Why tax filing has become a big topic for crypto traders?

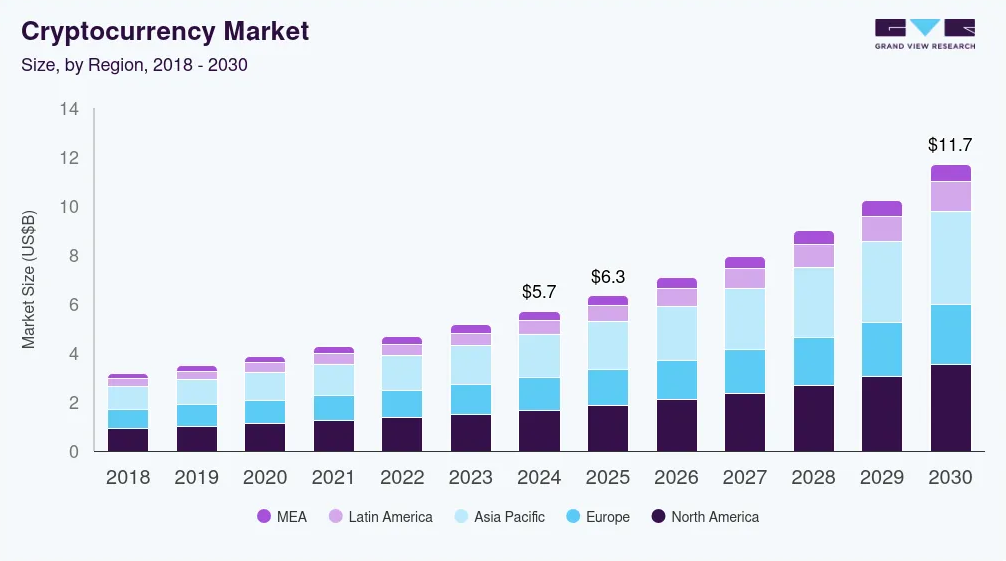

Crypto trading has grown massive in the last few years. In 2024 alone, the global volume hit something like 18.5 trillion dollars. That’s not a small niche anymore, that’s mainstream. And with so much money moving around, tax offices everywhere started paying attention. Crypto tax is now a hot issue for traders.

A lot of governments used to be slow about crypto, but now they’re not ignoring it. Almost every country is moving toward cryptocurrency tax filing rules. For traders, it means you can’t just cash out and hope nobody notices. And the risk of ignoring it is big. You can get fines, penalties, or even frozen exchange accounts.

In the US, there was a case in Texas where a Bitcoin investor hid millions in profits, ended up pleading guilty and not only had to pay restitution but also got prison time. So crypto tax compliance is not something to brush off.

It all comes down to one question. How do you actually file your crypto taxes legally and safely? We aim to guide you through it in this article.

Why You Have To Pay Taxes On Cryptocurrency

A lot of new traders think crypto means anonymous. It used to feel like that back in the early days, but not anymore. Exchanges now require KYC (Know Your Customer), and most even share info with tax authorities if asked. So regulators already see a lot of your activity, even if you think it’s private.

When it comes to taxes, crypto is treated just like other income or investments. There are a few main categories:

-

Capital gains crypto: If you sell or exchange crypto for a profit, that profit is a capital gain. If you buy Bitcoin for $5k and sell for $15k, that $10k profit is taxed. Pretty straightforward.

-

Ordinary income: If you receive crypto as payment for work or services, it’s counted as ordinary income like wages.

-

Mining or staking rewards: Crypto you earn from mining or staking is also treated as ordinary income.

Even if the amount is small, it still counts. Like a student who buys and sells Bitcoin and makes a $1000 gain, they still have to pay Bitcoin tax.

In the US, the IRS already put a “virtual currency” question on annual tax forms. It’s literally the first thing on the form. So the rules are clear now. Crypto income tax applies.

Global Tax Landscape: How Different Countries Handle It

Every country looks at crypto taxes in its own way. That’s why knowing global crypto tax policies matters so much. Here’s a quick look at some countries:

-

United States: The IRS treats crypto like property. If you sell within a year, your profit is taxed like regular income (can be 10% up to 37%). If you hold longer than a year, you get lower long-term rates (0%, 15% or 20%).

-

United Kingdom: HMRC is strict. You must log every single trade. They apply Capital Gains Tax on profits above £3,000 a year. Depending on income, you’ll pay between 18% to 24%. If you earn crypto from mining or payments, it’s treated as income and taxed at higher rates.

-

Germany: Germany is one of the best places for crypto holders. If you keep coins for over a year before selling, profits are totally tax-free. Selling €50,000 worth of Bitcoin after a year will mean €0 tax. But if you sell sooner, you’ll pay normal income tax.

-

Japan: Crypto profits are treated as miscellaneous income, so they just get added to your total income. The higher you earn, the higher you pay, up to about 55%.

-

China: Officially, crypto trading is banned. There’s no clear crypto tax system yet, but regulation is always possible.

To keep it short, don’t blindly copy someone else’s filing method. Crypto tax in the USA isn’t the same as crypto tax in the UK or crypto tax in Germany. Always check your own country’s laws.

Step By Step Guide To Filing Your Crypto Taxes

Filing your crypto taxes sounds scary, but it’s really just a process. If you break it down step by step, it’s way easier. Here’s a crypto tax filing process that works for most traders:

-

Collect all records: You need everything. Buys, sells, trades, transfers, mining payouts, staking rewards, and even airdrops. Write down dates, amounts, and values in USD (or your currency). If you miss stuff, it’ll just cause problems later.

-

Calculate taxable income: Basically, look at what you paid vs what you sold for. The difference is your gain or loss. That’s your taxable amount.

-

Fill out tax forms: Every country has its own. In the U.S., it’s Form 8949 and Schedule D. In the UK, you have to report through HMRC. If you’re unsure, refer to official guides or get professional advice.

-

Use tools to automate: There are several crypto tax tools, such as Koinly, CoinTracking, and TokenTax, that can import CSVs or connect to exchanges to compute all gains and generate tax reports.

As an example, a day trader making 100+ trades per month can import directly into tax software. On the other hand, a student who traded Bitcoin only twice in a year can file in minutes.

The point is not to do everything manually. Using the right crypto tax software tools makes the crypto tax filing process much easier and reduces errors.

How To Legally Minimize Your Crypto Taxes

Paying taxes sucks, but you can make it a little less painful if you plan ahead. Legal crypto tax optimization is about using the rules to your advantage:

-

Long-term holding: Most countries give better tax rates if you hold more than a year. Like in the U.S., short-term trades can get taxed as high as 37% but long-term gains drop to 0–20%. So, just holding can save you thousands.

-

Tax-Loss Harvesting: This means selling assets at a loss to cancel out gains. For instance, if you made $10,000 in crypto profits this year but also hold coins that are down $10,000, you could sell the losers to wipe out your gains.

-

Allowances: Every country has some freebies. The UK gives £3,000 tax-free gains per year. It’s not huge, but why waste it? Always check what your country allows and claim it.

-

Be careful with grey areas: Some people think that if they shuffle coins between wallets or use private exchanges, they can dodge reporting. It might sound clever, but if tax authorities check, you’re in trouble. Stick to clear legal tax saving strategies, don’t risk shady tricks.

In short, crypto tax optimization is about smart planning, not dodging. If you’re smart with timing and use the rules properly, you’ll keep more money in your pocket and still stay compliant.

Common Mistakes People Make In Crypto Tax Filing

People often underestimate crypto taxes, then mess up. And with crypto tax mistakes, those slip-ups can cost way more than the actual tax bill.

-

Thinking small profits don’t matter. Even small profits must be declared.

-

Believing decentralized exchanges can’t be tracked. The blockchain is public, and authorities are advanced.

-

Forgetting to report mining or staking rewards.

-

Not keeping proper records. Incomplete records often trigger red flags.

Remember, mistakes can cost more than the tax bill itself. Good crypto tax compliance means avoiding these traps.

What Should Your Next Step Be

At the end of the day, every trader needs a crypto tax guide. Cryptocurrency may be exciting and new, but its tax treatment is now solidly in the mainstream. Tax compliance is a must for protecting your gains and peace of mind.

Here are the key reminders:

-

Compliance protects your profits long-term.

-

Every country has different laws. Don’t just copy random advice from Twitter.

-

Organize your records early and use tools to help.

So, if you want to stay ahead, start now. Keep learning, get prepared, and file your bitcoin taxes properly. And if you want more resources, trading insights, and compliance tips, head over to BTCDana.