Introduction: The First Thing You View in all Forex Pairs

When you look at a forex quote like EUR/USD = 1.10 for the first time, you may think that it is simply - it appears uncomplicated and even elementary. But there's a substantial amount of meaning contained within that quote, and the first currency - EUR in this example - is called the base currency, and it is the basis from which you'll take all of your actions in forex trading.

So currency pairs can be thought of as two parts, consisting of the base currency and the quote currency. The base currency has always been first, then a slash, then the quote currency. Therefore, in EUR/USD, EUR is the base, and USD is the quote. Currency pairs are set up like this for a reason - they tell you what you are buying and selling.

It is important to understand the base currency, as it implicitly tells you how to read prices and what unit you are trading. Therefore, in EUR/USD = 1.10, you are buying 1 euro (as represented by the base currency EUR), at the price of $1.10 (as represented by the quote currency USD). The base currency (EUR) is similar to a "product name" when you are shopping for famous products from the vendor - just like "1 bottle of Coke costs $3" is telling you that it is the bottle that you have in hand, the currency pair has the value of the unit or "product" that you are trading.

This may seem straightforward, but misunderstanding this concept can be costly. Every trader who has been successful, professional or amateur, mastered this basic but significant concept first. After you grasp base currencies, you will be able to read forex quotes as easily as price tags at a store.

What is a Base Currency? The Anchor of Every Forex Trade

The base currency is simply the first currency in any forex pair. It is your base reference point. It is the currency that is compared to another currency to create an exchange rate. If you look at GBP/USD = 1.25, you are talking about 1 British pound = 1.25 US dollars.

Now here is what makes this concept so critical: whenever you trade forex, you are always buying or selling the base currency. Always. This isn't debatable or negotiable. This is how the forex market works.

Why is it called a 'base' currency? Because it is the baseline, the primary for comparison. When I say, "1 apple = 3 bananas," the apple is the base unit of measurement. Everything else is measured against it.

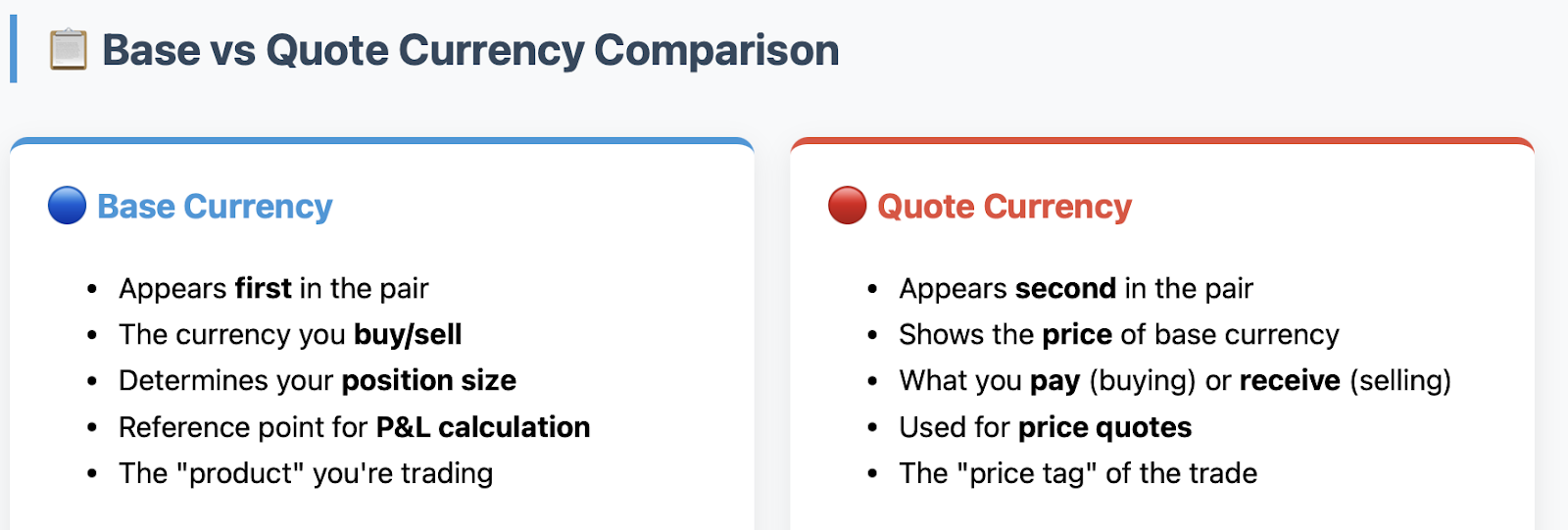

Let's clarify the difference between base and quote currencies.

Base Currency:

-

Appears first in the pair

-

The currency you buy and sell

-

Determines size of position

-

The point of reference for your profit and loss

Quote Currency:

-

Appears second in the pair

-

Tells you the price at which base is traded

-

What you pay (when you're buying) or what you receive (when you're selling).

Professional traders never confuse them because they know the cost of mixing up the two currencies can cause costly mistakes. For example, if you believe you are buying USD when going long EUR/USD, you are actually buying EUR and selling USD. Confusing them can ultimately cost you a profit.

The concept of a base currency applies to every forex pair, whether major, like EUR/USD, or exotic, like USD/TRY. Understand this simple concept, and you'll never be confused about what you are actually buying/selling.

Why is the Base Currency Important? The determinant of profits, losses, and trade size.

Understanding base currency is not only theoretical; it has a clear and direct impact on your money. Everything in forex trading is based on base currency - position sizing, taking profits, loss calculation, etc.

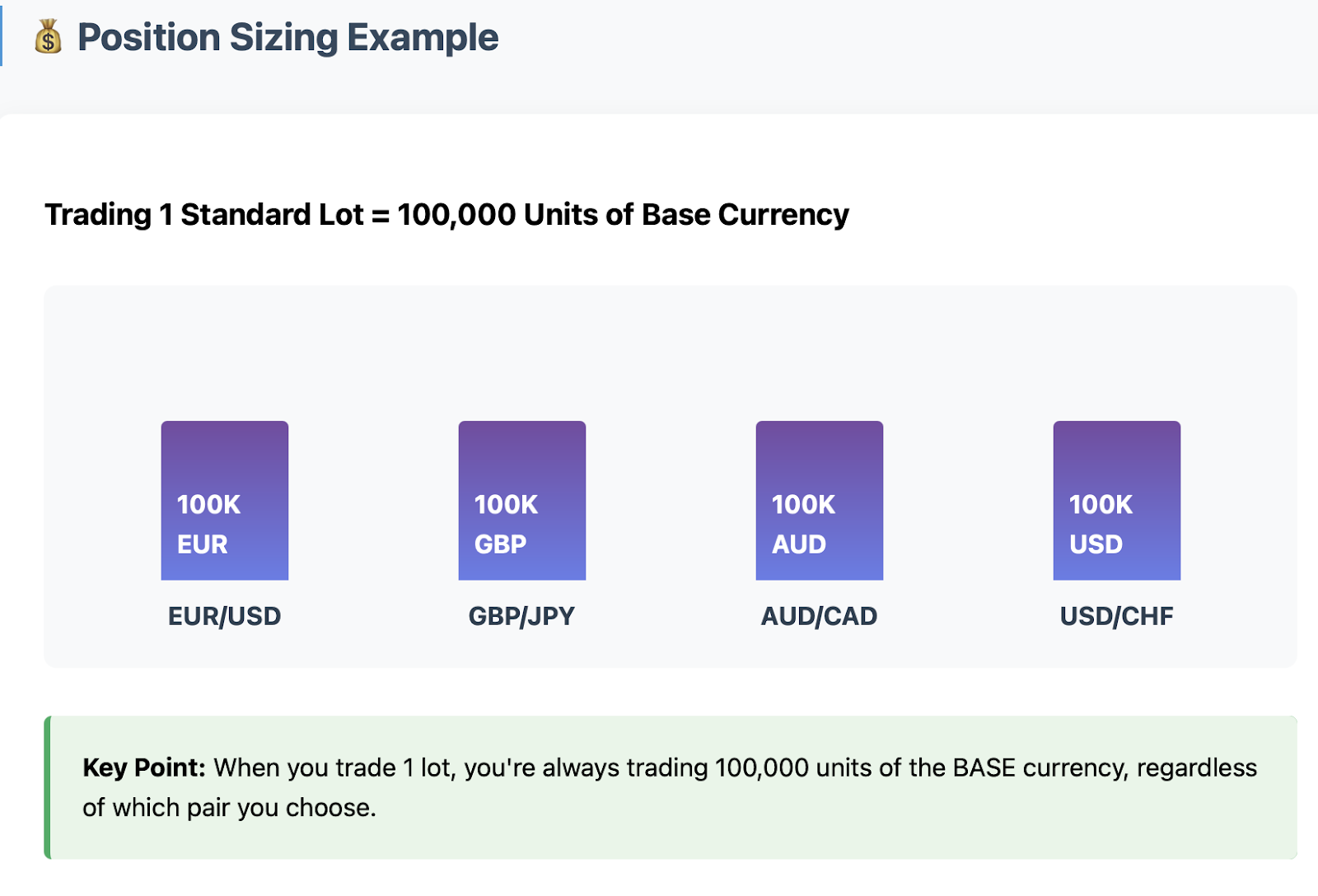

Trade Volume and Position Sizing

When you trade 1 standard lot in forex, you are trading 100,000 units of the base currency. When you buy 1 lot of EUR/USD, you are buying 100,000 euros, not dollars - this is where a lot of beginners get confused and end up with positions much larger or smaller than they want.

You can consider it like a supermarket transaction: when you hear that "1 case of soda costs $20," you know that you're purchasing the case (the base unit), not the dollar. The same concept carries over to forex as you're always buying or selling the base currency, not the relative currency.

Calculating Your Profit or Loss:

Your profits and losses are initially calculated in the base currency, then converted to your account currency if applicable. Therefore, the performance of the base currency impacts your bottom line directly.

For example, if you buy 1 lot of EUR/USD for 1.1000 and sell it at 1.1100, you made 100 pips; but those 100 pips are worth 100 euros, not 100 dollars, since the conversion to your account currency occurs later.

Price Movement Understanding:

The base currency directly offers you information as to what is stronger or weaker. When EUR/USD goes from 1.1000 to 1.1100, the euro (base currency) has gotten stronger against the dollar. When USD/JPY goes from 110 to 109, the dollar (base currency) has weakened against the yen.

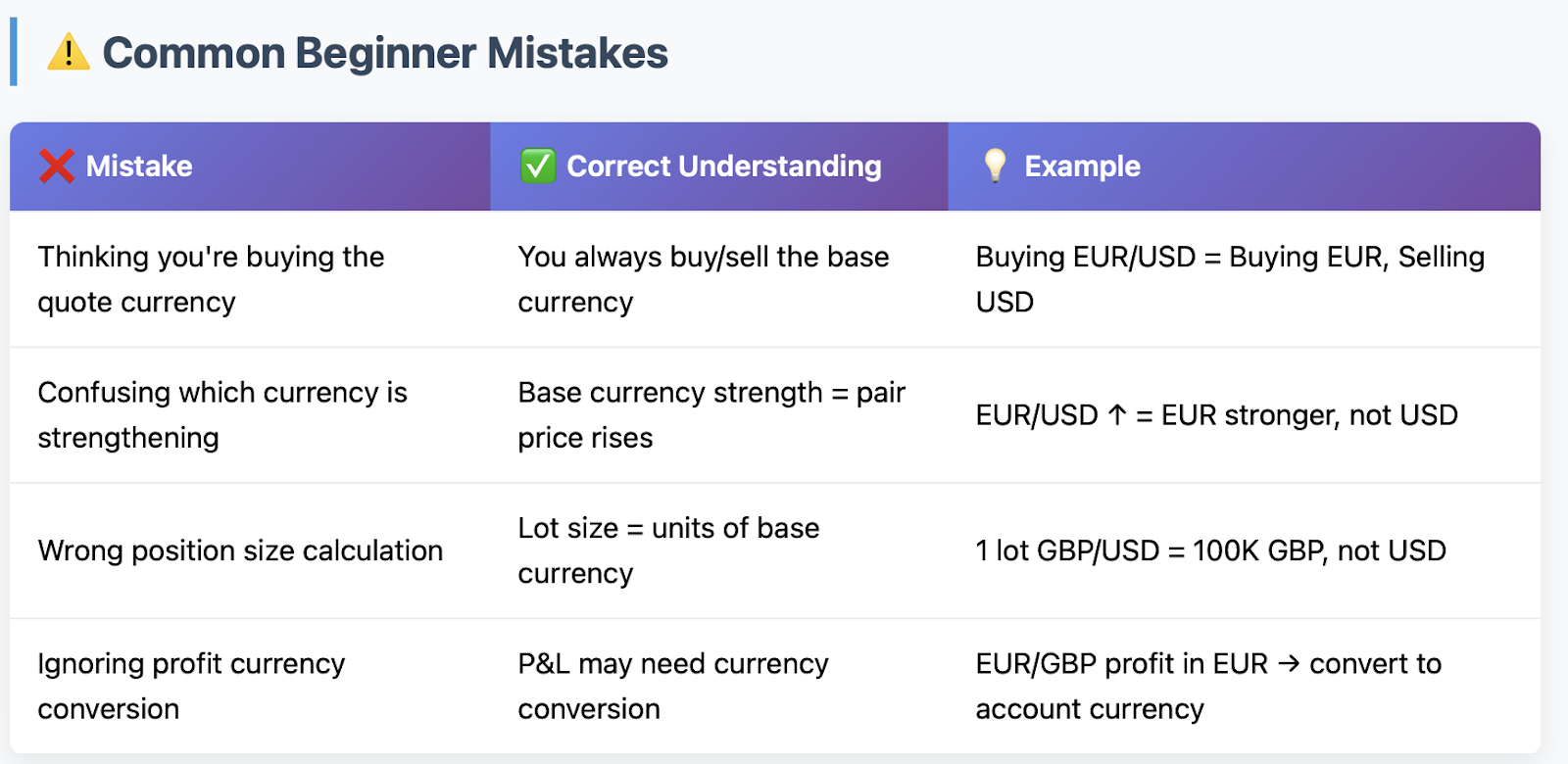

Most Common Mistakes for Beginners.

The biggest error that new traders encounter is thinking that they are buying the quote currency when, in fact, they are buying the base currency. When EUR/USD goes up and the new trader thinks "the dollar is getting stronger", in fact, what is actually happening is that the euro is getting stronger. This thinking causes the trader to stray away from their analysis of the market.

Another error is not considering which currency their returns will be in. If your account reflects USD and you're trading EUR/GBP, your returns, which are in euros, will need to be converted back to dollars, and therefore expose you to an additional layer of currency risk.

If you can define the concept of base currency adequately, then you won't make these costly mistakes, and you'll be able to better serve the purpose of your trading plan for success.

Common Base Currencies in Forex: The World's Most Traded Money Anchors.

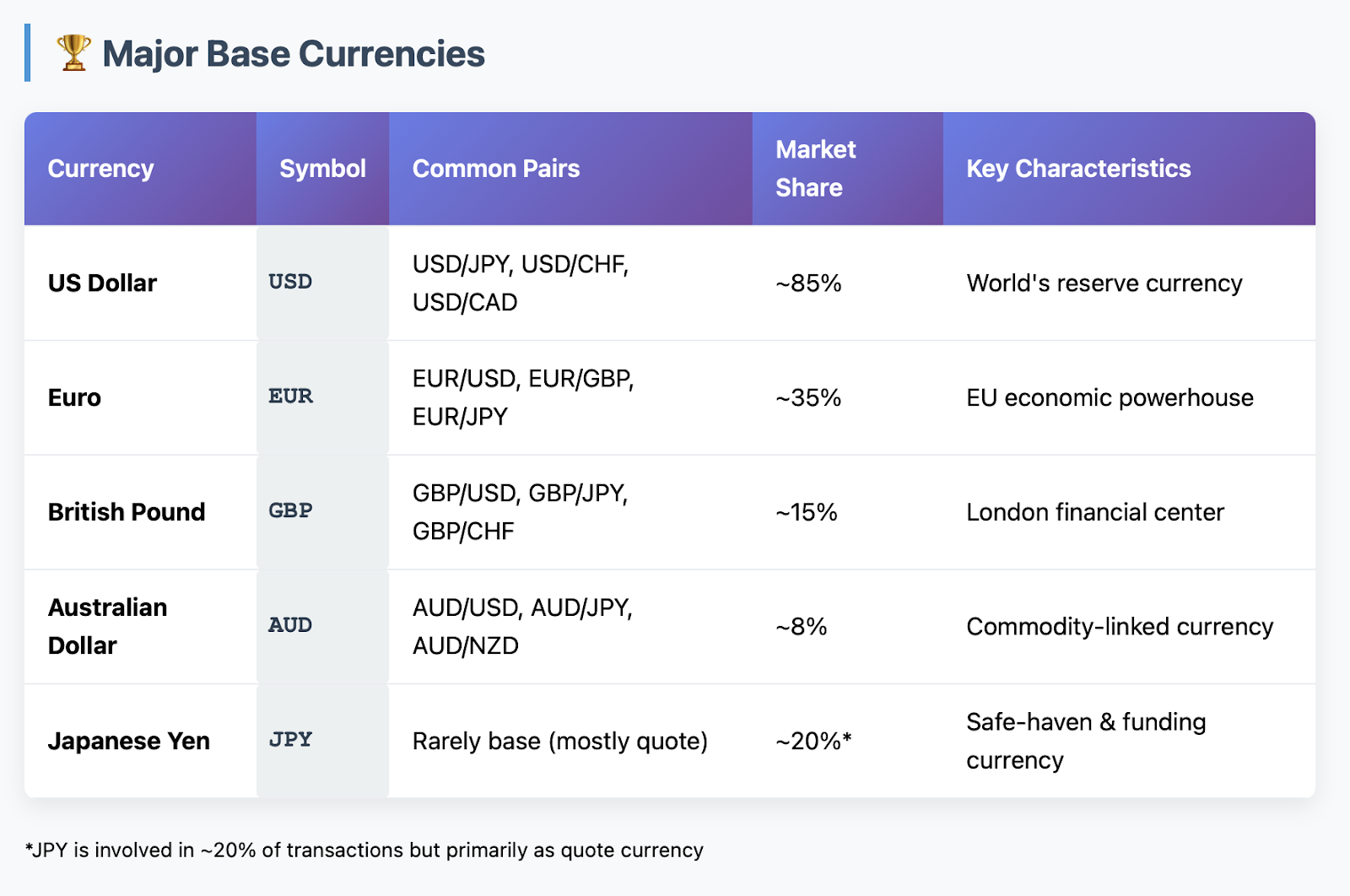

In the world of forex, not all currencies are equal. A select few currencies form the majority of transactions and are utilised as base currencies far more than others. Knowing who the big players are gives you a sense of what this looks like from the perspective of global financial powers.

US Dollar (USD)

The Dollar is the world’s primary reserve currency and is involved in about 85% of all forex transactions. As a base currency, common USD Pairs include USD/JPY, USD/CHF, and USD/CAD. The USD holds this privilege based on the size of the American economy, the relative political stability of the US, and the USD being the pricing standard used to price oil and several other commodities globally.

Euro (EUR)

The Euro was established to reclaim some of the economic power driven by the USD. Thus, the currency represents the economic power of the European Union. EUR-based pairs like the EUR/USD and EUR/GBP account for significant liquidity in the forex market because they represent major economic blocs. The Euro’s strength as a base currency illustrates Europe’s relevance as an economic trade bloc.

British Pound (GBP)

Despite the uncertainties surrounding Brexit, the pound remains one of the important base currencies utilised by forex traders. GBP/USD (known as “Cable” to traders) has centuries of trading history. The prominence of the pound in the FX market directly reflects London’s global importance as a major financial centre and the UK’s historical economic relevance.

Japanese Yen (JPY).

It is interesting to note that the yen hardly ever trades as the base currency in any major pairs, typically as quote currency (like USD/JPY or EUR/JPY). This shows Japan is a funding currency in global trades and acts as a safe-haven in turbulent markets.

Australian Dollar (AUD)

The Aussie dollar acts as a base currency in pairs like AUD/USD and AUD/JPY. It has been able to maintain its strength from Australia's strong exports in commodities and a stable political system. Often in AUD pairs, the movements of AUD must equate with commodity prices; traders who follow various resource markets find themselves trading exotic pairs often.

These currencies didn’t become major base currencies by accident; they represent countries with large, stable economies, deep financial markets, and large amounts of international trade. Just like many major retailers price their products in the most widely accepted currencies, the forex market naturally gravitates towards these established monetary powers.

Knowing which currencies trade as bases will allow you to be marginally aware of trends and open pair choices that complement your trading strategies.

Using Base Currency in Trading: Theoretical to Practical.

Now it’s time to take a practical approach. Clearly, knowing base currency theory does nothing for you without being able to apply it to actual trades. So let’s look at how successful traders use their understanding of base currency to guide their trading decisions.

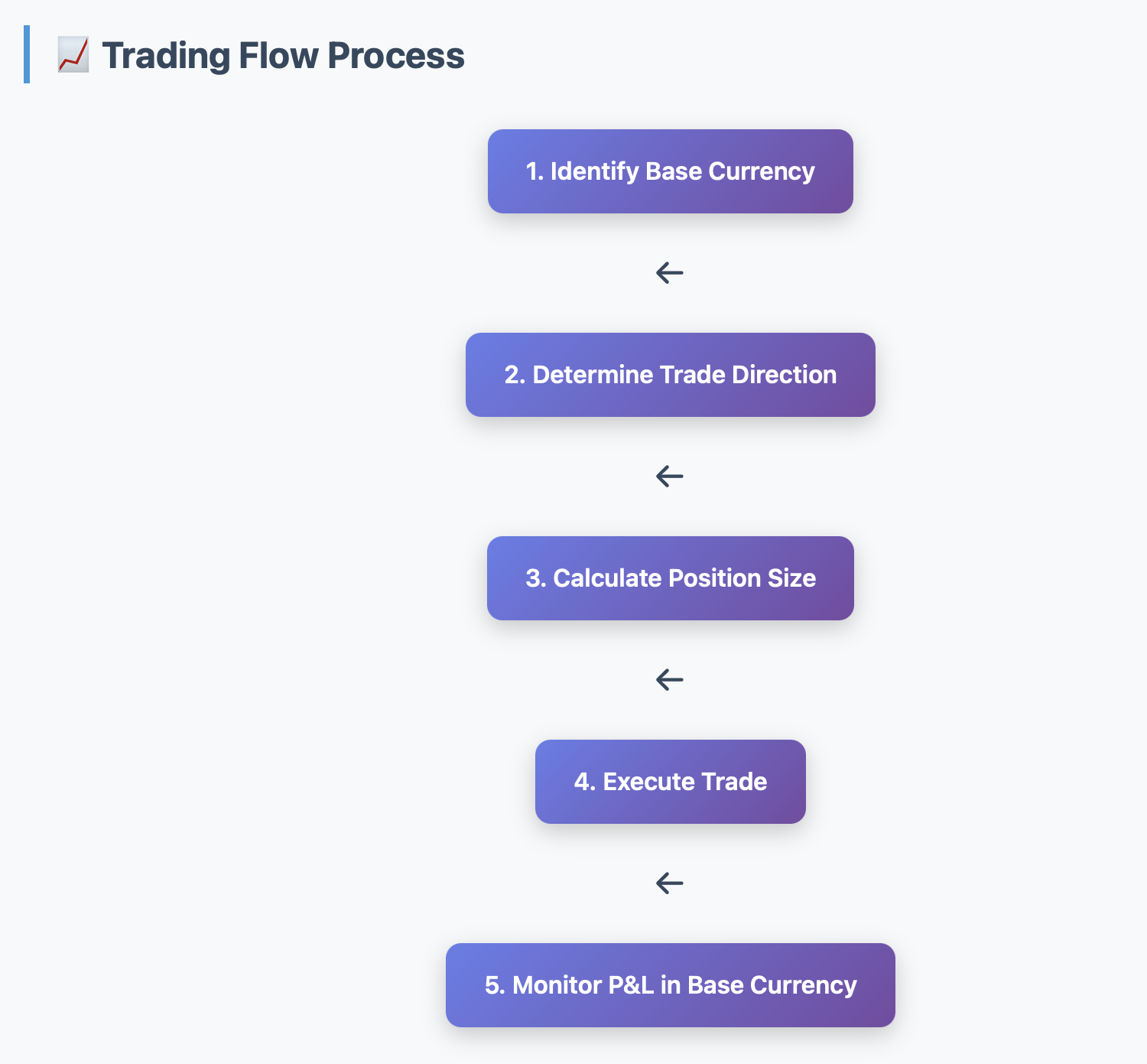

Taking Your First Trade.

As an example, when you click "Buy" on EUR/USD, you are actually buying euros and selling dollars. When you click "Sell" you are selling euros and buying dollars. This may sound simple, but many new traders confuse the differences and think that they buying the pair when in fact they are actually buying the base currency, euros.

Let's say for the sake of this example you think the euro is going to get stronger than the dollar. You then buy 1 lot on a EUR/USD with an entry of 1.1000. You have just bought 100,000 euros with 110,000 dollars (100,000 * 1.1000). The market moves and now the exchange rate is at 1.1100. You can then sell those euros for 111,000 dollars, for a profit of $1,000.

Risk Management and Position Sizing:

Your position sizes are always based on the base currency. For example, if you wanted to risk 1% of a $10,000 account (or 1% or risk ($100) on a EUR/USD trade, you will want to determine how many euros that will equal, not dollars.

Let's say your stop loss is 50 pips away. With EUR/USD at 1.1000, each pip for a standard lot is worth about $10. So 50 pips = $500 risk. To risk only $100, you'd trade 0.2 lots (20,000 euros), not a full lot.

Profit and Loss Conversion

Things can get tricky because of the difference between the account currency and the base currency. For example, your account might be USD, and you are trading EUR/GBP. Your profits in this case will be in euros, and you need to work back to dollars.

Here's a scenario to give you an idea. You buy 1 lot EUR/GBP at 0.8500, or 0.8550. You had 50 pips profit, so you made 500 euros (50 pips x €10 per pip). However, your account is a USD account, so you will have to convert that 500 euros into USD currency using the current EUR/USD rate to determine your dollar profit.

Reading Platform Interfaces..

In general, all trading platforms will clearly show the base currency in their order screens. The platform will use terminology such as "Amount" or "Volume". This means the number reflects the units of the base currency. So if you were to trade EUR/USD and you wrote 1 in the amount field, you would be trading 1 unit of EUR, not USD.

Practical recommendations.

Again, you should always double-check which currency you are actually buying before entering a trade. For example, your analysis is correct for AUD/USD, and you forget it is USD/AUD, and you execute a trade based on your analysis, you will turn a winning analysis into a losing trade in a hurry.

Always keep track of what currency your profits are in, particularly if trading multiple pairs, as a EUR profit during a EUR weakirmingn against your account currency can significantly reduce the value of your total profit.

Start off with small sizes. It takes time to get use to position sizing in various base currencies and small errors on big positions can be costly.

Most importantly, always think in base currency when evaluating your trades. If EUR/USD is rising, the euro is stronger. If USD/JPY is falling, the dollar is weaker. This type of discipline will help your analysis of the market and trading outcomes.

Master the Base, Master Forex!

The base currency may seem like a small detail, however it is the foundation of success in Forex trading. Every professional trader started by mastering the base currency, because Forex trading is built on top of this one concept.

You've read about the following already; that the first currency in any pair is the base currency and it determines what you are actually buying or selling and it dictates your position size and profit. This is not an arbitrary fact; major base currencies are USD, EUR, GBP; and there are reasons why they dominate global markets and also understanding when to use base currencies is the difference between successful traders and traders who have difficulty.

The best way to put this knowledge into practice is to simply practice! Even if you aren't ready to fully commit to trading Forex yet, or if you are going to stick with demo accounts in the meantime, you will start practicing. Observe currency pairs in your day to day life and see if you can find the base currency. Look up EUR/USD, GBP/JPY, AUD/CAD - which currency comes first? What does that tell you about the quote you were looking at?

At some point, you will be ready to make the leap from observer to participant, and when that happens, it will be easier because you will have avoided many of the expensive mistakes that trip up most beginners simply due to not thinking about the base currency. You will know what you are actually buying, how to size your positions properly, and how to calculate your actual profits and losses.

So, are you ready to practice and put this knowledge to good use? The next step is to consider how base currencies behave in live markets by dealing with real forex pairs, and watching how base currencies move with respect to economic news, and even overall market sentiment.

Your journey to forex mastery begins with mastering the basics - and now you have the foundation to build on with btcdana.com