1. Introduction

Overtrading and chasing the market are common habits that result in the costliest mistakes, wasting crypto traders’ capital and capitalizing on their confidence.

Overtrading is the act of taking trades in and out too often with no plan or strategy, often out of boredom or emotions. Chasing the market means entering long positions when there are big price spikes or panic selling during price plunges, and trading is based solely on emotions of fear of missing out (FOMO) or further losses.

In the world of crypto, where prices can move quickly, operate 24 hours a day, and where even small amounts of volatility can send panic waves amongst traders, the emotional triggers of FOMO, greed, and panic often override logic. Traders become so emotionally overcome by the impulse of the market that logic and reason can comprise a trader's trading strategy.

The 2021 Bitcoin bull run produced a thrill-ride for retail investors. With prices blasting past $60,000, retail investors flooded into the space, while the institutional adoption, the newfound optimism from stimulus spending, and social media excitement lit the match. Then, when the crash occurred in May 2021, many of these same investors, panic sold and locked in their losses instead of holding through the volatility.

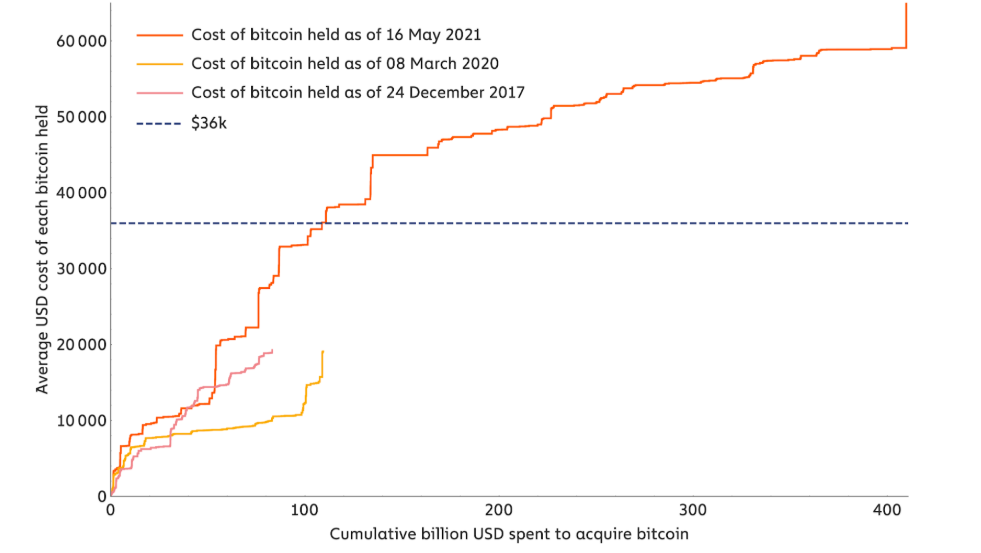

Figure 1: May 2021 Crash

Here is what happened to many retail investors during that cycle:

During the Bull Run

-

FOMO (fear of missing out): Retail investors flooded in after Bitcoin surged from ~$8,000 in early 2020 to ~$64,000 by April 2021.

-

Influencers Matter: Tweets from Elon Musk and others amplified the excitement.

-

Easy Access: Platforms like Robinhood and Coinbase made it easy for first-time investors to trade crypto.

2. Characteristics and Risks of Overtrading

Overtrading is one of the most frequent and consequently expensive errors in crypto, forex, and CFD markets. Overtrading doesn't only mean trading a lot, it means trading without discipline, without strategy, and without the patience to wait for setups.

Some behavioral characteristics of overtrading include:

-

Making many frequent entries and exits driven by current market noise rather than a clear entry and exit strategy

-

Not having a defined, consistent strategy

-

Using emotional impulses, trading because a trader is bored, angry, or tense about FOMO

We see overtrading behaviors in crypto markets more than anywhere else because they trade virtually 24/7 and are extremely volatile. Traders are lured into getting involved in every single tiny price movement, believing they "have to" be there for every swing.

Biggest risks of overtrading:

-

High costs of trading fees: Every trade has fees, slippage, and spreads that add up and erode profits without you paying attention.

-

Rapid loss of capital: Frequent trades without solid setups and trades are losing much more than winning, and losses stack quickly.

-

High mental stress levels: Overtrading drains the trader's mental energy. When our mental energy is drained, we become fatigued, frustrated, and make bad decisions.

To use a simple analogy, think about someone who is consistently making and losing money by buying and selling second-hand items online. They pay for shipping every time they send an object and pay multiple transaction fees each time, while they think they are “staying busy” all day, they are ultimately losing money.

To give a clear professional example, the data from most trading platforms will frequently show that high-frequency retail traders have much worse net win rates than less frequent traders. They may score the occasional small win, but losses through fees, slippage, and emotional errors render their overall outcomes worse.

Case: A 2021 study by Petar Peshev titled Analyzing CFD Retail Investors' Performance in a Post MiFID II Environment found that more than 80% of retail CFD accounts lost money, and that high-frequency traders suffered disproportionately larger losses

Table 1: Comparison Chart: Trading Frequency vs Profitability

3. The Dangers and Psychology Behind Chasing the Market

Chasing the market is another pitfall that is closely related to emotion. In this case, the tendency occurs when traders deviate from their plans to buy into an uptrend or sell into a downtrend as a result of fear or greed.

Definition:

-

Buying at the top of a surge without waiting for an entry plan or trigger

-

Selling in a panic after a sharp move down when you argue you still had long-term conviction

Psychological triggers:

-

FOMO (Fear Of Missing Out): You see other traders profiting and feel left out.

-

Panic: Your losses keep piling up, and you're watching your account steadily losing value, and you can’t handle it anymore (or it's because you're very stubborn).

-

Greed: Waiting for infinity... Find me a trader who has a good feeling about stocks going down, and I will show you a trader who will talk themselves into thinking prices will continuously go up forever.

A simple analogy: Imagine if you saw a stock pump and it pumped very quickly, without waiting for it to cool down, you bought it on the way up, only for it to drop immediately after you initiated your trade.

The sentiment in the Crypto markets often mimics the Fear & Greed Index. The crazier the market gets, the more people pile in, until they are all gone at the top (extreme greed), and today it has reached a low bottom. Which will show extreme fear, and then everyone gets the hell out.

Figure 2: Fear and Greed Index

Case study: The NFT and DeFi bubbles of 2020–2021 saw many traders chasing hype projects without due diligence.

NFT Bubble Highlights

-

Rapid Growth: The NFT market exploded to over $41 billion in 2021, rivaling the global fine art market.

-

Speculative Mania: Investors rushed into pixelated avatars and digital collectibles, often paying millions for assets with little intrinsic utility.

-

Celebrity Hype: High-profile purchases by Justin Bieber and Neymar (e.g., Bored Ape NFTs) fueled demand, but many of these assets lost over 90% of their value.

-

Crash: By September 2022, NFT trading volumes had dropped 97% from their January peak

4. Practical Strategies to Avoid Overtrading and Chasing

Recognizing these traps is only the first step. In order to truly avoid them, traders need to apply clear, repeatable methods:

-

Make a trading plan and stick to it. Set entries, exits, risk tolerance, and whatever else you need to remember, and continue to do it.

-

Use technical indicators. Indicators like moving averages or RSI (Relative Strength Index) can help confirm setups and diminish emotional biases.

-

Establish limits for trading frequency. Limit how many times you trade daily or weekly. This will help you build patience and avoid over-trading on impulse.

A simple analogy: Limiting yourself to a daily gaming time will reduce distractions and prove you can control urges. Trading limits will help do the same.

Often, many traders will use RSI to avoid buying overbought, be cautious about entering during oversold conditions, and lessen FOMO-based entries.

Tools for emotional regulation:

-

Record trades and emotional patterns

-

Use mindfulness techniques to help you be less reactive

-

Conduct structured reviews of both successful trades and unsuccessful trades

Conduct regular performance reviews: This will allow you to analyze your trades weekly, which will enhance your logical thinking, your consistency, and your recognition of emotional awareness.

Case Study: “DeltaEdge Capital” — Discipline in Action

DeltaEdge Capital was a mid-sized proprietary trading desk specializing in swing trading U.S. equities and crypto assets. The lead trader worked from a discretionary scalping position, then switched to a rules-based system that utilized plans for entries and exits.

Execution discipline:

-

No impulse trades, all entries had to be validated on the checklist.

-

Always use stop-losses, even during a volatile session.

-

Partial exit at +2R, full exit at +3R, no matter what perceptions existed in the market.

Performance Metrics (Q1 2025)

Key Takeaways

-

Planned entries and exits mean less chance for emotion to interfere.

-

Executing consistently is more profitable than having discretion.

-

Keeping a trade journal and performing post-trade reviews strengthens discipline and generates better setups.

5. Capital Management and Risk Control

Sound capital management gives you the greatest protection possible against overtrading and chasing.

-

Spread capital among trades: Don't put all of it into 1 idea.

-

Set a maximum loss per trade: Many of the pros follow the 2% rule—risk only 2% of your capital in any trade.

-

Implement risk limits in your strategy: When you limit your position sizes, you can minimize emotional pressure and the desire to "make it all back" in one trade.

A simple analogy: Think of your weekly allowance. The best way to save money is to spend only a little bit per day. Institutional portfolio managers diversify their portfolios to spread risk and minimize their exposure to a single event.

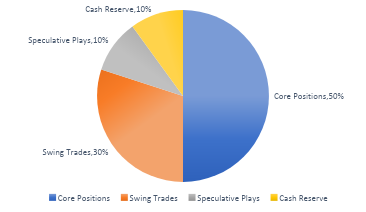

Figure 3: Capital Allocation Strategy

Figure 4: Key Principles in Practice

6. Psychological Mindset and Trading Discipline

Trading psychology can frequently be the difference between long-term success and continuous losses. While markets will always be irregular, the trader's mindset decides their response. Emotional swings, such as fear, greed, and frustration, will negatively impact their decision quality and may lead to poor trading actions such as overtrading and chasing the market.

Building patience, calmness, and self-discipline is necessary. Profitable traders know they do not need to catch every trade. They build patience, wait for their setups, and consistently manage their risk. This self-control reduces the impulse of the emotional kind and protects capital in the long run.

Using a trading journal is one of the most effective ways to improve emotional control. By developing a process of writing down their trades, reasons for entry/exit, and emotional states, they are better able to identify tendencies in their responses.

Are you trading from boredom? Panic? Over-confidence? Journaling allows you to see these triggers, which makes them manageable.

Take a simple analogy: Think of it as preparing for an important exam. You will remain calm and have planned and studied consistently leading up to the exam, as opposed to cramming the night before in a panic.

Professional example: Elite institutional traders, and many successful retail traders for that matter, often have performance coaches or psychologists to help. These individuals employ structured processes, including emotion tracking and mental rehearsal, to help the trader maintain discipline under pressure, even during periods of extreme market volatility.

Figure 5: Emotion vs Rational decision-making

7. The Influence of social media and Herd Mentality

The influence of social media and herd mentality on trading decisions is easily one of the most downplayed risks in crypto trading. Social media platforms like Twitter, Telegram, and Discord are filled with crypto influencers (KOLs) providing trade ideas, hyping coins, or promising high returns.

These KOL influencers often create strong social proof, resulting in large swaths of traders heading in the same direction all at once. The issue is, in many cases, these KOLs are trading based on hype, ego, and self-interest, or more virulent still, commercial motivations rather than a well-thought-out trading strategy.

Example: a small altcoin may pump 500% in just a couple of days because of a few big name influencers shilling their followers to buy the coin, but when the hype is finished and the early buyers dump the coin, the late buyers are left with 90% losses.

Telegram & Discord groups often catalyze potential moves that much further. If an "exclusive" call is made via spammy, urgent messages that use emotional language, that can push traders to follow on what they see as being the hype from social media and enter trades without proper diligence.

To mitigate these social trading risks, traders need to develop independent thinking and robust filtering of information habits.

-

Verification pointers: check the claims for any empirical or factual data. Look for responsible and balanced analysis (no hype!). Don't believe in guaranteed profits.

-

Don't buy because "everyone is talking about it."

-

Cross-reference news with credible source(s).

Encouraging independent thinking is very important. A disciplined trader does not follow a herd mentality. They evaluate opportunities for themselves based on their own rules, they always control their risk, and they ignore all the noise around them.

Key take away: Social Media does not trade signals. Always filter out what is not helpful, always question where your sourcing info comes from, and stay true to your own plan. Herd mentality can ultimately be a shortcut to emotional trading blunders, and a trader destroys their own capital.

Table 2:Market Sentiment vs Price Movement

8. Conclusion

Overtrading and chasing the market can be the most common and potentially damaging mistakes that might be made by crypto, forex, and CFD traders. In the moment, these behaviors could feel productive or necessary, and yet it is likely that they both detract from capital returns and trading confidence.

It is important to remember a few key actions:

1. Observe when emotional triggers are driving trading, whether it be FOMO or panic.

2. Build your strategy to be clear and rational and stick to it.

3. Practice good capital management and risk management.

4. Develop emotional discipline – journaling and self-awareness can help with this.

5. Separate yourself from social media noise and hype, and focus on self-directed decision making.

Control your emotions and consistently use a strategy as the foundation for successful trading. For more articles on trading psychology and how to improve trading strategy and capital management, please stay connected with BTCDana.com.