Introduction:

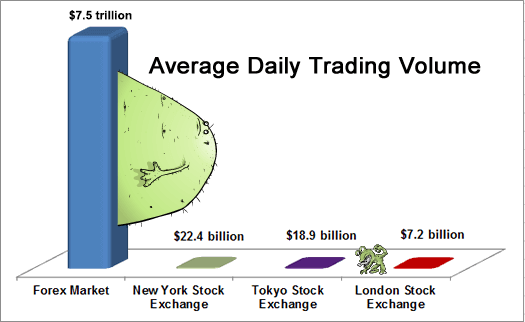

Forex is the biggest financial market in the world. Every single day, more than $7.5 trillion is traded. That’s bigger than stocks, bonds or crypto combined.

When we talk about global economic uncertainty, we mean things like political instability, inflation running too high, wars disrupting trade flows, or sudden changes in central bank policies. All of these hit forex markets in ways no one can fully predict.

Take 2022 as an example. The U.S. Federal Reserve hiked rates faster than in decades, going from near zero to above 4% in one year. The USD Index hit a 20 year high of 114 in September 2022, and emerging market currencies dropped hard.

For pro traders, that was a year of dollar whiplash. For beginners, it’s like studying for an exam without knowing the questions. You can’t just prepare one answer, you need to be ready for multiple possibilities.

The big question is, why does the future of forex trading strategies need to change? Because risks and opportunities are both tied to global uncertainty now. Anyone who understands this and follows forex market trends has a better shot at navigating what comes next.

Main Drivers That Move The Forex Market

There are four big forex risk factors that sit behind currency swings:

-

Monetary policy

Central banks like the Fed, ECB, and BOJ set interest rates. When the Fed raised rates aggressively in 2022, the U.S. dollar jumped while the yen weakened because the BOJ stuck to ultra-loose policy. -

Geopolitics

Wars, sanctions, and trade disputes all push currencies around. The Russia-Ukraine war in 2022 hit the euro badly. The EUR/USD pair dropped below parity for the first time in 20 years. -

Economic cycles

Inflation and recession fears change investor sentiment. In 2020, inflation was low, but COVID disruptions pushed investors to the USD and JPY as safe havens. By 2022, inflation hit 7–9% in advanced economies, sparking big shifts again. -

Unexpected shocks

Natural disasters or pandemics can move markets instantly. When COVID first broke out, safe-haven currencies like the dollar and yen surged heavily.

For a beginner, imagine planning an outdoor event and then it suddenly rains. Everything changes fast. That’s how global economic trends affect forex.

To sum things up, uncertainty is not short term. It’s baked into the market. If you don’t factor in these long-term variables, you’ll miss the true forex market impact.

Why Old Forex Strategies Don’t Always Work Now

Traditional forex trading strategies don’t always hold up. Here’s why that could be the case:

-

Technical analysis looks at old charts. It works when markets are calm, but can’t predict sudden events. When the Swiss National Bank dropped its currency peg in 2015, the franc surged almost 30% in minutes, wiping out traders who relied only on charts. This shows forex technical analysis limits in action.

-

Fundamental analysis checks data like GDP or inflation. It’s useful but too slow compared to market moves. Central bank surprises often move currencies before fundamentals catch up.

-

Leverage risks: Many newbies lean heavily on math formulas or max leverage, hoping for big gains. In volatile times, that backfires. One bad trade with high leverage can wipe out an account. Old methods rarely accounted for these blow-ups.

It’s like studying last year’s exam paper for a test and then your teacher changes all the questions. Your prep is useless. Pure forex fundamental analysis or chart-only rules don’t cut it anymore. Traders need methods that can react instantly.

How AI And Big Data Are Changing The Future Of Forex

The future of forex trading is all about tech. Here’s what’s reshaping the market:

-

AI and Machine Learning: Algorithms scan massive datasets like prices, news, and even tweets. They detect patterns faster than any human.

-

Big Data Analytics: Tools like Glassnode and Santiment mix news, social media sentiment, and economic releases to form signals. This is what we mean by big data forex analysis. Imagine a bot reading a world leader’s tweet and making a move before humans even see it.

-

Automated Trading: These programs follow pre-set rules and trade 24/7 without emotion. Think of them like a GPS for markets. They re-route your strategy when there’s traffic.

-

Smart Risk Management: New software adjusts stops and positions automatically. For example, an AI-based stop-loss can adapt if volatility spikes.

Many big players (and even retail platforms like MetaTrader) offer these tools. Quant funds use them to predict moves in pairs like USD/JPY or EUR/USD. The AI forex trading revolution is already here. Tech-savvy traders who leverage AI and analytics will likely outperform those sticking to old methods.

Survival Guide: Practical Strategies For Trading In Uncertain Times

When markets get crazy, the focus should be on risk control and flexibility. In an uncertain market forex environment, these forex trading strategies can help:

-

Diversify: Spread your trades. Don’t rely only on one pair like EUR/USD.

-

Adaptive strategies: Try systems that shift with signals. Trend-followers or dynamic algos adjust as the market changes.

-

Risk control: Always use stop-losses and manage leverage carefully. Overleverage in volatile times equals disaster.

-

Keep learning: The market changes every year. Use demo accounts, take courses, and read expert insights.

Hedge funds and big portfolio managers often hedge across currencies. Instead of betting everything on USD, they might balance with other currencies or derivatives. That way, a big USD move won’t topple their portfolio. Even small traders can copy this idea by combining currency pairs or using market-neutral strategies.

The important thing here is to stay flexible. If plan A fails, have plan B ready. Effective forex risk management and diversification are the difference between survival and a blown account.

The Future Of Forex And What Traders Should Focus On

Forex is changing fast. The long-term forex market outlook is that volatility and uncertainty won’t disappear. Rigid old methods will struggle. Instead, focus on flexibility, data-driven insights, and strong risk controls. Think of it as preparing for a world where analysis comes from big data and AI.

In the future of forex, the winners will be those who combine new tech with smart basics. They’ll use trading platforms and tools to stay informed and ready.

So keep it simple, don’t overleverage, and let data guide you. Use stop-losses, diversify, and keep an eye on news and analytics. That way, when surprise events hit, you’ll still stand strong.

To get started and learn more, visit BTCDana. The future belongs to traders who adapt.