Introduction

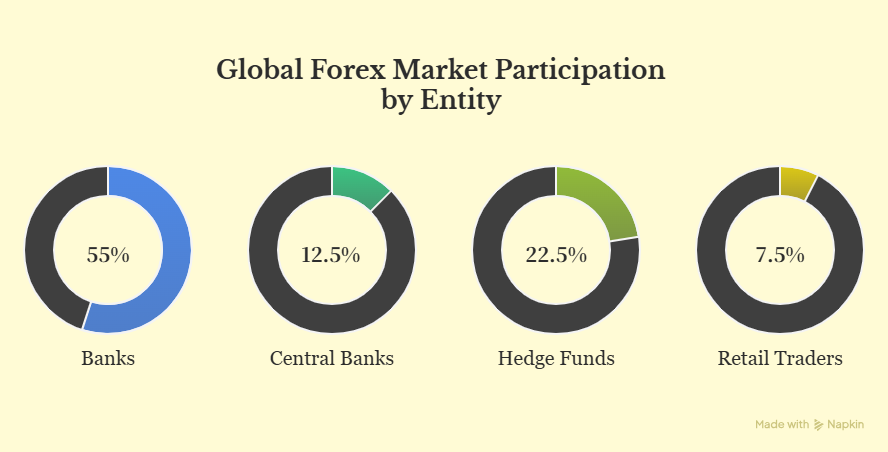

The forex market is the biggest and most active financial market in the world, with a forex market size exceeding $7 trillion in daily trading volume, according to the Bank for International Settlements (BIS). Unlike stock markets, forex trading is all about swapping currencies, and the market is mainly driven by a variety of forex market players, including central banks, institutional investors, corporations, and retail traders.

Among these players, central banks in forex trading are the most influential. They manage their countries' money policies and can change currency values based on their decisions about interest rates, money supply, and other market guidance. These choices can really impact exchange rates and create trends that even retail traders need to pay attention to.

In this blog, we will dive into how central banks shape the forex market, looking at their policies, the tools they use, and how traders can use this info to make smart trading choices.

Key Central Bank Policies That Move Forex Markets

Central banks influence currency values through various monetary policy tools. Understanding how these tools work is crucial for traders who wish to capitalize on market movements.

Types of Monetary Policies:

-

Expansionary Monetary Policy: This policy aims to stimulate economic growth by lowering interest rates and increasing the money supply. Typically, this is bearish for a currency, as lower interest rates can make it less attractive to investors.

-

Contractionary Monetary Policy: This policy is meant to fight inflation by raising interest rates and reducing the money supply. It is generally bullish for a currency, as higher interest rates attract investment and increase the currency's value.

Key Policy Tools:

-

Interest Rate Decisions: Interest rate decisions in forex are among the most impactful tools. Central banks raise or lower rates to manage inflation or stimulate the economy. Usually, higher rates strengthen a currency, while lower rates can weaken it. Traders closely monitor these decisions for trading chances.

-

Quantitative Easing (QE): Quantitative easing in forex refers to a central bank’s strategy of purchasing long-term government securities to inject liquidity into the economy. This can help spur growth but usually leads to a weaker currency because of the increased money supply.

-

Direct FX Market Interventions: Central bank forex intervention involves direct buying or selling of a nation’s currency in the forex market. These moves often aim to stabilize exchange rates or fix wild fluctuations, which can cause quick price changes.

-

Inflation Targeting & Forward Guidance: Central banks often set inflation targets and use forward guidance to signal future monetary policy actions, which can heavily influence trader expectations and market movements.

Examples:

Case Study Deep Dive: Federal Reserve vs ECB vs BoJ

To get a better picture of how different central banks impact the forex market, let’s take a look at three major institutions and how their policies have affected currency movements over the past few years.

Federal Reserve (Fed)

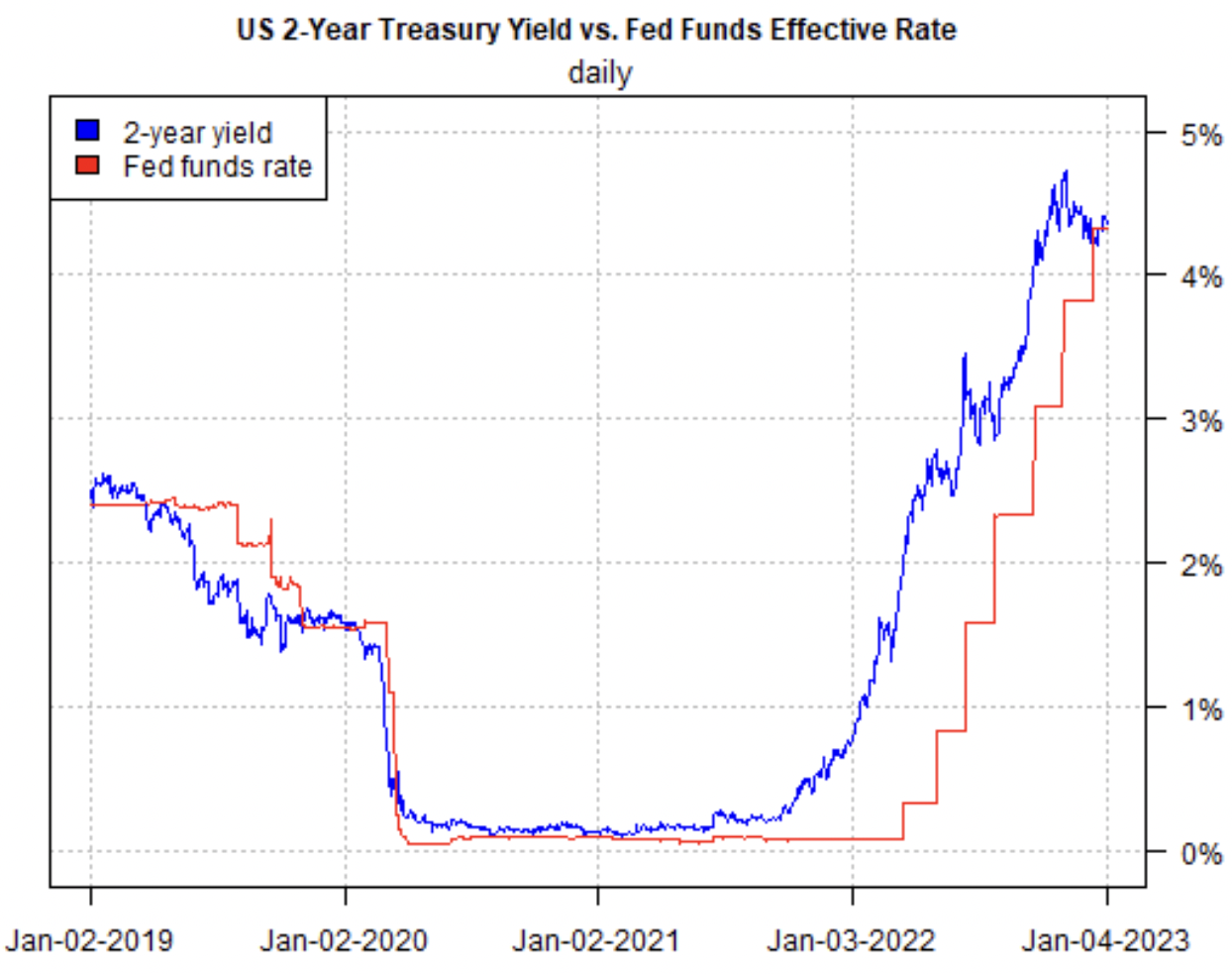

The Federal Reserve is a big player in the forex market and is often seen as a hawkish central bank. The Federal Reserve's forex impact stems largely from its focus on combating inflation through aggressive interest rate hikes. In 2022, the Fed hiked rates several times to tackle high inflation, which caused the U.S. dollar to rise a lot. This tough approach brought in more foreign investment, making the USD stronger overall, especially against lower-yield currencies like the JPY and EUR.

European Central Bank (ECB)

The ECB’s monetary policy is traditionally more conservative, with a strong emphasis on inflation targeting and maintaining price stability. Although they’ve raised rates a bit, they’ve generally been more relaxed compared to the Fed. This was clear in 2021 and 2022 when the EUR struggled to keep up with the USD, as the market felt the ECB was falling behind the Fed in tightening things up. As a result, EUR/USD didn’t see much growth, showing how sensitive the market is to the different approaches of central banks.

Bank of Japan (BoJ)

The BoJ has kept a very loose monetary policy to fight ongoing deflation. With near-zero interest rates and sustained quantitative easing, the JPY has consistently been one of the weaker major currencies. In 2022, the BoJ's forex intervention was a rare but notable move to halt the yen’s slide. But even with that, the USD/JPY gap still pressured the yen, thanks to the Fed tightening while the BoJ was easing, showing how interest rate differences affect currency values.

Pro Tip: Each central bank operates with different mandates. Some focus on inflation, while others care about employment or growth. For forex traders, it’s important to tweak your strategy according to what each bank is doing to stay ahead of the market.

How Traders Can Use Central Bank Signals in Forex Strategies

Understanding and acting on what central banks are signalling is key for any good forex trading strategy. By analysing monetary policy statements, FOMC dot plots, and press conference language, traders can get great insights into where the market might be headed and make smarter trading choices.

Monetary Policy Statements

Central banks put out policy statements after meetings that give important insights into their economic views and plans. For central bank news trading, key phrases such as “tightening likely” typically indicate a bullish outlook for the currency, while terms like “easing ahead” are considered bearish. Quickly reading these signs can give traders an advantage.

FOMC Dot Plots

These charts show the Fed’s expected interest rate path over time. A hawkish dot plot implies potential rate hikes and usually strengthens the USD. On the other hand, a dovish tone in the plot suggests restrained policy action, which can weigh on the dollar. Incorporating dot plot analysis into your forex fundamental analysis helps in anticipating long-term currency trends.

Forward Guidance

Central banks often give hints about what they might do next with their policies to help markets get ready. For instance, if the Fed hints at raising rates, traders might get ready for a stronger USD. This guidance works even better when combined with technical signals and market sentiment.

Practical Example:

If the market expects the Fed to raise interest rates, a trader might short EUR/USD in anticipation of a stronger USD.

-

Entry Point: Based on Fed rate hike expectations.

-

Stop Loss: Positioned at technical support levels.

-

Take Profit: Aligned with the policy timeline when the expected rate hike occurs.

BTCDana Tools:

Make the most of BTCDana’s live charts, news updates, and analysis tools to keep an eye on central bank signals.

Common Mistakes Traders Make with Central Bank News

Traders often make mistakes when reacting to central bank news. Here are some common pitfalls:

-

Overreacting to News: Traders sometimes react impulsively to central bank announcements without considering market expectations. This often leads to the “buy the rumour, sell the fact” phenomenon.

-

Ignoring Time Zone Differences: Central bank news often drops at different times, and traders might not consider how these differences affect market reactions.

-

Lack of Risk Management: Traders fail to set stop-loss orders during volatile policy windows, exposing themselves to large losses.

Misinterpreting Ambiguous Language: For example, the Fed's “dovish hike” (a rate hike with dovish guidance) caused confusion, leading to unexpected moves in USD after a rate hike.

Conclusion

In conclusion, central bank policies are a primary driver of currency values in the forex market. By understanding how central banks make decisions through interest rate hikes, quantitative easing, or market interventions, traders can position themselves to take advantage of these shifts.

If you want to be a successful forex trader, it’s essential to stay updated on central bank policies, predict future moves, and use tools like BTCDana’s economic calendar and real-time price charts to strategize effectively. Forex trading isn’t just about the numbers; it’s also about understanding the bigger economic picture, including the decisions made by central banks.

Ready to turn central bank insights into real trading opportunities?

Start trading forex with BTCDana today.