Introduction: Finding Opportunities in the Storm

Contracts for Difference (CFDs) are powerful tools that let traders speculate on the price movement of various assets, without owning them. With leverage, flexibility, and exposure to global markets, CFDs are ideal for short-term strategies. However, their greatest strength is also their biggest risk: CFD markets react strongly to global economic events.

A shift in interest rates, a spike in inflation (CPI), or a geopolitical conflict can move CFD prices within seconds. Whether you're trading gold, forex, oil, or stock indices, understanding macro events and their impact on CFD trading is essential.

For example, when the Federal Reserve hiked rates in 2022, the Gold/USD CFD entered a volatile consolidation phase. Traders who understood this CFD market reaction to macroeconomic policy were able to position themselves effectively; those who didn’t often got caught in unexpected reversals.

So, what do these major global events mean for your CFD positions? How do macroeconomic forces influence CFD price behavior? This article will guide beginner and intermediate traders through the most important connections between global economic events and the CFD market.

After nearly ten years, Japan raised interest rates two times in 2024, which caused turmoil around the world. When the Nikkei 225 initially broke past 40,000, the index proceeded to undergo serious selloffs in Asia and emerging markets around the world.

Global macro events and CFD trading are inseparable; your success depends on understanding this relationship.

Overview of Global Economic Event Types

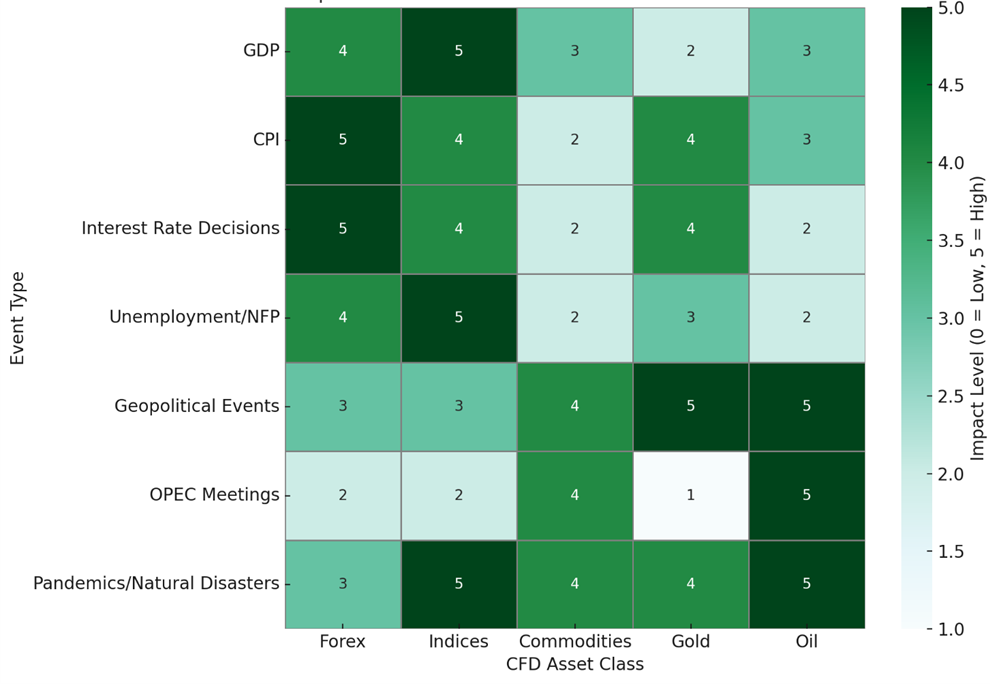

To master CFD trading, you must first understand the types of global economic events that move markets.

1. Economic Indicators

These are standard macroeconomic releases that affect investor sentiment and liquidity:

-

GDP: Slowing growth can trigger selloffs in index CFDs.

-

CPI & PMI: Inflation data affects rate-sensitive CFDs like forex and gold.

-

NFP & unemployment rates: Labor market strength drives USD-based CFDs.

These economic indicators impact CFD prices across asset classes, particularly when the results deviate from expectations.

2. Central Bank News and Policy

Nothing moves the markets like central banks. When entities like the Fed, ECB, or BOE issue:

-

Interest rate decisions

-

Meeting minutes

-

Forward guidance

They often cause sharp CFD market reactions, especially in currency, bond, and equity CFDs.

3. Geopolitical Events

From elections to trade wars and military conflicts, these events:

-

Add risk to the market

-

Increase volatility in oil, gold, and forex CFDs

The Russia-Ukraine conflict, for instance, had an immediate effect on energy CFDs and safe-haven assets like gold and CHF.

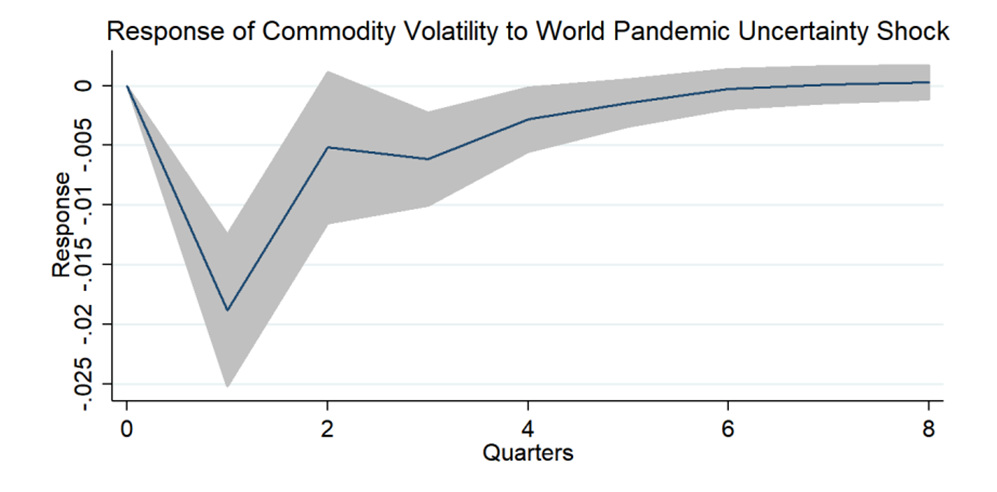

4. Black Swan Events

-

Pandemics (e.g., COVID-19)

-

Natural disasters

These create extreme volatility in commodity and index CFDs, often leading to sharp, one-sided moves.

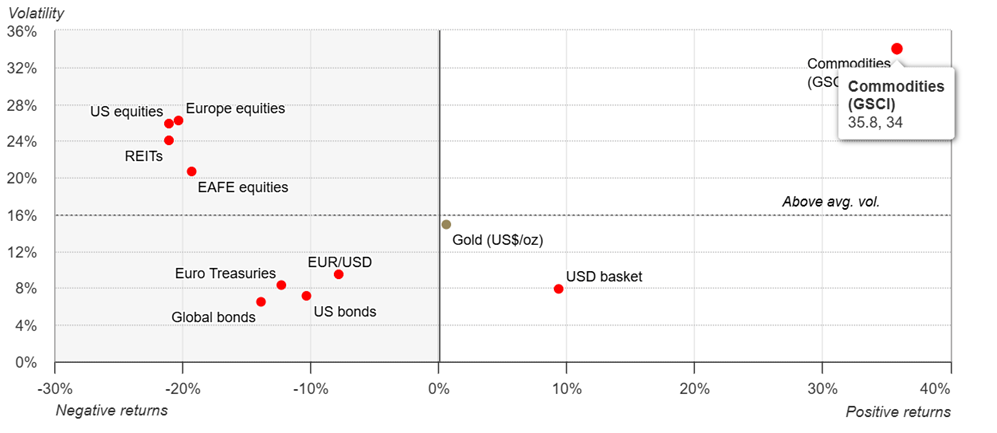

COVID-19 Pandemic (2020): The emergence of COVID-19 led to an unprecedented fall in global demand. The S&P GSCI Commodity Index decreased substantially more than 40% in Q1 2020, whereas oil CFDs decreased a record 56% as travel and industrial activities ground to a halt.

Gold CFDs benefitted from the uncertainty amongst investors looking for safe-haven interest and gold reaffirmed its status as the safe-heaven during periods of systemic shock.

Not every global headline triggers a trade, but knowing which macro events impact CFDs most is your trading advantage.

How Economic Events Transmit into CFD Price Movements

Understanding how macroeconomic data affects CFD trading requires following a basic but powerful concept:

The Expectation-Event-Reaction Cycle

-

Expectations: Traders price in their forecasts (e.g., a rate hike).

-

Event: The data or decision is released (e.g., 0.5% hike instead of 0.25%).

-

Reaction: If the result beats or misses expectations, CFD markets react instantly.

For example, a higher-than-expected CPI release might strengthen the USD, leading to:

-

A fall in Gold/USD CFDs

-

A rise in USD/JPY and USD/CAD CFDs

-

Pressure on equity index CFDs

Why Reactions Can Be Counterintuitive

Sometimes, good news leads to falling prices in CFD markets. If the market expects good data, a positive release may already be priced in. Traders may sell to lock in gains; this is the classic "buy the rumor, sell the news" dynamic.

Sentiment and Speculation

CFD trading is dominated by sentiment and leverage. Even small news can cause exaggerated moves when:

-

Traders are heavily positioned

-

Volatility is high

-

News contradicts expectations

Understanding macroeconomic data and its transmission into CFD price action is vital for anticipating market behavior.

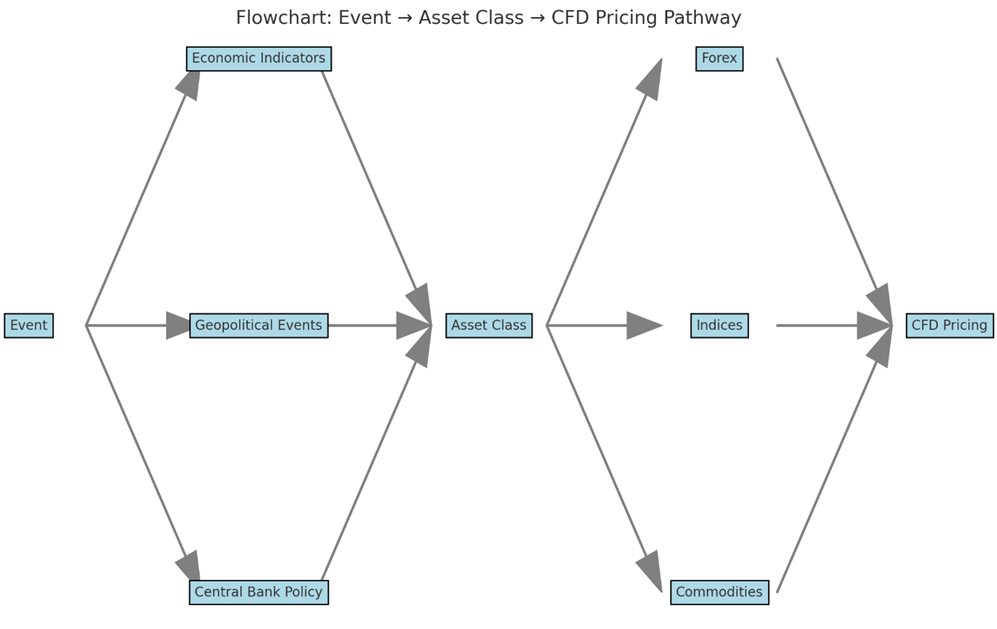

This flowchart outlines how global events flow through the system and relate to CFD pricing through a straightforward step-by-step process:

1. Event:

· Each of these processes is triggered by a major event.

· Examples: Economic data released, Central bank meeting, Geopolitical conflict.

2. Event Type:

The events take on three types of clarification:

· Economic Indicator Types (e.g. inflation, jobs data)

· Geopolitical Events (wars, elections)

· Central Bank Policy (rate hikes/cuts)

3. Impact on Asset Class:

Each of these events directly impacts Asset Classes such as:

· Forex (currency pairs)

· Indices (stock market indices)

· Commodities (oil, gold, metals)

4. CFD Pricing:

The final step: each of these price movements across Asset Classes is represented in CFD prices, presenting traders with opportunities (and risks) contingent on the driven event.

Events → Change in Market Sentiment → Impact on Asset Classes → Movement in CFD Pricing.

Sensitivity of Different CFD Assets to Economic Events

Different CFD instruments react differently to the same macro event. Recognizing their volatility profiles helps traders select smarter setups.

Rate-Sensitive CFDs

Why important: Interest rate decisions have an impact on borrowing costs, economic growth, and yield differentials.

· Forex Pairs: (example EUR/USD, USD/JPY): When the Fed raised rates early on in 2024, they pushed past 150 USD/JPY as yield differentials widened and mortgage holders' capital flocked to higher yielding USD assets.

· Index CFDs: (example NAS100, US30): In March 2024, rate cut expectations were pushed back by unexpected inflation rate readings which led NASDAQ prices to drop 5% in a week which is a reflection of growth-stock investor sensitivity to higher discount rates.

Inflation Sensitive CFDs

Why important: Inflation negatively impacts real returns and adjust item pricing for consumption.

· Gold and Silver: In April 2025: unexpected U.S. CPI expectations came in at 4.3% compared to expected 3.7% gold jumped $80 intraday as inflation hedge flows pushed silver up closely behind it.

· Crude Oil: Rising CPI potentially could alter OPEC+ supply cuts in Q2 2025 pushed WTI CFDs above $100 as traders needed to factor in sticky energy inflation and geopolitical risk premium.

Geopolitical-Sensitive CFDs

Why this is important: Political uncertainty increases demand for safe-havens and creates supply chain disruptions.

· Gold, CHF, JPY: In January 2025, the Red Sea tanker incident caused Gold to spike over $2,700/oz. CHF/JPY also rallied as capital rotated into lower beta safe-havens.

· Brent & WTI: Renewed tensions in the Taiwan strait in May 2025/mid-September 2031 caused both Brent and WTI rallied 6%+ over 3 sessions as there were concerns that major shipping routes could be blocked.

The Role of Market Sentiment and Expectations

Market psychology plays a critical role in how CFDs move after a news event.

“Buy the Rumor, Sell the News”

Traders often pre-position based on expected outcomes. Once the event occurs, profit-taking can reverse the trend, even if the data is "good."

How to Read Market Expectations

Use tools like:

-

FedWatch Tool

-

Rate futures

-

Institutional forecasts

These tools help assess how macro events influence CFD pricing before they occur.

Pre-Event vs. Post-Event Behavior

-

Before the event: Low volatility but high positioning risk.

-

After the event, True trend emerges as sentiment realigns.

The real driver of CFD trading during macro events is sentiment, not the data itself.

Event-Based Trading Strategies for CFD Traders

Here’s how to trade global economic events using CFDs across phases:

Before the Event

-

Use technical analysis to identify support/resistance.

-

Place pending orders just outside key zones

During the Event

-

Scalp fast breakouts

-

Trade news spikes with tight stops and controlled sizing

After the Event

-

Use RSI or MACD to confirm trend continuation

-

Wait for retracement entries after the initial surge

Risk Management

-

Size your trades based on expected volatility

-

Use stop-loss orders tied to ATR (average true range)

For example, During a U.S. CPI release, gold CFDs often spike. A well-placed breakout order with an ATR-based stop can capture the move while minimizing risk.

Historical Recap: Major Global Events and Market Moves

2020 COVID-19 Pandemic

-

Oil CFDs went negative

-

US30 and global index CFDs dropped over 30%

2022 Fed Rate Hikes

-

USD CFDs surged

-

Gold consolidated as markets priced in the rate trajectory

Russia-Ukraine War

-

Gold and energy CFDs spiked

-

CHF and JPY CFDs rose as safe havens

These historical CFD moves show how macro shocks impact various asset classes. Studying them prepares you for what might come next.

Pro Trader’s Macroeconomic Monitoring Checklist

Here’s what a smart CFD trader tracks monthly:

Key Economic Events

-

Non-Farm Payrolls (NFP)

-

CPI & PPI inflation data

-

Central bank meetings (FOMC, ECB, BOE)

-

GDP preliminary reports

Recommended Tools

Prioritize by Impact

Focus on high-impact events, match them with your asset class, and adjust position sizes accordingly.

This trading checklist ensures you never miss a high-volatility opportunity.

Conclusion

Whether it’s a central bank speech, a surprise CPI number, or a geopolitical escalation, CFD markets are shaped by macro events. The faster you understand this, the faster you'll become a confident, consistent trader.

To succeed:

-

Master economic insight

-

Build event-driven strategies

-

Use a macro calendar

-

And stay emotionally disciplined

At BTCDana, we provide you with the tools to succeed in all market conditions, from live macro alerts to advanced analytics and copy trading strategies.