What is copy trading? Copy trading is transforming access to CFD markets. It enables you to automatically replicate the trades of skilled traders—no need for prior analysis or expertise. When a professional initiates a trade, your account mirrors it according to your specified investment amount. This is commonly referred to as copy trading in CFD, and it's becoming more popular among traders at all levels.

In rapidly changing CFD markets characterized by high leverage and volatility, this hands-off method is appealing to novices and busy investors alike. You retain control over your funds and risk parameters while the platform manages trade execution. Automated CFD trading offers an effortless experience, allowing you to trade without constantly monitoring the markets. It’s particularly useful for beginners who want to avoid the complexity of traditional trading.

What started as casual signal sharing has evolved into a data-centric system. Services like BTCDana now provide complete transparency—displaying ROI, drawdown, and risk scores—empowering users to make informed decisions. This is why CFD copy trading explained is gaining traction, as it provides clarity on how copy trading works and its benefits for different types of traders.

Copy trading simplifies intricate strategies, reduces barriers to entry, and offers everyday users a more intelligent trading approach. It’s especially effective for those utilizing a beginner CFD trading strategy, as they can follow expert traders without needing deep expertise themselves.

Traditional Trading vs Copy Trading

Case Example:

John, an absolute novice, began utilizing BTCDana’s copy trading feature. He followed a highly successful gold CFD trader and evaded emotional pitfalls such as revenge trading. His consistent monthly earnings provided him with a practical and stress-free introduction to trading.

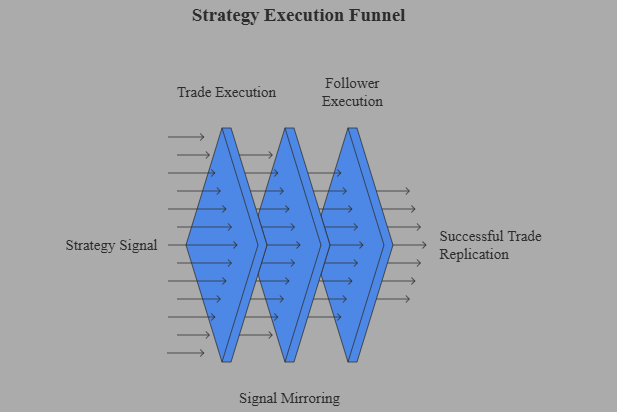

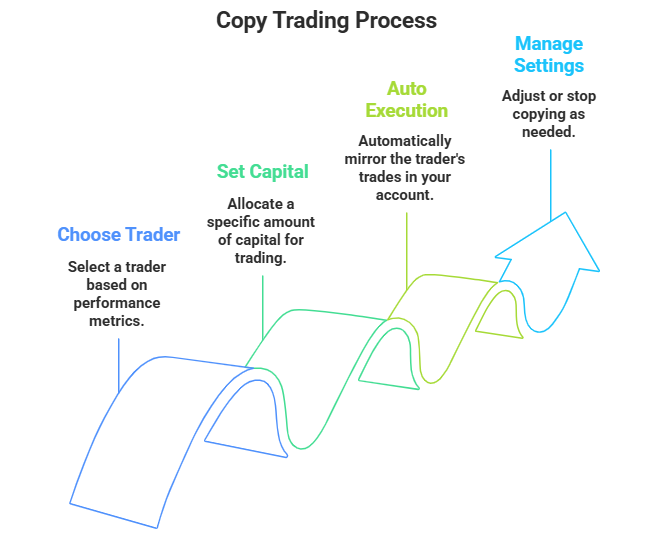

How Does Copy Trading Work in CFDs? A Step-by-Step Guide

Grasping how copy trading works on CFD platforms is essential for using it effectively. This CFD copy trading tutorial breaks down the process for beginners and intermediate users alike.

Key Elements:

-

Signal Provider: The seasoned trader whose strategy you emulate.

-

Follower: You — the individual replicating trades.

-

CFD Asset: The instruments being traded — forex, gold, indices, cryptocurrency, and more.

-

Platform System: It executes trades, sets take profit (TP)/stop loss (SL), and modifies positions based on your configuration.

Step-by-Step Process:

-

Select a Trader: Utilize filters such as ROI, win rate, drawdown, and risk score.

-

Determine Capital Allocation: Decide how much to invest (e.g., $100).

-

Automated Execution: As the trader executes trades, they are mirrored in your account.

-

Manage Your Copy Settings: You can stop copying, adjust capital, or change risk limits whenever you wish.

If you're wondering how copy trading works in fast-moving CFD markets, understanding these steps is key to maximizing results.

CFD-Specific Considerations:

-

Leverage: If a trader employs 1:100 leverage, your trades will scale accordingly.

-

Spreads & Slippage: Minor price execution variations may occur but are generally manageable.

-

Risk Settings: Most platforms allow you to set limits for individual trades or overall drawdown.

Types of Copying:

-

Proportional Copying: Your trade sizes adjust based on your balance (ideal for beginners).

-

Fixed-Size Copying: You copy a predetermined lot size regardless of the provider’s capital (more suitable for advanced users).

Copy Settings Comparison Table

Case Example:

Liam, a careful user, allocated $200 to copy an S&P 500 CFD trader on BTCDana who used a swing trading strategy. By leveraging how to follow traders in CFDs, Liam monitored weekly performance, applied stop-loss settings, and achieved a steady 10% monthly ROI—all while keeping risk in check.

Benefits of Copy Trading: Beyond Just Convenience

Copy trading provides more than just automation; it serves as a comprehensive gateway to smarter, passive trading strategies and a more secure approach to the financial markets.

Key Advantages:

-

Time-Efficient: No requirement to monitor charts around the clock or respond to economic updates, which is ideal for those seeking time-saving trading methods.

-

Informative: Witness how professionals handle risk, trades, and exits in real-time.

-

Emotion-Free: No need for panic selling or revenge trading — the strategy takes charge.

-

Minimal Capital Needed: Begin with as little as $50–100.

-

Diversification: Imitate multiple traders across various asset classes — such as gold, cryptocurrency, and forex — to decrease reliance on a single strategy.

-

Platform-Level Risk Management: Features like maximum drawdown limits and automatic stop-loss settings safeguard your investment.

Case Example:

Emma, a college student, follows three distinct traders: one specializing in gold, another in BTC/USD, and a third in EUR/JPY. She achieves steady gains between 5–8% monthly without ever examining a chart.

Copy trading provides users, particularly those with limited time or trading expertise, a means to engage with the market in a responsible and effective manner.

The Hidden Risks and Misconceptions of Copy Trading

Although copy trading presents convenience, it doesn’t guarantee profits. Recognizing the copy trading risks involved can prevent costly errors and misguided expectations.

Key Risks:

-

No Strategy Is Flawless: Even elite traders experience losing periods. Copy trading losses and drawdowns are a reality, even when following top-ranked providers.

-

Platform Credibility Is Crucial: Only rely on regulated platforms with authenticated performance data. Smart CFD risk management requires balancing ROI with risk exposure.

-

Avoid Blindly Following High Returns: Elevated gains may be associated with significant drawdowns. Seek a balance between ROI, risk assessment, and reliability.

-

Dependency Risk: If a trader alters their approach or ceases trading, your portfolio may be jeopardized.

-

Market Volatility Is Still Relevant: Unforeseen events like the COVID crash or geopolitical tensions impact even the best strategies. Failed copy-trading stories often stem from unexpected global events.

Copy Trading: Misconceptions vs Reality

Case Example:

A user followed a top-rated trader without reviewing the drawdown history. When the market reversed sharply, they experienced a 30% loss in a week. The takeaway: risk metrics are more important than attractive returns.

Copy trading is a tool, not a miracle solution. Being aware of risks and trusting the platform is essential.

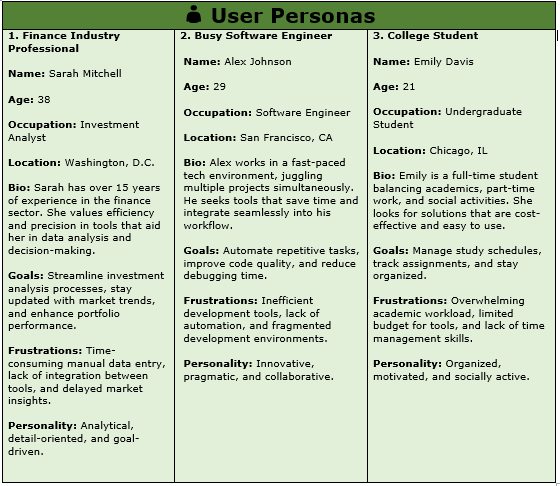

Who Should Use Copy Trading?

Copy trading isn’t suitable for everyone, but it’s ideal for those looking for efficiency, education, or reduced barriers. If you're wondering who should use copy trading, this guide will help clarify.

Ideal Users:

-

Busy Professionals: Desire CFD exposure without the daily hassle of manual trading. These users often benefit from beginner-friendly CFD tips and automation.

-

Novice Traders: Perfect for CFD trading for beginners who seek practical learning experiences by watching expert strategies unfold in real-time.

-

Emotionally Reactive Traders: Prevent impulsive errors by letting the strategy dictate actions instead of emotion.

-

Analytical Allocators: View copy trading as a strategic allocation tool and follow data-driven copy trading profiles to diversify investments.

-

Low-Capital Experimenters: Explore the CFD market with small capital—an excellent entry path for new users.

Who It’s Not For:

-

Speculators pursuing quick profits.

-

Gamblers disregarding risk management.

-

Passive investors who neglect to track performance.

Comparison Chart: Suitable vs. Unsuitable Profiles

Case Example:

Sarah, a full-time banker, built a diversified copy trading portfolio on BTCDana. She carefully selects the best traders to follow in CFD markets and uses real-time analytics to guide her investment strategy. With strong risk controls and transparency, she passively grows her savings while minimizing stress.

How to Start Copy Trading on BTCDana

Initiating with BTCDana’s copy trading system is straightforward and user-friendly.

Why BTCDana?

BTCDana is one of the best CFD platforms for beginner traders. Here’s why:

-

Verified, high-performing traders

-

Transparent statistics (ROI, win rate, drawdown)

-

Supports leading CFD markets: cryptocurrency, forex, gold, indices

-

Risk management tools: stop-loss, drawdown limits, copy limits

-

Mobile access for 24/7 tracking

3 Steps to Begin:

-

Register on BTCDana

-

Browse & Filter Traders: Use performance data to choose based on your risk profile

-

One-Click Copy: Set your capital allocation and activate risk controls

New users even receive demo funds to practice copy trading before committing to real funds.

New users even receive demo funds, making this a perfect beginner copy trading guide without the risk of losing real money. You can explore features, simulate real-time trades, and get comfortable before going live.

Final Takeaway:

Copy trading CFD platform BTCDana blends automation, education, and risk control—all designed with the user in mind. Whether you’re new to trading or just want a smarter, more passive strategy, BTCDana opens the door to dynamic markets without the steep learning curve.

CTA: Begin your copy trading adventure today at BTCDana.com and discover more efficient, straightforward investing.