Everything you need to know about forex trading strategy 80% of forex trading takes place in around 18 of the major currency pairs that you are able to trade via most brokers.

Introduction

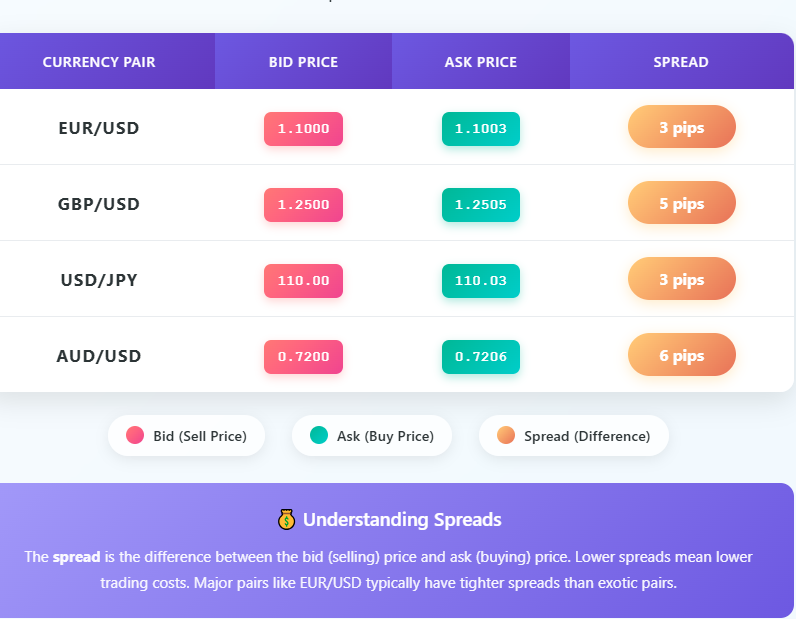

Whenever you make a forex trade, you’re mindlessly paying a fee that most new traders aren’t really aware of: the spread. It doesn’t matter if you are long EUR/USD or short GBP/JPY, the spread is always there. And knowing how spreads work, why they’re there and the right way to handle them can mean the difference between profitable trading and slowly bleeding your account dry.

We’ll take you through a deep dive into everything you must understand about various forex spreads explained in simple words. By the time you’ve made it to the bottom, you’ll learn how to trade smarter and fatten your wallet.

1. What is a Spread?

The spread, in forex trading, refers to the difference between the Bid and Ask price of a currency pair. Call it the “price of admission” to every trade you do.

The Simple Formula

Spread = Ask Price – Bid Price

Real-World Example

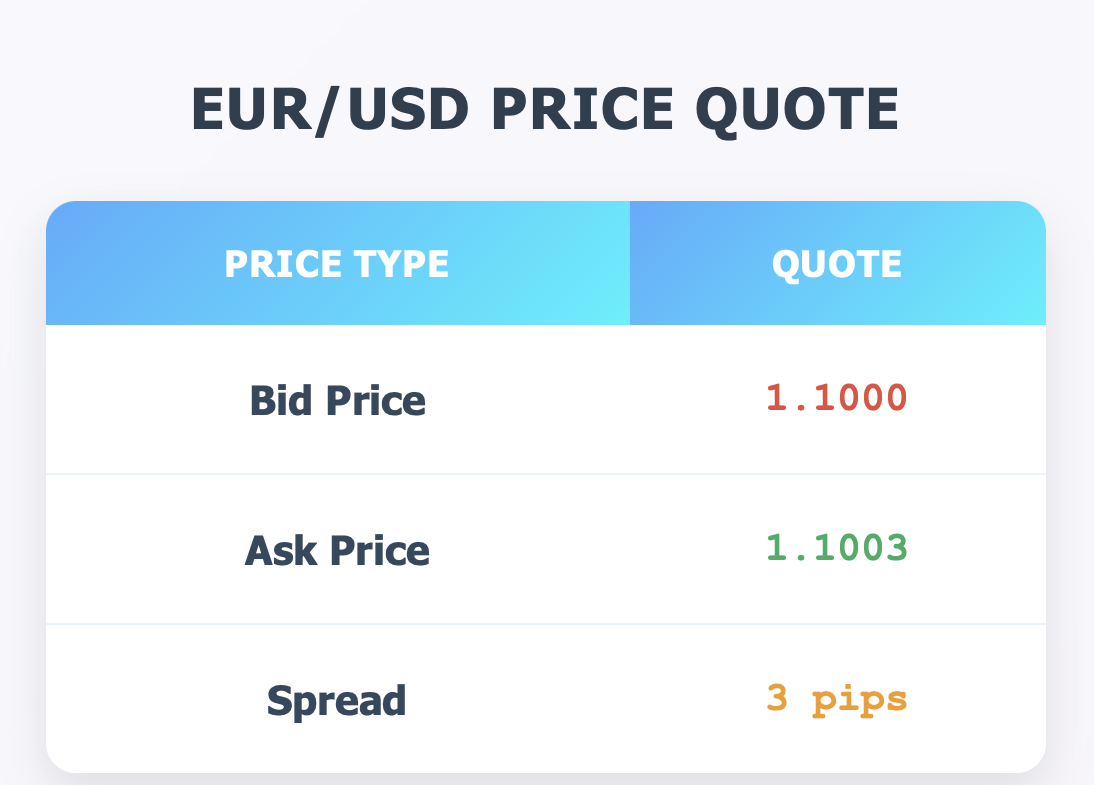

For example, assume you’re following EUR/USD quotes on your trading platform:

In this example, if you want to buy EUR/USD, you will pay 1.1003. If you wish to sell it right after purchasing, you will receive only 1.1000. This 3-pip difference is the spread — and it goes straight to your broker.

Why the Spread Matters

The spread is a cost that you pay right away when you enter a trade. Even if the market doesn’t budge, you’re already starting in a slight deficit equal to the spread. This is why it is so important to understand spread costs and how to manage these costs to ensure your trading is profitable.

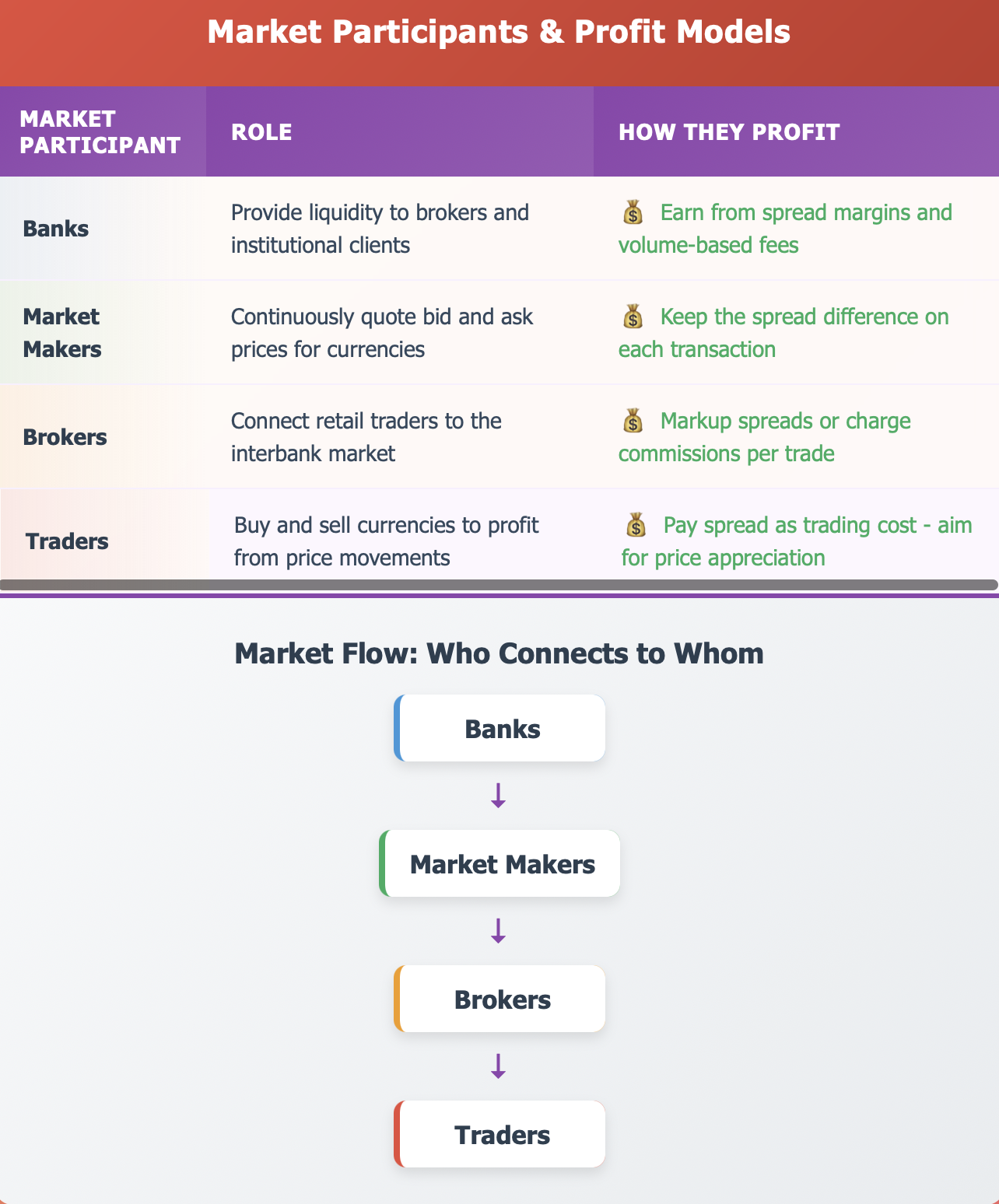

Why Do Forex Spreads Exist?

Knowing why spreads exist will help you understand the market structure so that you can trade more prudently. Unlike stock and commodity markets, forex is not traded on a regulated exchange and thus does not have a centralized exchange.

Supply and Demand Dynamics

Spread widths are functions of supply and demand first and foremost:

High Liquidity = Lots of buyers and sellers =V Narrow spreads

Low Liquidity = Low participants = Wide spreads • By the numbers – the lower the # of bids, the wider the spread.

Real-World Analogy: Airport Currency Exchange

Now, consider changing money at an airport. That exchange booth may buy your US dollars from you for €0.85 each, but sell euros to you for €0.88 each. That €0.03 is their “spread”, or income -- that’s how they cover their costs and turn a profit, just as in forex trading.

Professional Example

High-frequency trading firms earn millions by capturing minuscule spreads over thousands of trades a second. It may only be 0.1 pip for each trade, and you might be doing 100,000 trades in a day, but when those profits are compounded like that, they add up.

Pip and Spread: How They Work Together

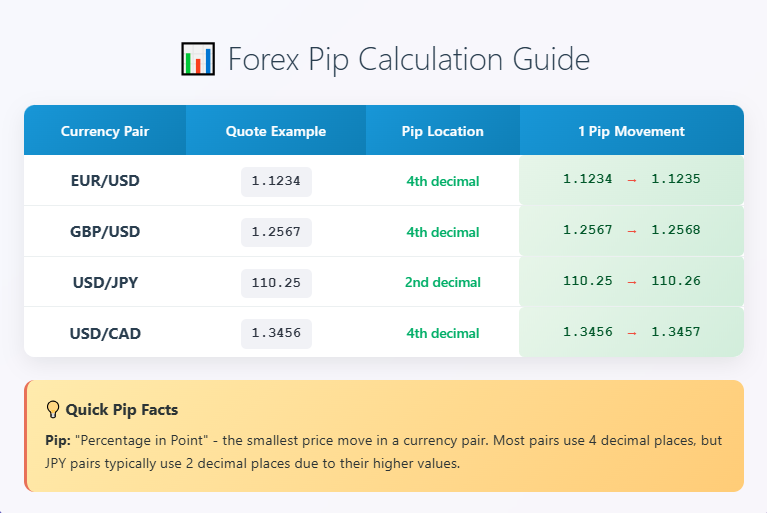

To properly understand what a spread is you should first of all know that a pip is. And how it fits in with measuring spreads.

What is a Pip?

A pip (percentage in point) is the smallest unit of price movement in forex trading. For most types of currency, a pip is the fourth decimal place.

Spread Measurement Examples

Kitchen Scale Analogy

You can think of a pip as the smallest gram measurement on a kitchen scale. Single grams may feel small, but if you’re measuring enough ingredients for a large recipe (or making a lot of trades), those tiny measures can have a big impact on the overall outcome.

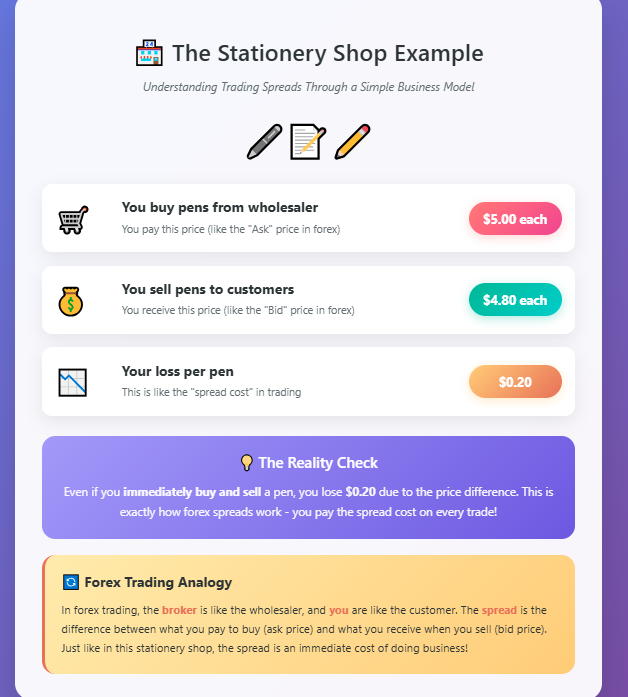

A Simple Everyday Example: Understanding Spread Like a Stationery Shop

The spread idea is easy to understand if you think of it like this!

Real Trading Scenario

Let’s take Sarah, a high school student practicing trading forex with a demo account:

-

Sarah wants to buy EUR/USD

-

Platform display: Bid 1.1050 / Ask 1.1052

-

Sarah clicks "Buy" at 1.1052

-

After that, her post indicates a 2-pip deficit

-

Why? For if she sold immediately, she would receive only 1.1050

It is this “invisible cost” that makes many beginning traders wonder why they’re starting in the red even though the market hasn’t moved against them.

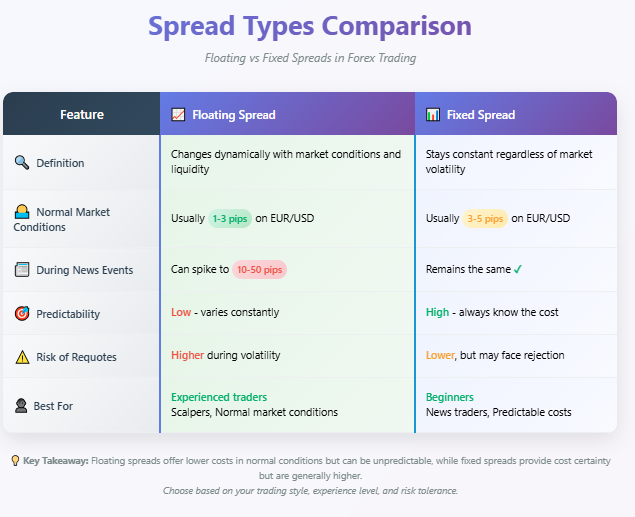

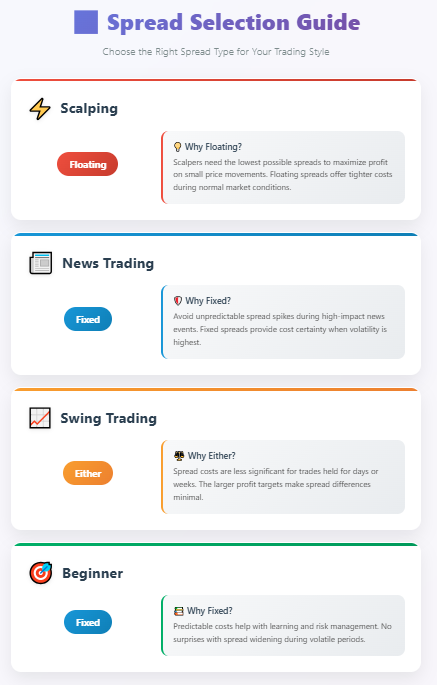

Floating vs. Fixed Spread: Which One to Choose?

It’s very important to know the difference between fixed and floating spreads when selecting a broker and trading conditions.

Real-World Example: NFP Friday

Now we will see each type of spread perform at the time of Non-Farm Payroll (NFP)!

Taxi vs. Bus Pass Analogy

-

Floating Spread = Taxi with surge pricing: Cheaper during off peak hours, more expensive during rush hours.

-

Fixed Spread = Monthly bus pass: Always the same price, whether you are traveling during a busy time or it’s that icy hour before the (moto)bus leaves town.

Which Should You Choose?

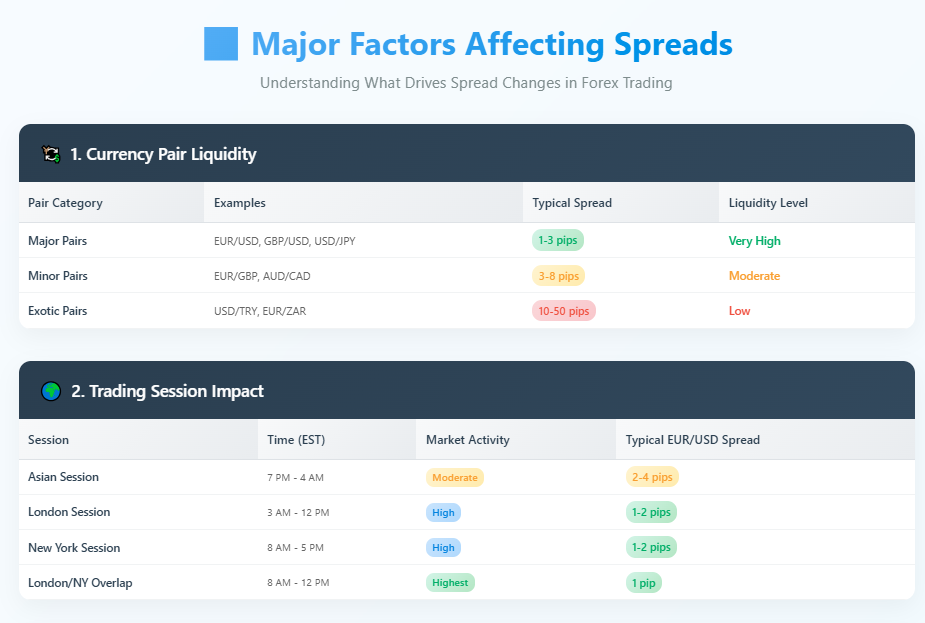

What Factors Affect the Spread?

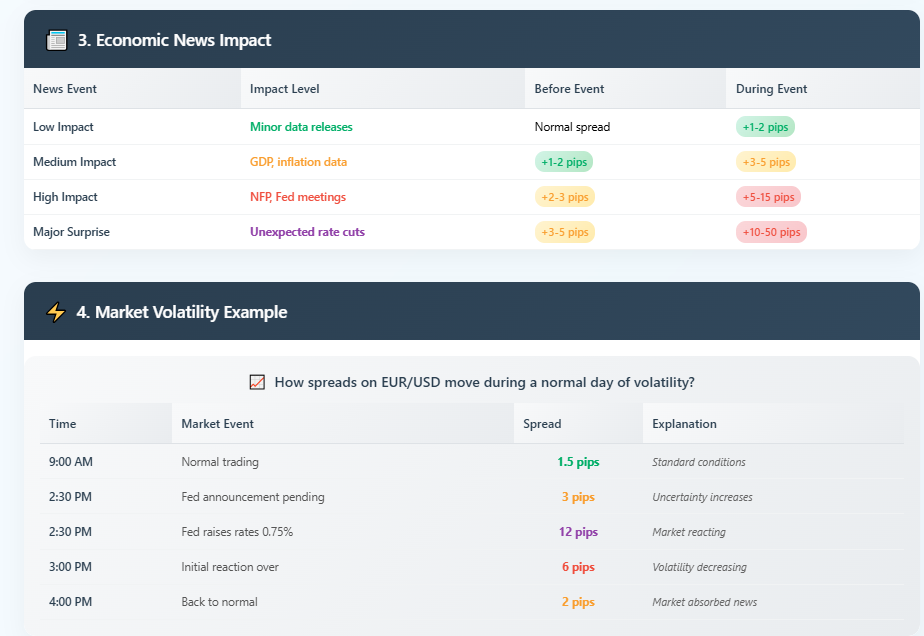

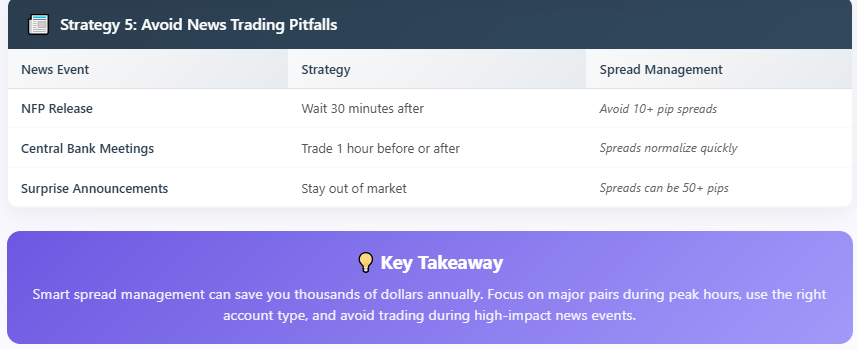

Knowing what causes spreads to tighten or widen helps you time your trades more effectively and avoid unnecessary fees.

Ways to lower your spread cost

The fact of the matter is, successful traders understand that controlling spread costs are critical to long term profitability. Here are tested approaches you can take to pay less.

Practical Example: Two Traders Compared

Trader A (Poor Spread Management):

-

Only trades exotic pairs Asian session

-

Uses market orders during news

-

Average spread cost: 8 pips each way

-

100 trades a year = $800 in spread charges

Trader B (Smart Spread Management):

Trades across the 8 major currency pairs Featured in:

-

Uses limit orders when possible

-

Average spread cost: 1.5 trade pips

-

100 trades a year = $150 in spread costs.

Annual Savings: $650

Summary & Frequently Asked Questions

Key Takeaways

Only cost of spread is incurred as the trading portion in forex beginner s italia. By learning about what spreads are, how they work and who/what influences them with luck you'll be set to increase your trading profits. Remember these essential points:

Spreads – The instant cost of trading– Every trade must have modest loss to begin with.

-

Timing is key - Trade in Hypest-laviest hours of power.

-

Key to choose a pair -Important pairs have better spreads.

-

Keep abreast - Be aware of news headlines which could make the spreads grow wider

-

Pick your broker carefully - Account types vary in terms of spreads offered

Frequently Asked Questions

Q: Should a beginner really be concerned with spreads?

A: Absolutely. Spreads on all your trades impact every single trade you have once more. A newbie paying 5 pips instead of 2 is seeing their trading costs increase by a whopping 150%! This difference can add up over time and be the difference between being profitable or not.

Q: Is the lowest spread best?

A: Not necessarily. You need to consider:

-

Order execution quality

-

Broker reliability

-

Additional fees or commissions

-

Customer service and platform stability

-

Occasionally, it is worth paying an extra pip for better execution and service.

Q: How do spreads compare with commission?

A: They're different cost structures:

Q: Can I be profitable with wide spreads?

A: Yes, but it's harder. If you swing trade and hold your trades for days, even weeks probably spread differences in tool mattering. But for day trading and scalping, tight spreads come predominant.

Q: Are spreads fixed at weekends?

A: Yes, dramatically. Spreads on weekends can get as wide as five to 10 times normal when liquidity is very light. The best traders are not the weekend warriors!

Ready to Start Trading?

Knowing spreads is not enough in the forex market. The easiest way to get a feel of how spreads function in real-time is by opening a demo account and monitoring live spread quotes. You will soon be able to identify when spreads are good for trading and when you should wait instead.

Take Action Today:

-

Try a Demo Account to Practice without risk

-

View live spreads on various trading sessions

-

Try to use some order types and see what happens with them

-

View spreads for any combination of 10 pairs dictionary with

-

When you transition to live trading, start small

Keep in mind: Every expert trader was once a beginner. Fail to learn the basics such as spreads, and you are bound to fail during trading.

Forex Glossary