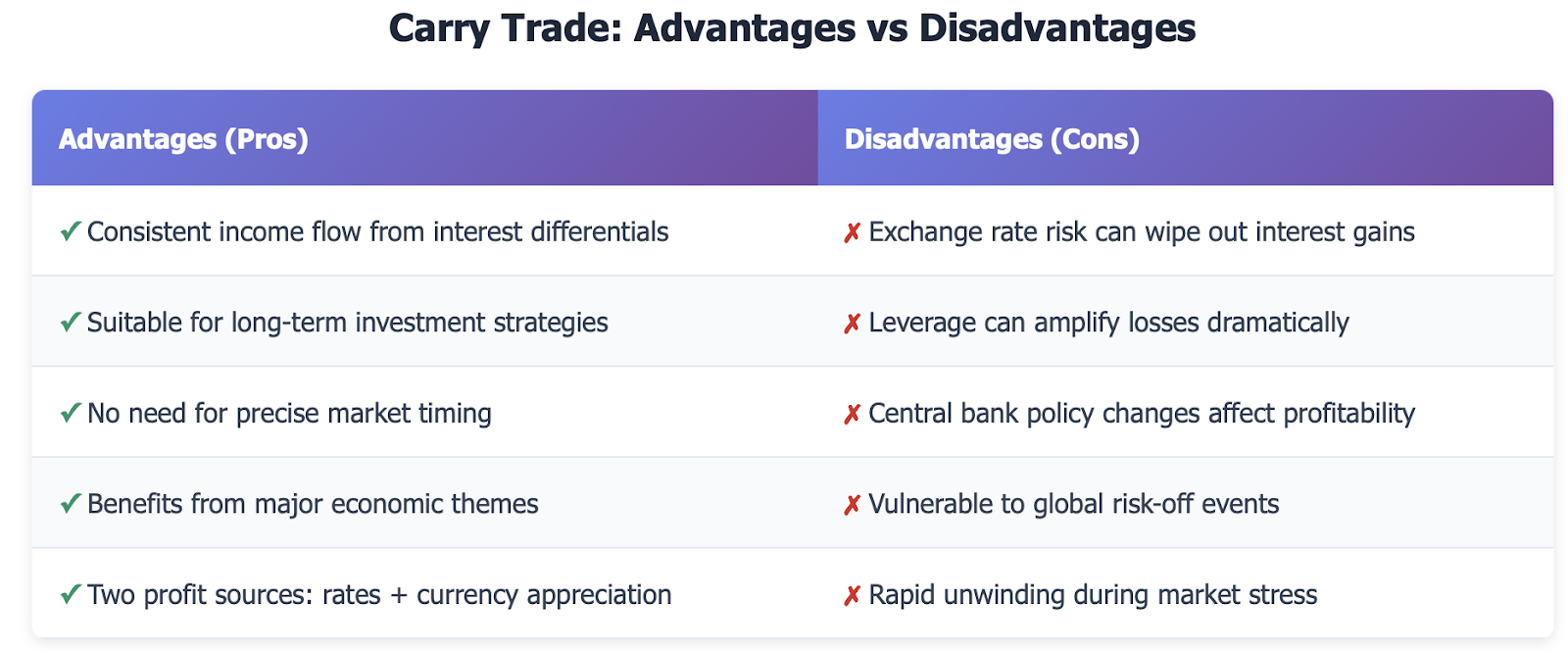

Carry trading has several unique advantages that can be appealing to both retail and institutional traders. The primary advantage of a carry trade is consistent income flow. Unlike trading strategies that require precise market timing, carry trades can create a steady cash flow as long as interest rate differentials favor the position.

Carry trades are particularly attractive with longer-term investments. Whether you find yourself glued to your charts all day, or if making quick investment decisions is not your style, carry trades allow you to hold long positions for weeks, months, or years, collecting interest payments whilst possibly putting on a winning trade from favorable movements in currency prices.

Global macro traders prefer carry trades, as they can have a higher tendency to follow through on major economic themes. If a country is forced to raise interest rates to combat inflation or attract foreign investment into their economy - from a fundamental perspective, a carry trader in their currency can ride the themes for a long time.

The risks are significant and not to be taken lightly. Number one is exchange rate risk- currency moves can easily eclipse any benefits from interest rates. In fact, if the low-yield currency strength is materially high relative to the high-yield currency, you could end up losing money that would've taken you in interest a few months or years to earn.

Leverage is a game changer for both performance gains and losses. Many carry traders use leverage to amplify their returns, which is great until it goes the other way and the results are devastating. With leverage like 10:1 if your currency depreciates 10% you have lost 100%.

There is also upside risk that adds complexity to the proposition of carry trade. Central banks can change interest rates on a whim which can eliminate what was previously attractive carry trade differential. Plus, on the longer sales risk, you can also take on risk when there is big global macro and/or policy uncertainty. For example, if something happens with the economy-- for example a political instability, a currency crisis, or a material shift in global risk appetite-- that could trigger a huge unwinding, or paring back, of carry trades.

A great example of this is the 2008 crisis. When things froze up in credit markets and risk took a nosedive, everyone was scrambling to exit carry trades or unwind carry positions because they wanted to park their funds in a "safest" of safe havens.

Taken as a funding currency of convenience, at the same time, traders started leveraging the Japanese yen on risky positions with high-risk high-yield currencies. Traders who had leveraged positions were getting margin calls-- deposit calls, and forced liquidations as the Japanese yen increased well over 20% combined from high yielding currencies in just a few months.

Think of carry trading as purchasing a rental property using a mortgage. In good times, the rental makes your mortgage payment and creates net cash flow, but if the property market falls out or the tenants leave, you will still have the mortgage, while the property is declining in value.

Popular Currency Pairs for Carry Trade

Some currencies are naturally suited to carry trading based on centralized policies of the countries and their economic conditions. High-yielding currencies usually come from countries that appear to have growth prospects, higher inflation, or central banks looking to maintain higher interest rates to attract foreign capital.

The Australian dollar, New Zealand dollar, Turkish lira, and South African rand have all historically offered attractive yields for carry traders. These currencies are often supported by commodity-exporting economies, growing populations, or central banks that have indicated a willingness to maintain moderate interest rates to support their currency, or manage inflation.

On the funding side, the usual suspects for low yielding currencies would be Japanese Yen and Swiss Franc, as well as at times even the Euro. After battling over the past few decades deflation, Japan has kept interest rates close to zero, and as such, the Yen has always been a low-cost way to fund a carry trade. Similarly, the stable economy and conservative monetary policy of Switzerland keeps the Franc interest rates relatively low.

The AUD/JPY currency pairing remains a carry trade textbook example. The resource-rich Australian economy, historically higher interest rates, and a near-zero Japanese rate environment provide a classic carry trade pairing. Under stable markets, the carry income was reasonably certain; however in risk-off environments, the paired AUD and JPY could experience extreme volatility.

The NZD/JPY pairing has similar dynamics to AUD/JPY but with a greater degree of volatility, potentially increasing carry income every month. New Zealand's small, open economy makes its currency very sensitive to global risk, creating more opportunities and more risks for carry traders.

The other extreme of higher risk to earn carry income is with the TRY/JPY carry trade. Carry can be very high due to often Turkish interest rates exceeding 15% at times. While the carry income could be very high, political instability in Turkey and currency crisis can easily make for extreme losses.

When selecting carry trade pairs, successful trades look at much more than interest rate trims. They looked for economic stability, political risk, liquidity of the currency, and how the pairs correlated to global economic risk sentiment. A carry pair with 5% annual income may look good but if the high-carry currency pair could have a 20% swing frequently, the carry income is secondary to exchange rate risk.

Ultimately, the key is to identify currency pairing where the interest rate rim is from bona fide economic fundamentals rather than from crisis-related rate rim that is unsustainable.

How to Use Carry Trade in Real Trading

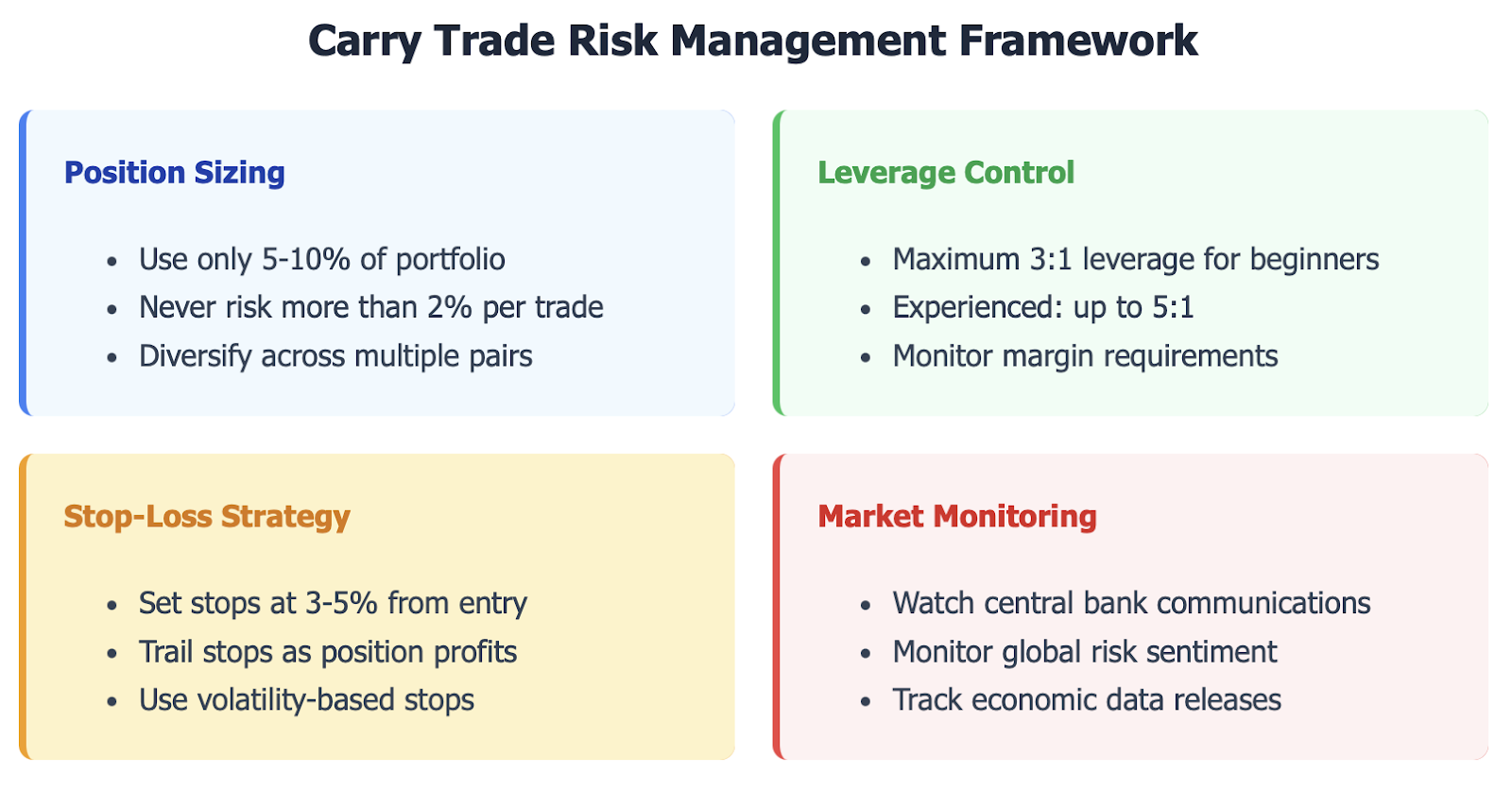

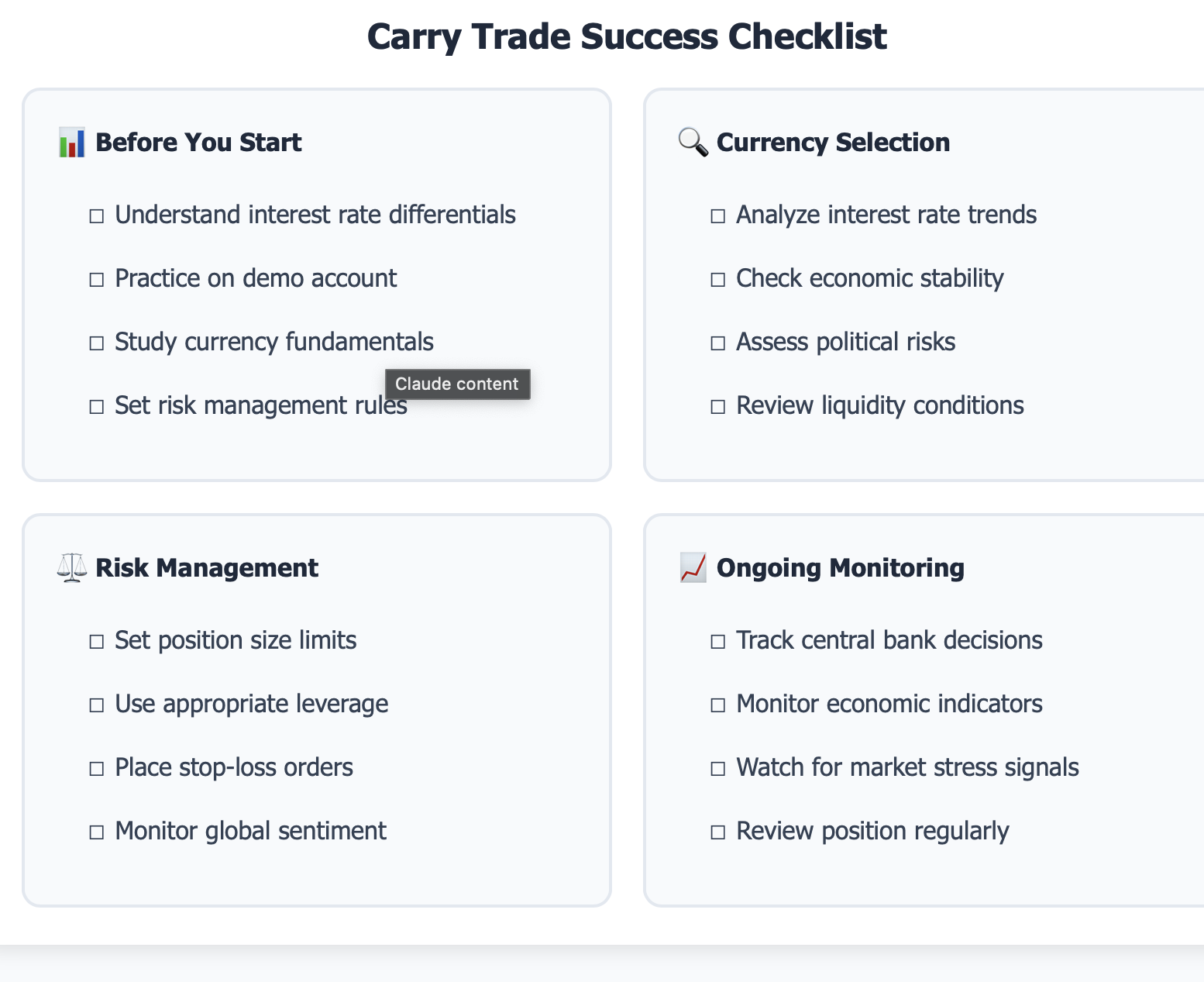

Performing carry trades successfully requires more than finding interest rate differentials. You also need to have a systematic plan that incorporates: fundamental analysis, proper risk management, and realistic expectations for the potential returns and possible draws.

Begin by choosing currency pairs that are based on sustainable yield differentials that are supported by solid economic fundamentals. For example, simply because a country offers rates of 8% might seem appealing, if those were rates resulting from a currency crisis or runaway inflation, the trade might have terrible unintended consequences. Look for instances where higher interest rates represent real economic strength or clear monetary policy to maintain currency value.

It is also important to confirm the trend before putting on positions. Even if the interest rate differentials support the trade, adverse currency trends can usually overwhelm carry income. A lot of carry traders simply wait for technical confirmation that the exchange rates support their fundamental thesis before putting any capital at risk.

For example, say the AUD/JPY trade has Australia at 3% and Japan at 0.25%, with an annual carry profit of approximately 2.75%. Then say the Australian dollar appreciate's 5% against the Yen over the same year giving you a total return of just under 8%. If instead, the Yen appreciates 10% against the Aussie, you would experience a loss of approximately 7% even with the potential carry profit.

Risk management distinguishes successful carry traders from those who incur trading losses. This means stop-losses must be set to limit downside exposure, leverage must be controlled to maintain sustainable levels, and macroeconomic conditions must be constantly monitored for the potential to trigger an unwinding of carry positions.

Position size is tremendously important. Many traders use small allocations to carry trades, implementing them as one aspect of a larger strategy and not trying to allocate their entire portfolio towards interest rate differentials. This gives them room to receive short-term volatility but also capture longer-term carry income.

Macroeconomic monitoring cannot be neglected. Central bank policy changes, critical economic data releases, and geopolitical developments can quickly change the sentiment around risks and destroy carry positions. Good traders stay alert for global developments and remain prepared to respond and even reverse trades when fundamentals change.

The most sophisticated carry traders do not just buy and hold. They actively manage their positions, using the thin and discreetly functional nature of their respective currency pairs to take profits when currencies reach extremes, add to positions during temporary losing streaks, or hedge the exchange rate risk while still retaining exposure to carry income.

Keep in mind, carry trading is best employed during slow, stable, risk-on environments. During periods of global uncertainty, crisis, or market turbulence, investors commonly flee from high-yield currencies to safe-havens. Hence, carry trades are generally most vulnerable to a sharp unwind.

Conclusion: Key Takeaways for Traders

Carry trading is one of the longest-standing trading strategies in forex, primarily because it is based on an economic reality: interest rate differentials = profit opportunities. When done correctly with proper have risk management techniques in place, carry trades can produce consistent sources of income and relatively desirable long-term returns.

The biggest draw for carry trading is its potential of producing consistent cash flow without being constantly plugged-in to the market or needing to time trades perfectly. More succinctly, you are being paid to hold positions based on the interest rate differentials of nations.

However, carry trading is not a get rich quick scheme or free lunch. Exchange rate fluctuations can wipe away months of interest income quickly, leverage can increase your losses past your risk tolerance, and macro events can send ripple effects through the global markets and cause carry trades to be unwound instantaneously.

For everyone who is new to trading, the first milestone is understanding the basic logic before risking any real cash. Start out using demo accounts, trade only the major liquid currency pairs, and avoid trading excessive leverage until you have felt how quickly carry trades can turn against you.

Once you have achieved a level of comfort with trading, advanced traders can start integrating carry trading into broader macro trading schemes. They can utilise economic analysis to identify interest rate differentials over short, medium, and long term horizons that are sustainable while ensuring strict risk controls are in place.

The carry trading Boom/Bust of 2008 is forever on my mind even though most rational traders would agree that there are times when these trades may make sense to enter. In most cases, traders who made it through that period of time, were using conservative levels of leverage, holding diversified positions, and were flexible enough to adapt real time when conditions changed.

If implemented correctly, carry trading can add value to a truly sound forex strategy and no one will disagree that trading is as much about respect as it is about risk. Success in trading comes from patience, discipline, and never forgetting that in financial markets what goes up, sometimes goes down even faster than going up.

Are you ready to open a trading account to take advantage of carry trading? You can open an account with BTCDana to take advantage of the advanced features on our trading platform.

Plus you will join thousands of traders just like you who utilize BTCDana's execution and spreads to generate the most out of their carry trades.