The Importance of Execution Speed in CFD Trading

Why is it that certain traders always seem to catch market opportunities while others are left watching the profits slip away? The answer lies in the speed of execution in many cases.

Execution speed is the time it takes for you to identify the trade and complete the order, once you hit 'buy' or 'sell'. Execution speed is important in CFD trading because that small detail can have a significant effect on your overall profits, especially when markets are volatile, or you are trading often.

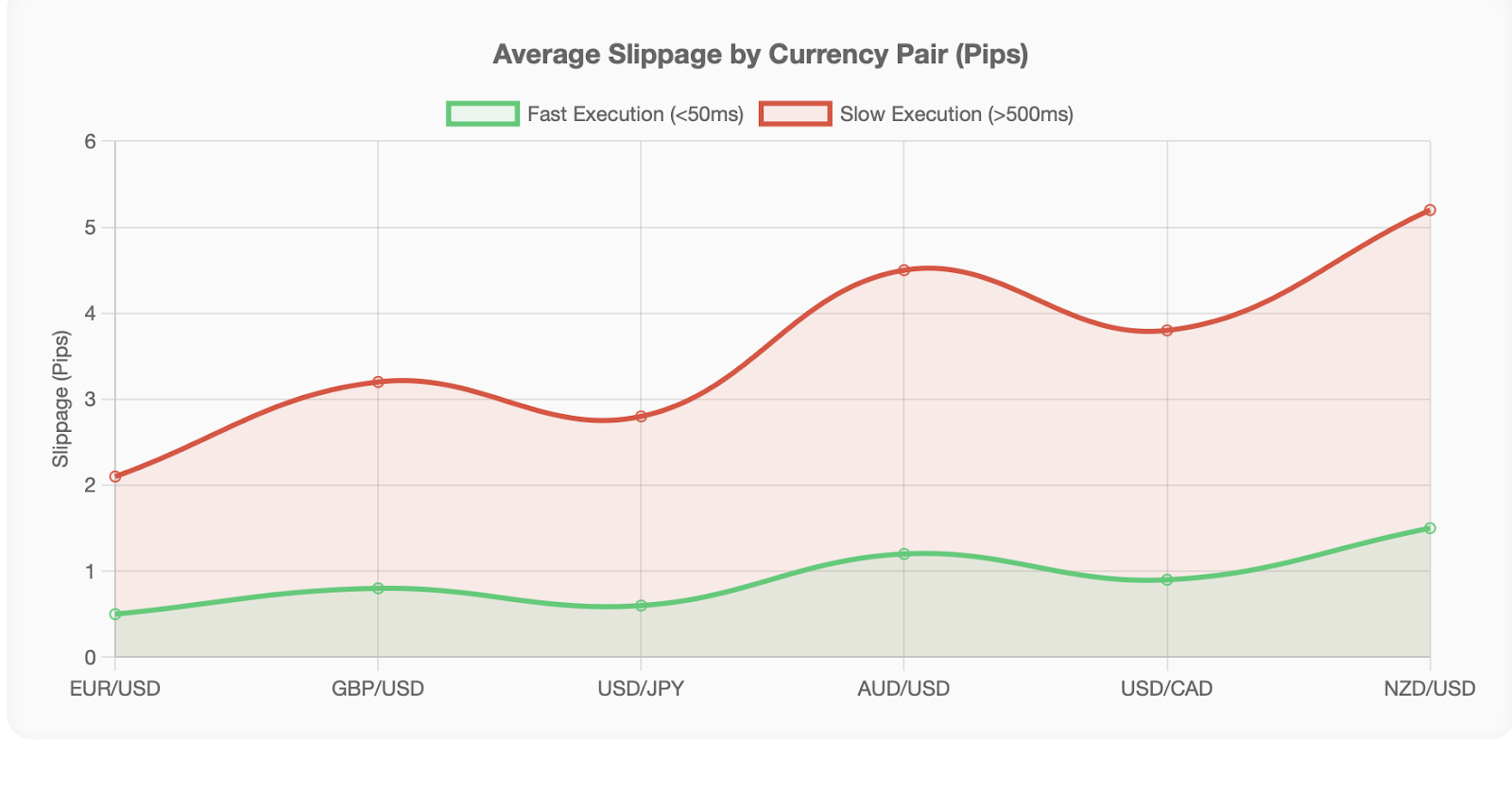

Execution speed is often associated with latency (how long it takes for your trade order to reach the broker's server) and slippage (the difference between the order price you expected, and what you actually buy or sell). When the EUR/USD pair moves 50 pips in a matter of seconds, even a delay of 200 milliseconds can cost you 5 pips in slippage. That's real money going down the drain.

Here's an easy analogy: How many times have you tried to get limited edition concert tickets online? If your internet connection is slow, someone with a much better speed can grab the tickets before you do. CFD trading works the same way. While others are executing their trades at a good price, you may be buying at a high price and selling at a lower price due to the slow execution of your order.

This isn't just a techie detail for computer nerds. The effect of execution speed influences every strategy, whether you're day trading major currency pairs or swing trading commodities. Faster execution equates to tighter spreads, less chance of slippage, and better entry/exit points.

We will look at what execution speed really means, the variables affecting execution speed, practical ways to improve execution speed, common mistakes traders make, and real examples illustrating how milliseconds translate to profit/loss.

What Execution Speed Really Means

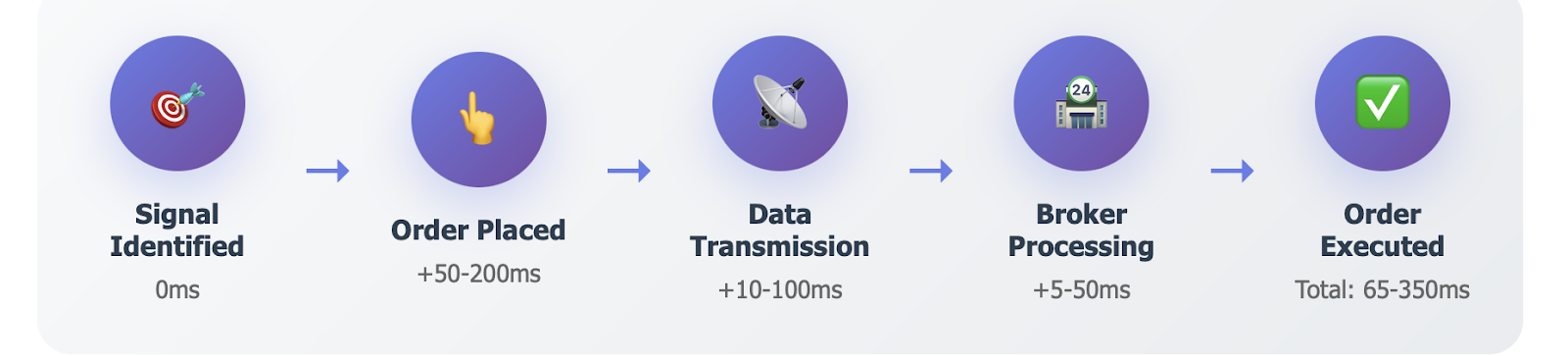

Simply put execution speed is the actual time it takes from the point you submit the order until your order is executed. Simple enough! But like any concept, we should explore the related terms that impact the applicability of speed and execution in your trading.

Latency refers to the distance in milliseconds it takes for your order signal to transfer to your broker's server. Slippage is the price movement occurring in the distance between the submission and execution of your order. Ultimately these three aspects together account for the total price of your last trade.

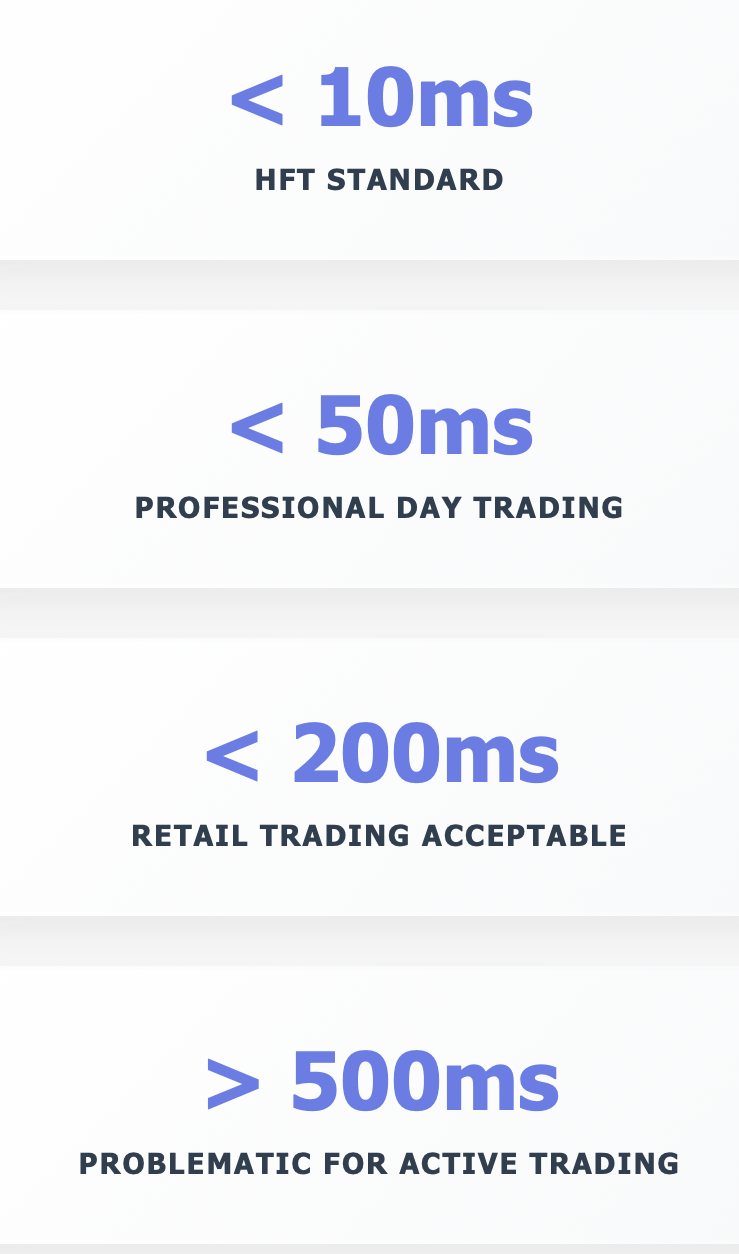

The demands on execution speed vary with different trading styles. High-frequency traders need microsecond execution speed, making thousands of trades a day. Day traders utilize milliseconds to exploit intraday price movements. Swing traders can generally afford to use slower speed, as the strategy looks for holdings to last from one day to weeks.

Take this as an example of a professional setting: there are high-frequency trading firms who spend millions of dollars on fiber-optic circuits and direct market access specifically to execute EUR/USD orders in less than 10 milliseconds, and they are quite literally racing against time, and each other, for a better price.

In an everyday comparison, think of online gaming. Competitive players need low latency internet connections to ensure their input is recognized as soon as they act. If there is a delay between a player inputting an action and their character responding, they will lose. The same goes for a delayed trade execution; they will lose money.

When we measure execution speed we need to consider the difference between market orders, and limit orders. Market orders are executed in real time at the price available and may still incur slippage in volatile sections of the market. A limit order is executed only at the price given, but may not be filled if that price is not in the market (and the market continues to move).

Currency pairs can move dramatically in very short periods of time due to the implementation of economic events like the US Non-Farm Payroll releases. Traders with more significant advantages in execution speed over their competitors can take a better position at a better price than traders with a slower execution and significantly more slippage.

The main takeaway is that execution speed is everything, and has a direct impact on your trade price and profit potential. It's not just background noise, it is a primary contributing factor to your strategy's success.

Key Determinants of Execution Speed

There are many things that affect how fast your orders will execute, and knowing these factors will allow you to see opportunities for improvement.

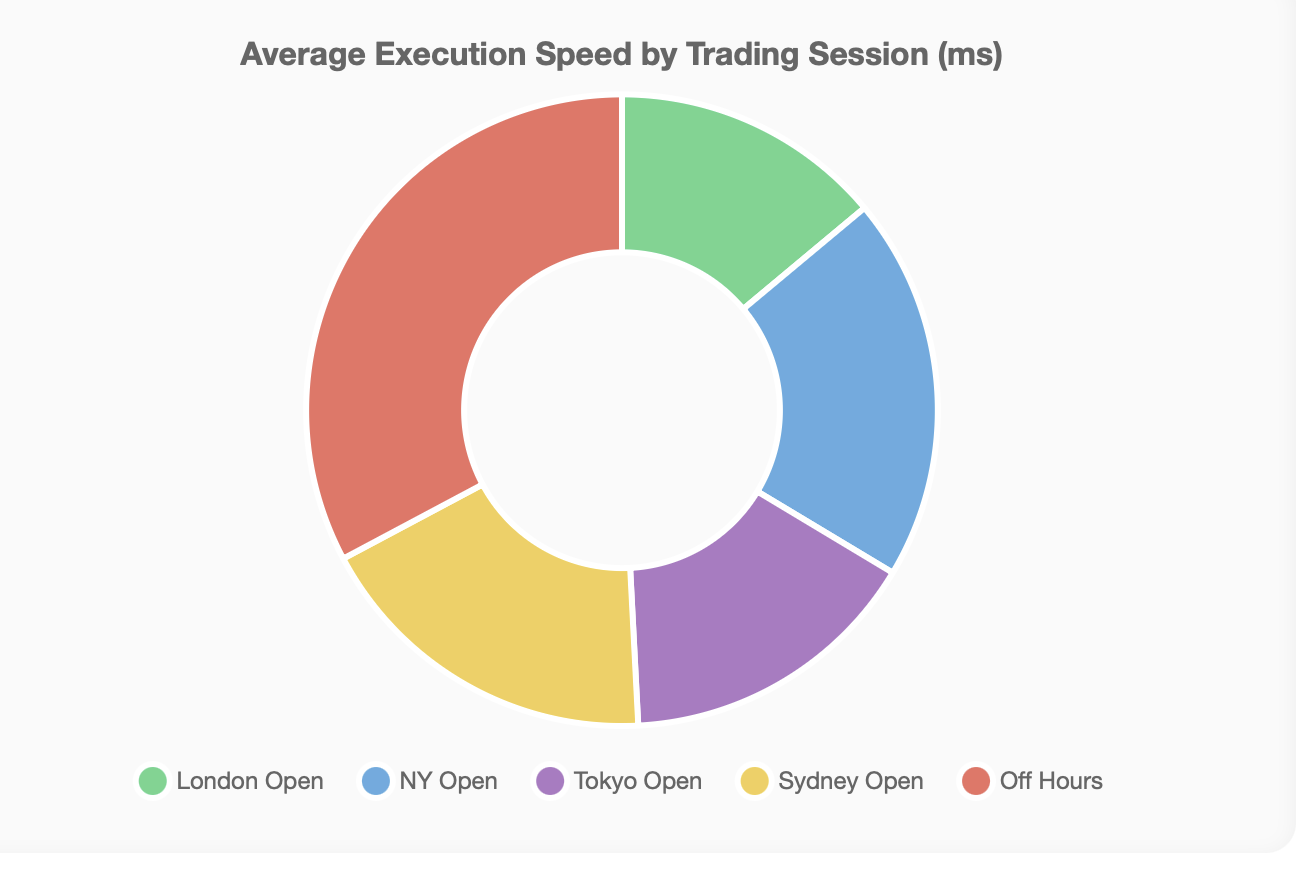

Market volatility is the first consideration. In periods of high volatility, such as the London or New York market open, GBP/USD can be infinitely variable within seconds. Thus, you might lose price altogether if you are off by 500 milliseconds.

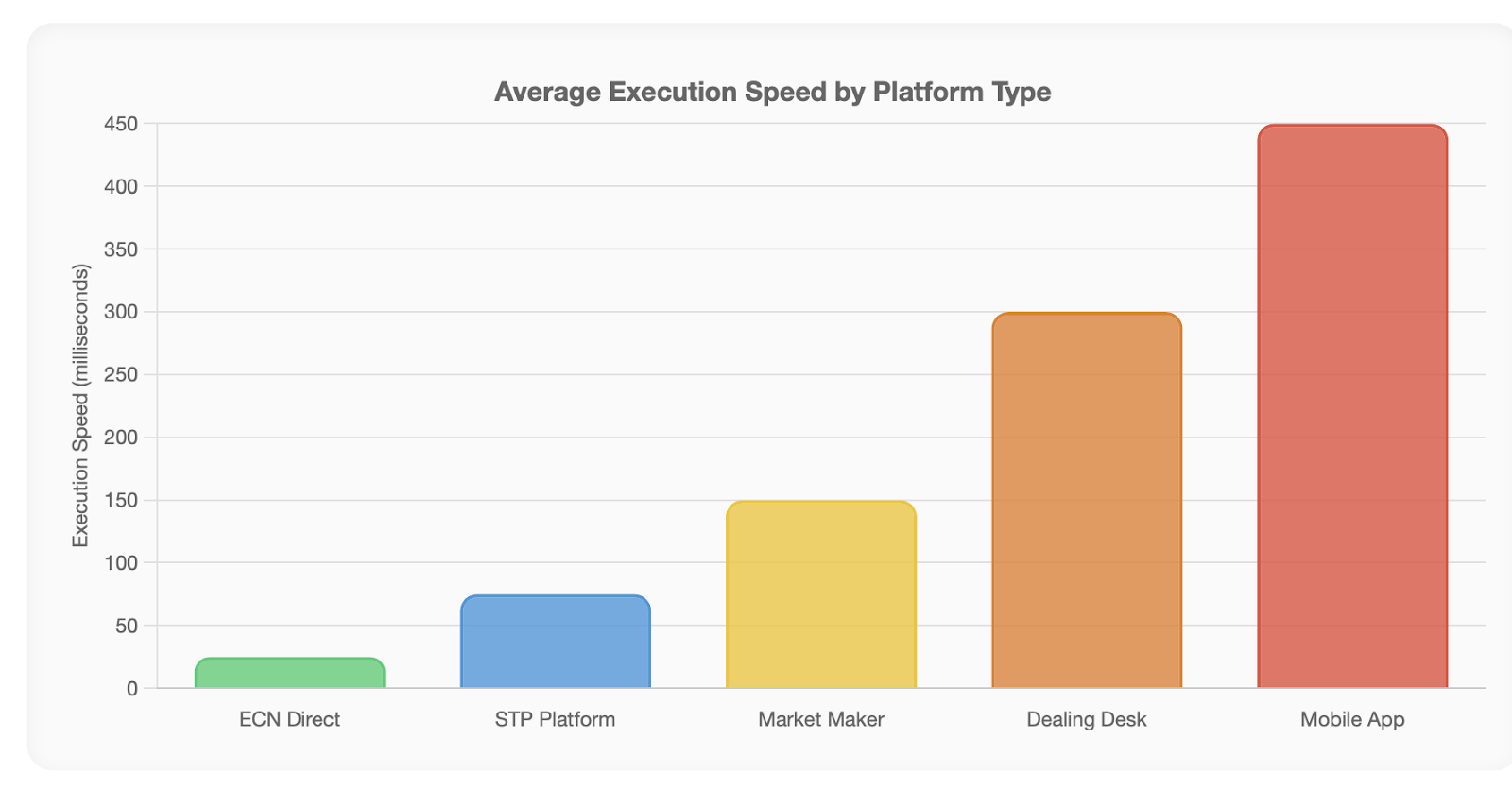

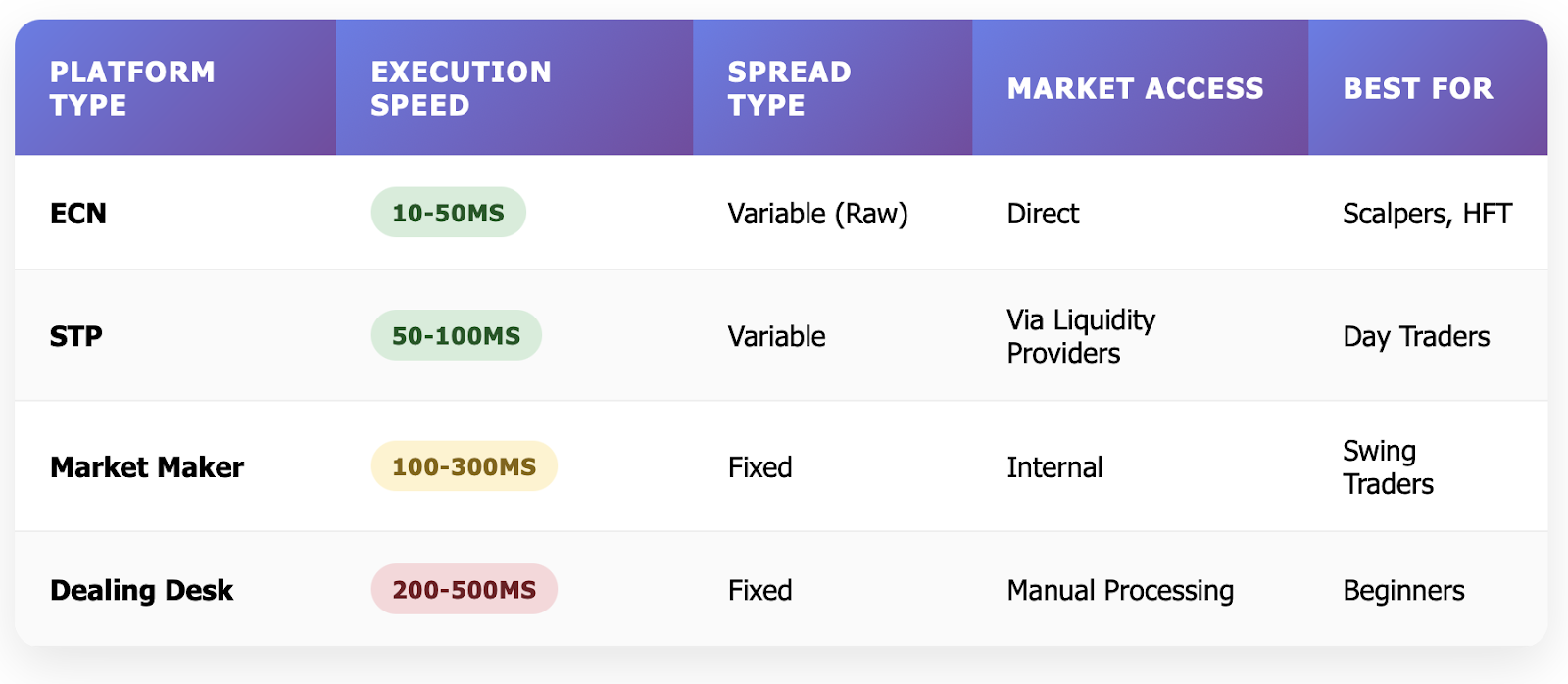

The type of trading platform you use also makes an enormous difference. Straight Through Processing (STP) platform will forward orders directly to liquidity providers. Electronic Communication Network (ECN) pricing is essentially the same, but ECNs normally offer the quickest execution because they provide direct market access.

Market makers will normally offer fixed spreads, but because they are taking the other side of your trade, their execution will likely be slotted for the end of their cycle that allows the best possible execution.

Network latency is a function of your physical distance from the broker's server, and the quality of your internet connection. If you were located in New York, for example, and using a server located in London, your latency would be considerably higher than that of someone located in London. Your internet speed, internet connection issues, and routing also matter.

The kind of order choice also has an impact on your likelihood of execution speed. Generally speaking, market orders execute with greater speed as they accept prices at the current market price and tend to be executed faster than limit orders. A stop order generates a market order once price reaches a certain price level which may incur slippage during periods of volatility.

Think of it this way: a fast food order at the register (market order) you would be taking as is, for what they set. Calling for a fast food order with the specifications that you need (limit order) may take longer and may take some time before the order may be filled when you arrive.

When you are considering your broker's technology infrastructure, it can make a difference. Some brokers really spend the money on low latency systems, colocation services at exchanges and have established relationships with liquidity providers. Other brokers may be using legacy systems and may be routing your order to multiple brokers before reaching a final execution.

The time of day you place an order can also matter. At times when London and New York sessions overlap as they have high levels of liquidity but if you are looking for the best price then you may have to contend with many competitors in the market. During off hours, the competition may be less, but the spreads may be wider too.

How to Improve Your Execution Speed

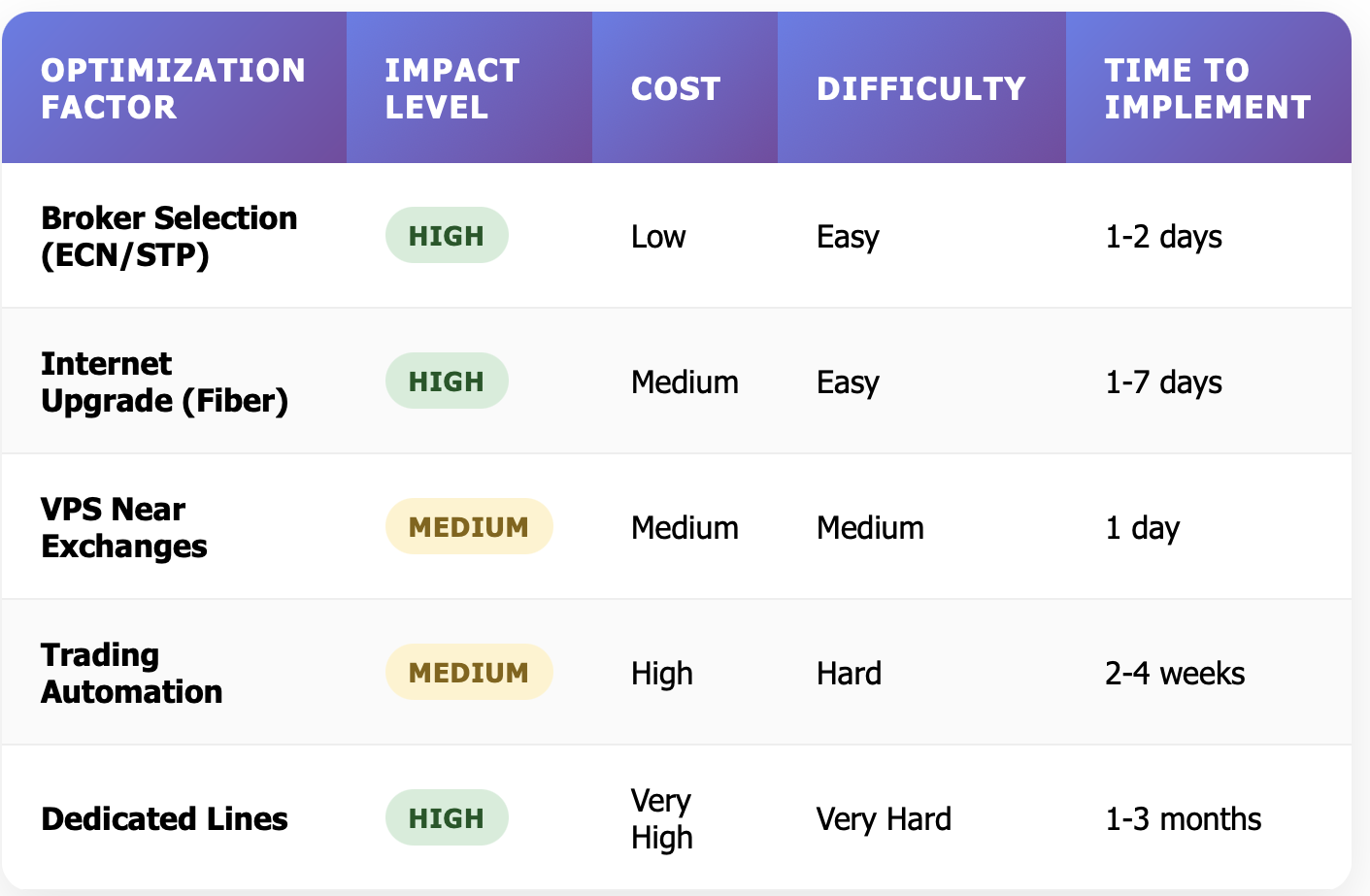

When it comes to increasing execution speed, you can only focus on the factors that you can control while also considering your cost constraints and technological limitations.

Begin with selecting brokers. Make sure that you choose ones providing direct market access as an ECN or STP broker is far better than a market maker. If a broker is posting execution speeds of below 100 milliseconds - make sure that this was tested by an independent review or you also verify it on your end with demo or real trades.

Maximize the speed of your setup. If fiber-optical internet is available, upgrade. Be knowledgeable of your physical distance to the broker server (e.g a New Yorker using a broker server data located in Sydney). A few serious traders go as far as to relocate to areas around the financial centers or use VPS options that are located close to the exchange servers.

Use the right order types depending on the time of day and market conditions. Market orders fill instantly - you trade the price at that time with no regard for whether or not you knocked out the current market price. Limit orders control cost in relatively normal conditions but may not fill in volatile markets.

Keep note of your slippage and analyze the differences between when you thought you were filling at a particular execution price only to fill at a different price depending on the time of day and market conditions. Data can help you tweak strategies and determine if speed of execution is an important factor in your trading style.

Finally, consider using implementation of conventional automated trading systems. It can remove even those minor delays in human reaction time. Expert Advisors (EAs) and trading algorithms have the ability to execute orders with desirable criteria within milliseconds. The robot does not hesitate and, therefore cannot finger fumble or hesitate based on your emotions.

Professional high-frequency traders have lines dedicated to exchanges such as NYSE, and executing trades in under 10 milliseconds. While most retail traders might not be able to replicate this setup, it is a good reminder that reducing the amount of time delaying execution is paramount when trading.

For example, for online shoppers, there are auto-refresh scripts and pre-saved payment information which significantly improve the chance of getting a limited time item faster than a person who has to click manually. Similarly, a trade setup with parameters pre-set and fast dedicated connection is always going to outperform a manual entry.

Make a habit of checking your speed to execute trades during the market you normally participate in. What is an acceptable speed during an Asian session may no longer be acceptable during an important US economic announcement if the market is volatile. After all, you should not adjust your trading execution based on the specifications, but based on actual performance.

Mistakes to avoid relating to execution speed

Most traders are willing to focus on the wrong things regarding execution speed, which impacts their results and additional expense.

The first mistake is focusing on just advertised execution speeds and not verifying the performance in real time. Brokers will all say they have a 50-millisecond execution speed, but if you are trading in a market that is volatile they may only deliver 500-millisecond execution. The only way to know this is to test them in different market conditions.

Another frequent mistake is fixating on the time it takes to send an order, and then completely ignoring slippage. Fast order routing does not mean a thing if you get 3 pips of slippage every time you trade because of poor liquidity or wide spreads. It is all about execution quality as a whole, not just speed of execution.

Some traders build overly complicated networks to send trading orders, which can create higher latency instead of reducing latency. It is entirely possible that a trader can set up many different Pretty VPNs or use a proxy server or routing a connection through a far away server. In some cases simplicity is the answer.

Chasing microsecond improvements in execution time while ignoring the cost of trading fees is another misaligned emphasis. Paying additional fee(s) for just barely faster execution can bring your net profits down more than the improvement in speed can contribute. A trader has to do the math to see whether or not improvements in execution speed actually helps their bottom line.

There are a lot of scenarios where traders run tests on execution speed during quiet times in the market, but they fail to check speed of execution when they are under serious market conditions (times when speed is critical). Your broker might give you great execution speed in the quiet hours of Asian trading, but their execution might really struggle during US economic announcements.

Here's a relatable example: students trading from Wi-Fi on campus often face an onslaught of network restriction and shared bandwidth obstacles resulting in a varying degree of execution speed. Students are obsessed with finding a broker, but they don't realize their inconsistencies start before they get to the broker.

Some traders also confuse execution speed with trading frequency. Swing traders, who hold trades for days, do not require the same microsecond precision as scalpers, who will execute dozens of trades a day. Make sure the execution speed obligations are aligned with the trading style you are actually utilizing.

In summary, optimizing production speed is important but it must also be weighed with strategy strengths and the associated cost. You do not want to sacrifice good risk management or any reasonable cost, just to perhaps execute marginally faster than needed and not alter the outcomes of your trading as a result.

The Real World Effect Case Study

Let me show you how execution speed affects real-world trading scenarios using case examples.

Case Study 1: High-Frequency versus Everyday Trader During EUR/USD Volatility

During a European Central Bank announcement on a particular day in the spring, the EUR/USD may have moved 80 pips in under 30 seconds. A trading high-frequency trader with a 10-millisecond execution, was able to pick up the move at 1.1850, and a retail trader with an 800-millisecond execution was filled at 1.1868. Ultimately depending on the spread on their execution, the additional 18 pips on a handful of standard lots could have added up to $180 in missed trading profit or an extra cost.

The high-frequency trader used Direct Market Access (DMA) utilizing servers near the location of key exchange houses. The retail trader used a standard retail trading platform trading out of their home internet. Same market opportunity, completely different result based only upon execution speed.

Case Study 2: Execution of Gold CFDs Market Order versus Limit Order

A trader planned on buying Gold CFDs when the price reached $1950/ounce, with very recent US inflation data released. Using a market order, and with the fast execution, the trader was filled at $1951.20 because of the speed of the price movement. Another trader used a limit order for $1950 and was never filled, as the price gapped upward and continued to rise.

The market order trader would capture a move up of 40 points over the next hour. The limit order trader would miss the entire opportunity, waiting for their exact price. Fast execution with limited slippage sometimes wins out over waiting for perfect prices.

Case Study 3: Network Latency at London Open

Two traders in different parts of the world, looking to trade GBP/USD at the London market open. Trader A was in London with fiber internet and had an execution speed of 50 milliseconds. Trader B was in rural Australia with satellite internet and execution times of 600 milliseconds.

When GBP/USD traded 60 pips higher in 2 minutes from positive UK employment data, Trader A captured most of the move with very limited slippage. Trader B had their orders executed while GBP/USD had already made a significant move which limited their profit potential to only an average of 15 pips profit per trade.

Case Study 4: Manual versus Automated execution

An experienced day trader who would manually execute EUR/USD trades and had an average time delay of 2-3 seconds from reaction to order was able to implement an Expert Advisor that got their reaction time down to 100 milliseconds with the same signals.

Across more than 100 trades, this system improved the average entry price by 1.20 pips versus the manual execution. While that may not seem like a large amount, it added $1,200 in profit on standard lots over one month of trading.

These examples do a great job of showing that speed of execution is not any sort of theoretical exercise for traders. Speed of execution will impact your trading account balance only regarding whether you can achieve better fills on trades, less slippage, and will help you take trades that slower traders will likely miss.

Maximizing Your Execution Speed: when it comes to taking action

Let's bring this all together with some practical advice that you can put into action straight away.

Make sure you are choosing your broker wisely and assessing the execution quality, not the marketing talk. Also ensure you are assessing brokers during turbulent market periods and not only during calm periods. Test brokers and document the actual fill prices versus each brokers' expected prices, across all order types and market periods.

Enhance your technological setup, the first thing recommended is upgrading to the fastest internet speed you can get in your location. Computers and internet or VPS hosts on your side of the globe (like your broker will be) will always be faster if your broker is located in a worldwide central business and exchange location. Also, it goes without saying, get rid of unnecessary software and eliminate processes that might slow down your trading platform.

Also, it is important to select the appropriate order types depending on market volatility and your trading strategy; for instance, market orders if price is moving fast and you need to get in or out of a position quickly. Limit orders in situations when it suits your market conditions and allows you to wait for a specified price level.

Do not forget to monitor how well you are executing trades, by collecting data on how much slippage you are incurring at certain times of the day, with different currency pairs, and with different levels of market volatility. Another good idea is to keep the detail of how quickly your trades get executed in your trading journal along with comments on your trades.

Automate where possible so that you can eliminate 'human delay' factors. Even if the automation is basic (for example pre-programmed sizes of orders, or risk parameters) and can reduce the process of getting the trades executed manually every time, your results will be improved.

A realistic expectation is needed around your requirements. Executing trades quickly will give day traders and scalpers a huge advantage. However, as a swing trader, your focus may lie elsewhere, like on the price of the spread and financing overnight differences.

Be aware that optimizing execution speed requires consideration of many factors. Executing at a higher cost, with the fastest execution, might not help your net profits. You have to work out if you are actually better off by executing faster once you consider all costs.

Test everything in the live market, particularly during high-volatility events. Execution speed matters most during fast-moving markets. Your setup might work perfectly in slower periods and then will struggle to perform when you really need it.

Fancy fast execution? Then become a member of btcdana.com and trade on our low latency trading platform engineered for serious traders. Competitive spreads, fast execution, and robust technology infrastructure await you. Start optimising your performance with the high execution speeds available to professionals.