CFD trading presents tremendous possibilities to profit in the financial markets, but it also carries substantial risks because of leverage and volatility. The question that every serious trader has is: "How to minimize those risks without putting a crimp in profit potential?"

The answer is hedging, which is the more sophisticated risk management strategy virtually all professional traders and institutional investors employ. Think of it as insurance for your trades. Similar to insuring your car to protect you from accidents, hedging protects your trading portfolio from adverse effects of market movements.

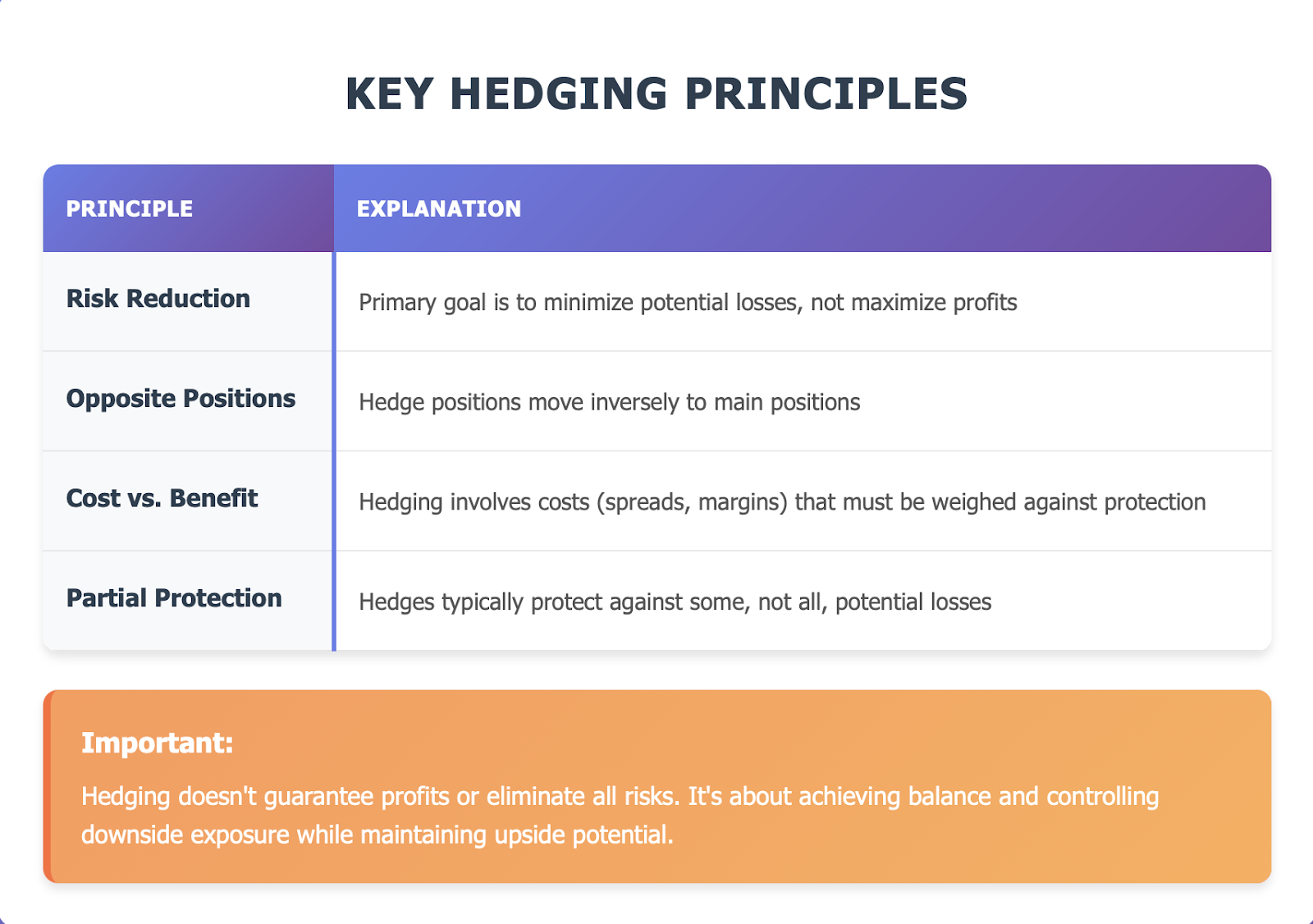

Hedging is not speculation, it is not figuring out how to beat the market; it is a well-planned and executed risk management strategy that can help to protect your capital during erratic market conditions. Professional traders know that simply profiting is not the end goal, it's protecting those profits and minimizing losses during times when the markets do not move in your favor.

Take this scenario between you and during the market crash in March of 2020, those traders with hedged positions severely limited their risk, while those hedged positions were taking massive losses; and you clearly see the protective power of proper hedge strategies.

What Does Hedging Mean?

Hedging is a way to minimize the risk of adverse price changing by taking offsetting positions in related securities. In simplistic terms, it is opening a position that moves in the opposite direction to your original trade (the main trade), creating a buffer against losses.

A simple analogy would be to say that it's like a high school student who plans to go out on the weekend but is worried that it might rain, so they bring an umbrella as a precautionary measure. The umbrella is the hedge. It doesn't mean the student will definitely not have sunny weather, but it will protect the student if the conditions are suboptimal.

If you are long the S&P 500 index CFD, you might establish a short on a corresponding ETF or correlated index to hedge your original position. This creates a position with offsetting moves that limits both your potential losses and gains.

Varieties of Hedging Strategies in CFD

CFD hedging strategies could be classified in different ways, and they can serve different risk management purposes:

1. Direction Hedging

-

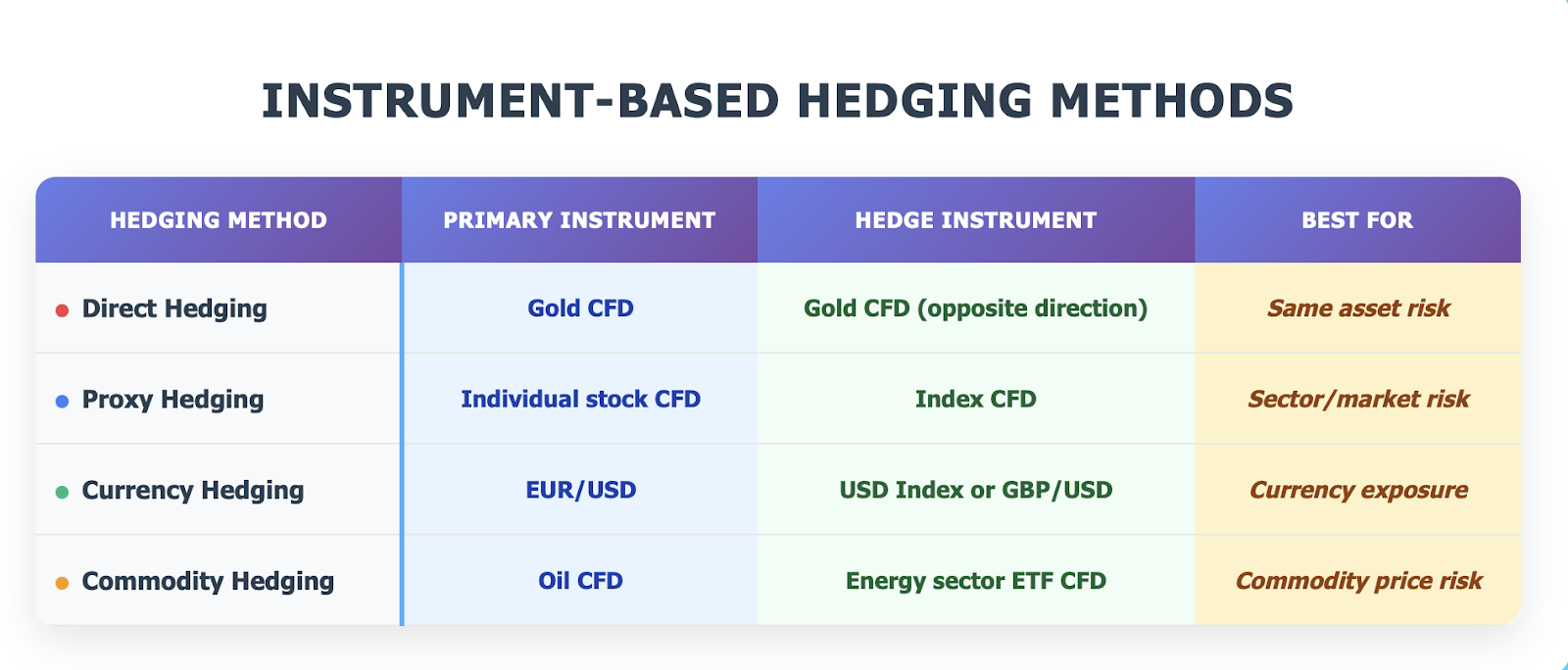

Same Asset Hedging: Establishing the opposite positions in the same underlying asset Example: Long Gold CFD + Short Gold CFD with varying position sizes Use case: to mitigate exposure while having some skin in the market.

-

Cross-Asset Hedging: involve correlated assets to hedge each other Example: Long EUR/USD + Short USD Index Use case: Management of currency exposure.

2. Instrument-Based Hedging

3. Time-Based Hedging

Short Term Hedging: Protection of invests for specific events

-Specific news announcement (NFP, Fed meetings)

-Earnings Releases

-Economic Data releases

Long Term Hedging: Continuous risk management of invests

-Portfolio Insurance

-Systematic risk management

Example of Advanced Strategy: Delta Hedging

For advanced traders delta hedging is a process of re-hedging however using delta, or how closely the underlying asset tracks to market movement and continuously using this ratio to determine hedge ratio positions. Requires complicated risk management and time to assess those ratios.

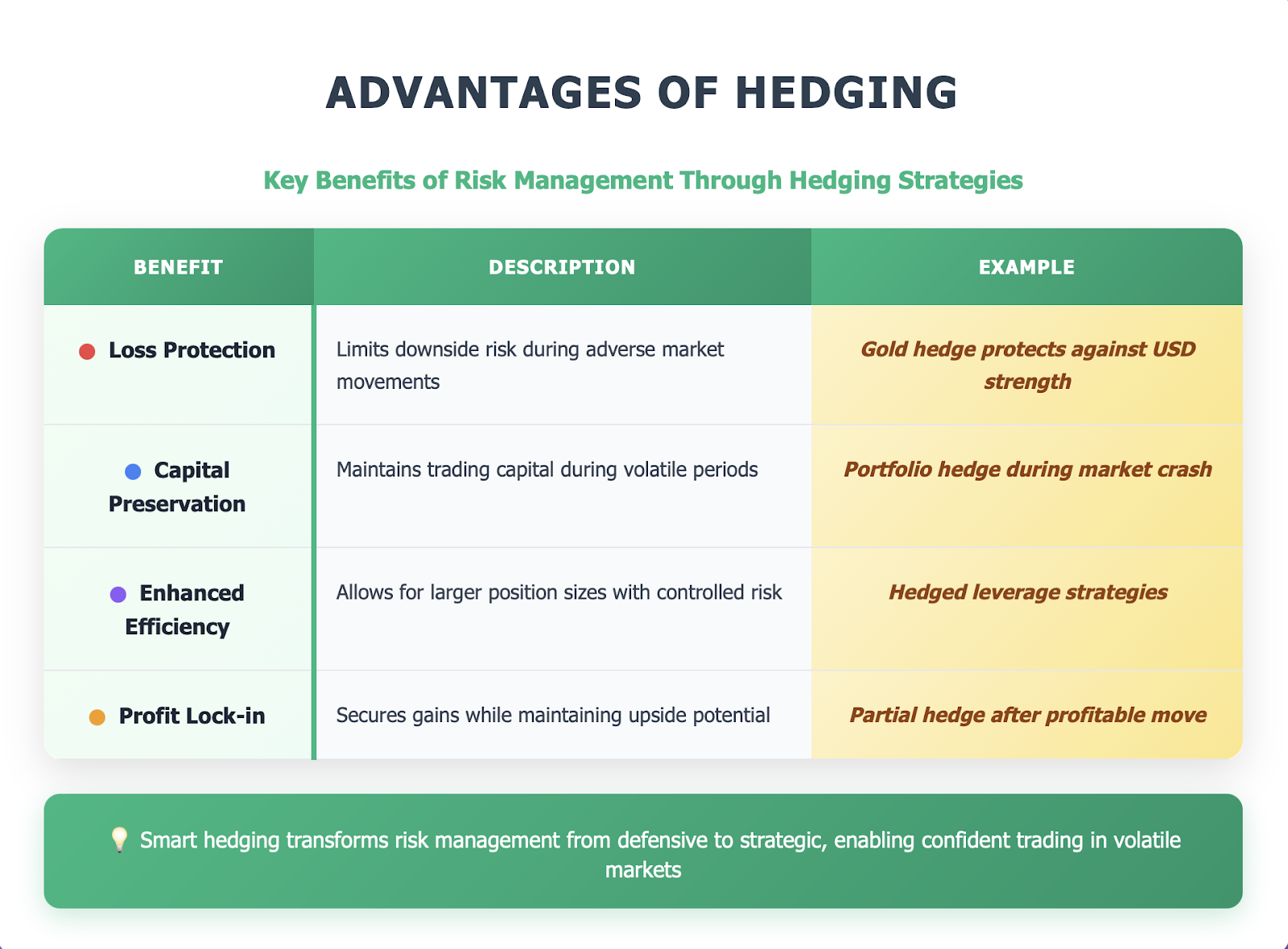

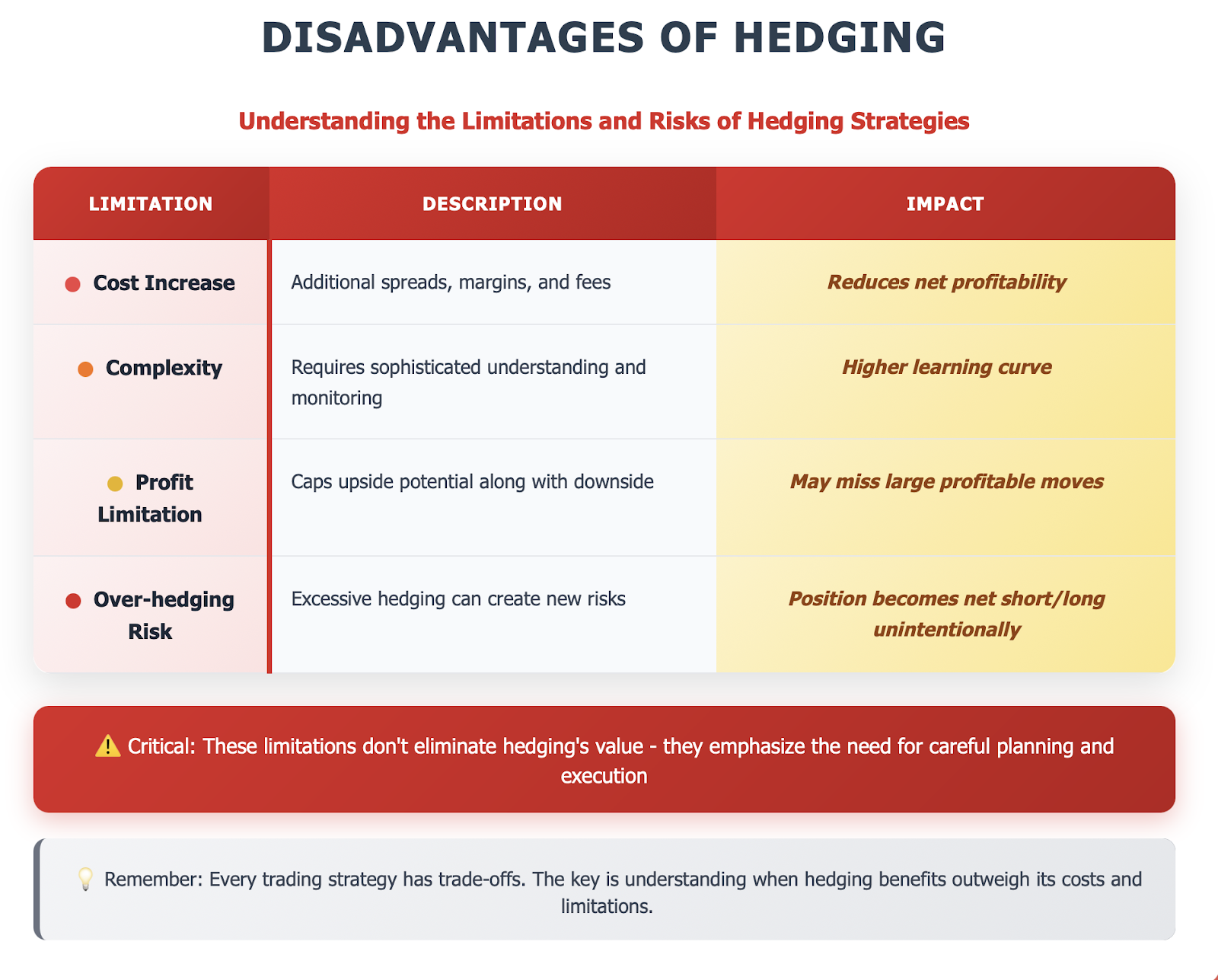

Pros and Cons of Hedging

It is important to understand the pros and cons of hedging to be able to effectively utilize in strategy:

Real-World Context

You can think of hedging in terms of wearing armor in battle: you receive protection but surrender or give up speed and resiliency. Your job is to pick the best combination of protection and performance based on your risk appetite and objectives of trading.

Practical Hedging in CFD Trading

Let’s look at real-world situations demonstrating hedging strategies:

Case Study 1: Beginner Oil Hedge

Situation: A trader is long crude oil CFDs but is uneasy about volatility because of an upcoming OPEC meeting.

Hedge Strategy: Open a short position in oil CFDs equal to 50% of the long position.

The step-by-step method was:

Assess Risk: Identify the possible price swing of 10-15% of the oil price.

Setup Hedge: Short 0.5 lots for every 1 lot long the trader is long.

Monitor: Watch both positions as well as financial market news.

Adjust: Close the hedge after the OPEC announcement when clarity about the next step emerges.

Result: The trader limited their losses to the equivalent 12% price decline in the oil price.

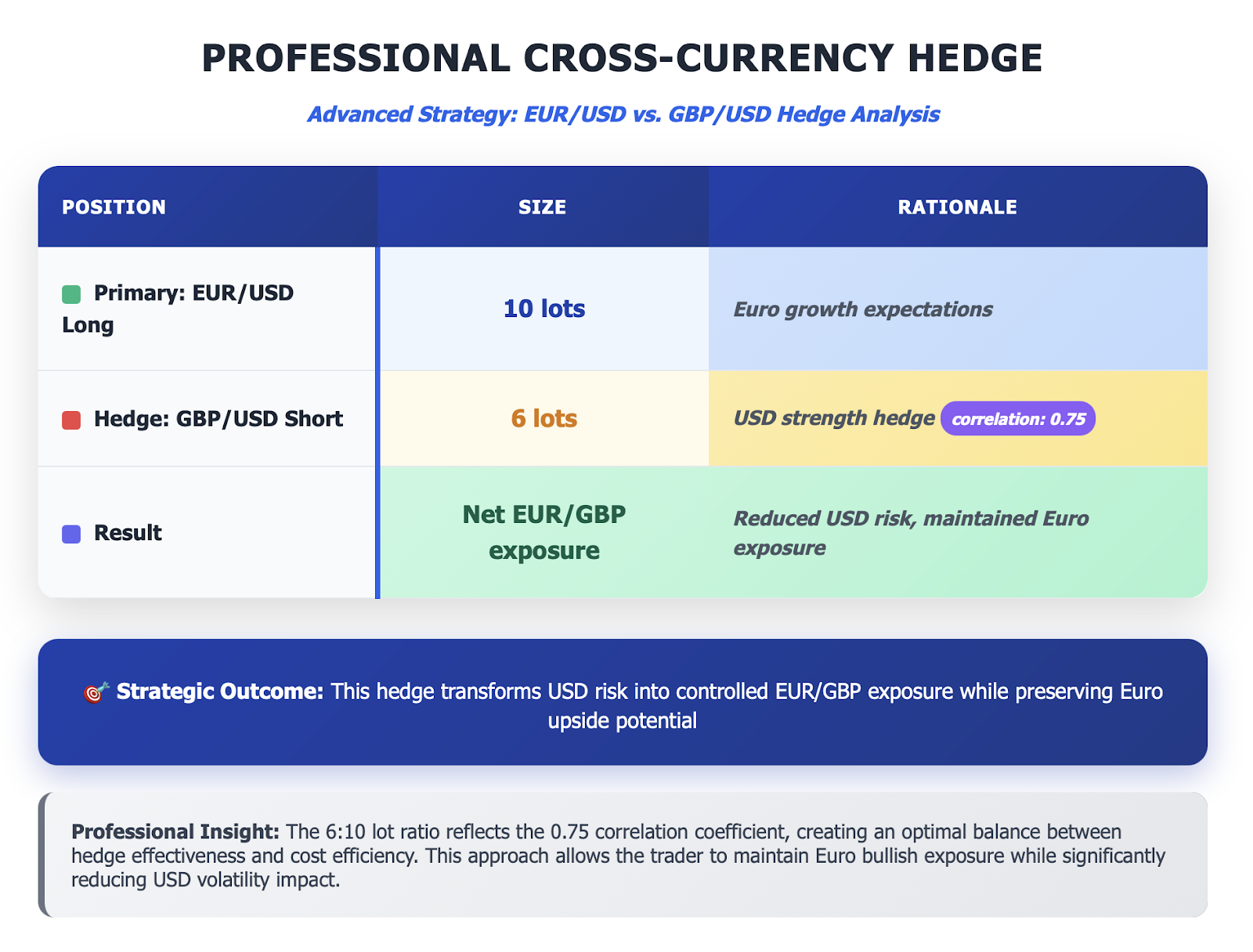

Case Study 2: Professional Cross-Currency Hedge

Situation: A trader executes a significant long position in the EUR/USD. The trader is significantly worried about a strengthening USD.

Hedge Strategy: Short the GBP/USD hedge to hedge USD exposure.

Hedging Mistakes to Avoid

Hedge size: An oversized hedge may actually increase losses compared to the desired hedge.

Correlations: Asset correlations may be ignored or there might be a failure to select hedge instruments that are sufficiently correlated.

Static/unchanged hedges: Failing to adjust your hedge as the market evolves.

Cost: Ignoring the costs of the hedge position in the context of a profitability analysis.

When Should You Hedge?

Timing is everything when it comes to hedging. The following framework can help to inform your hedging decision forcing a consideration of hedging alternatives:

When to NOT Hedge

-

Low account equity: insufficient margin to cover both positions

-

Strong directional conviction: clear opinion of market direction and highly confident

-

Short-term scalping: transaction costs typically exceed hedging benefits

-

Poor correlation: hedge not negatively correlated to our main position

Decision-Making Checklist

Before we hedge, ask yourself:

Market Outlook: is there honest uncertainty around the direction?

Temperature of Risk: can we stomach the loss if we did not hedge?

Adequate Capital: do we have sufficient margin to open both positions?

Cost / Benefit Analysis: do costs outweigh the benefits of hedging?

Exit mechanics: do we have a plan to undo the hedge?

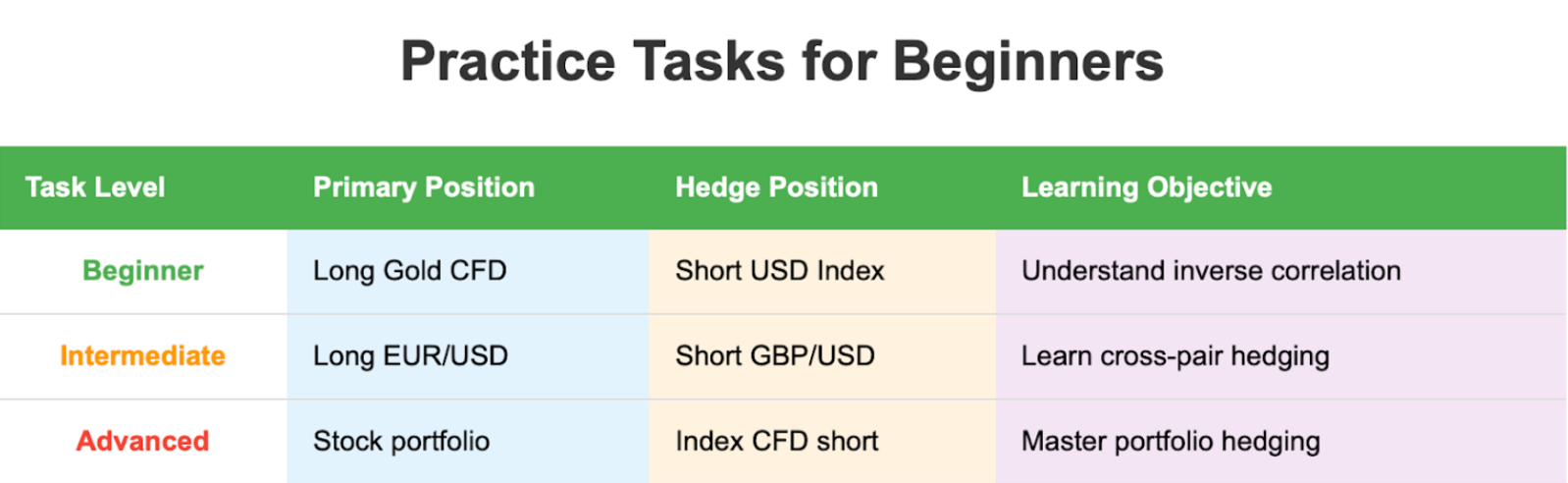

How Beginners Can Practice Hedging (Simulation & Training)

The quickest way to learn how to hedge is in a pure practice environment: no risk or potential losses.

Recommendation for practising

Start with Demo Trading: Use only a paper trading account to practice different hedging strategies

Start small: When developing your hedging strategies; first start with the same asset hedges, before you try the cross asset strategy

Keep notes: Make a record of every time you try a hedge, what was the outcome, and what you learned.

Graduated stage process: Once you become comfortable on demo trading, you can transition to real and eventually small positions.

Training Materials

-

Demo accounts for practicing safely

-

Educational webinars covering hedging strategies

-

Trading journals to record hedge trades

-

Mentoring programs with education

Key to Success: Efficiency, patience, and methodical approach to learning are key in proper utilization of hedging processes.

Hedging vs. Corporate Hedging: Understand the Difference

It is necessary to clarify the distinction between trader hedging and corporate hedging:

Examples at Work

Corporate Example: A well-established airline takes a hedging position on its fuel costs by purchasing some oil futures contacts to lock in fuel prices for the next 12 months.

The airline know that its operating cost will be known and predictable (regardless of fluctuations in the oil price) based upon its purchase of futures contracts.

Trader Example: A CFD trader shorts gold (a direct short) while long on a position on some relevant mining stocks. The CFD trader acts in this way to hedge against an unpredictable gold price for a short period of time during earnings season.

By recognizing the difference between these examples a trader may be then able to choose appropriate hedges underpinned by their aims and objectives and timeframes.

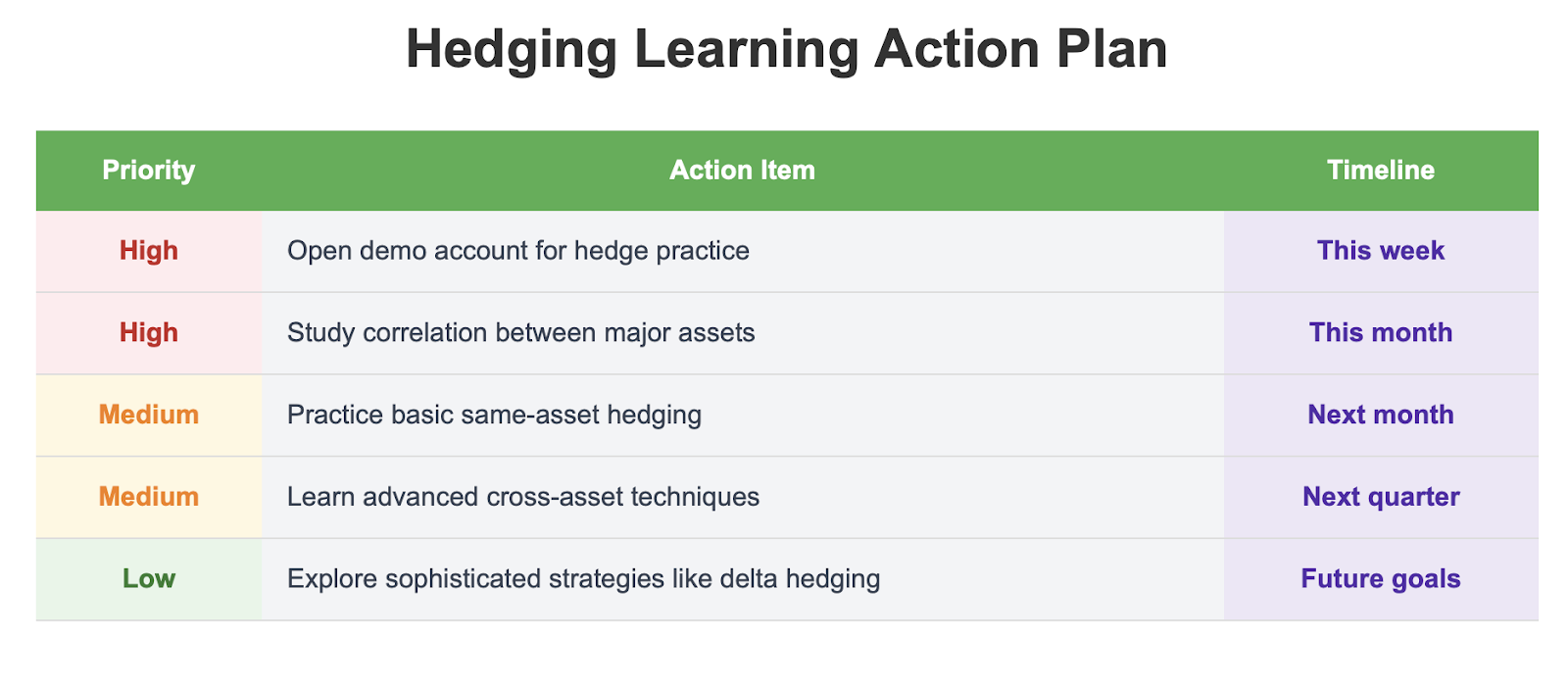

Key Takeaways and Recommendations

Summary of Core Elements

Hedging in CFD trading are advanced risk management tools that require:

-

A clear understanding of hedging - what hedging will, and will not entail

-

The correct timing of when to hedge - this timing is based on the risk/reward of the position which outweighs the cost of taking the hedge

-

The ongoing management of the hedge position - the markets are always evolving

-

Cost awareness - be mindful of all the costs in hedging when calculating the profitability of your trade

What Should a Beginning Trader Do?

-

Learn the Basics - ensure you have a very good understanding of CFD trading

-

Start Small - practice CFD trading with demo accounts and small position size when engaged in hedging

-

Learn Gradually - work your way from starting to identify basic same asset hedging before building your hedging skills and knowledge

-

Disciplined Approach - follow a systematic method for your hedging decisions

-

Keep on Learning - keep up to date with hedging techniques.

Final Recommendations

Remember that hedging is not something you can learn overnight. Hedging is a skill to practice and will get better with experience. Start with simpler approaches, focus on the principles of managing your risk, and build complexity to your hedging strategy as your understanding and experiences grow.

Ultimately, hedging is not about removing all risks, it is about managing risk as best as you can while still allowing you to trade profitably.

Sign up with a demo account on BTCdana Now!