Bullish Market Explained: Their Meaning and Relevance to Traders

Have you ever wondered why some traders always seem to make money when markets are rising compared to others who always seem to lose the opportunity? The answer is based on revealing what a bullish market is and how traders can take advantage.

A bullish market simply means that we are in a market environment where prices are increasing. It’s simply the financial world equivalent of a rising tide, which will lift all the boats. During bullish markets, optimism rolls over the traders involved, buyers are always heavier than sellers, and prices tend to increase over time.

Now lets look at this from the opposite side, a bearish market where prices are declining, pessimism is reigning, and traders are either relying on short selling or avoiding any involvement in the market, again, the contrast could not be greater.

Here is a professional example I may provide, Bitcoin (BTC/USD) increased in price from $28,000 to $35,000 over the course of a few weeks. It is clear to see BTC's whole price development was in an uptrend. A CFD trader knowing that the market was bullish could have opened long positions earlier in that process and made a significant amount of money on those trades.

In an even simpler analogy, let's say you are a high school student who has been tracking the price of a popular video game skin. You see it's increased in price from $50 to $80 over the last month. That steady price increase described? That's a bullish market environment.

What a lot of novice traders will overlook is that a bullish market doesn't simply mean that prices go up! It is about market psychology, market momentum, and timing. The traders that make money consistently are traders that are able to identify these conditions early and position themselves based on this insight.

This article will cover everything you need to know about bullish markets. We will explain the definition and characteristics of a bullish market, discuss influencers of price increases, outline some proven trading strategies, explain the psychological hurdles that you will encounter, and provide case studies of the real world in accordance with these principles.

Definition of a Bullish Market and Characteristics Every Trader Should Understand

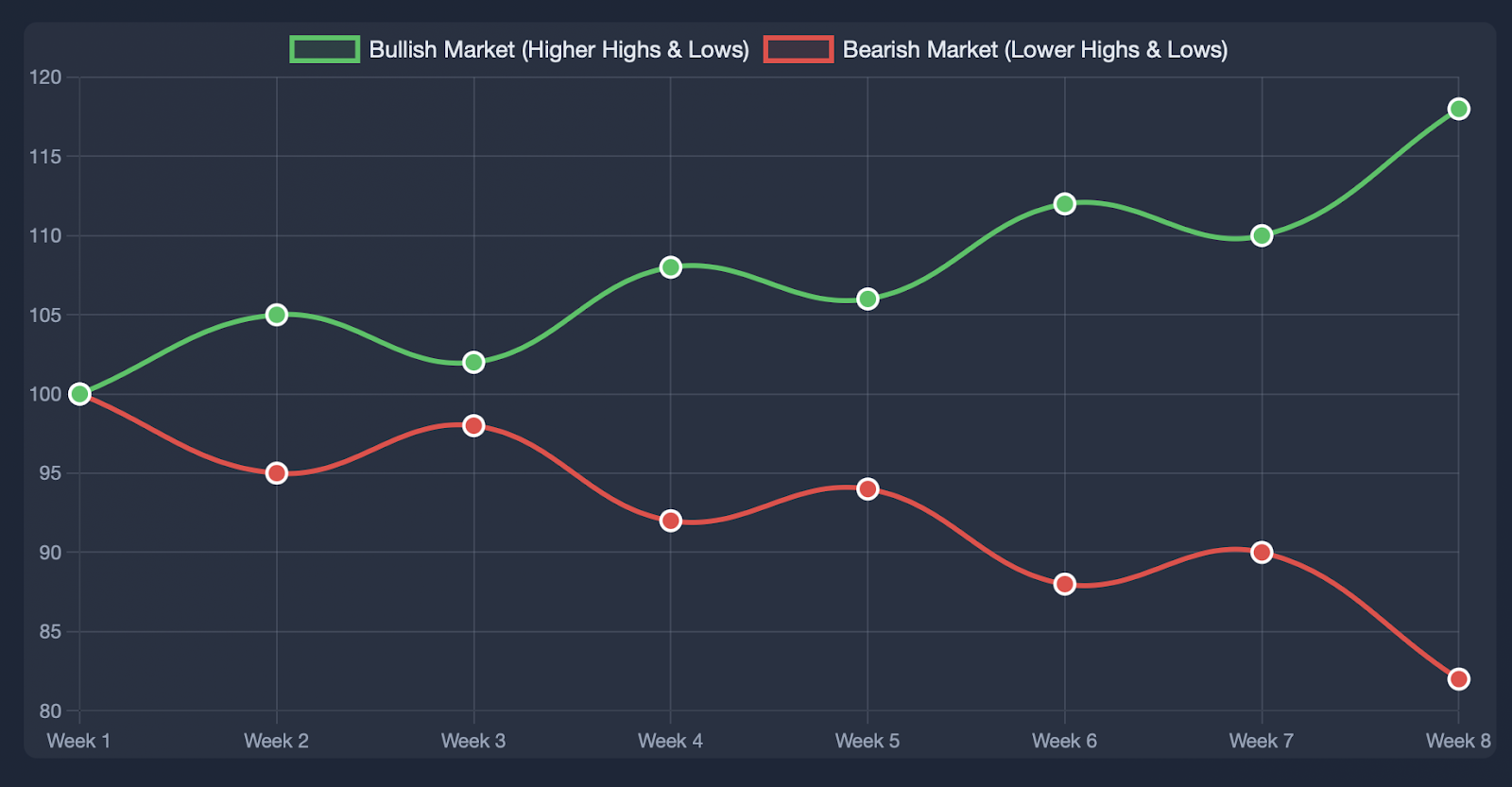

Now let's get clear on what market conditions characterize a bullish market. A bullish market is a market environment where prices consistently trend upward based on what technical analysts refer to as "higher highs and higher lows." These peaks and valleys create patterns that seem like staircases, with each peak and valley above previous peaks and valleys.

Some defining characteristics you may notice would be continually increasing prices, favorable market sentiment, and relatively stable trading volume or increasing trading volume. The feeling of confidence in the future is what drives the buying vs. selling.

You can contrast this with a bearish market where you see lower highs and lows. In a bearish market there is not only pessimism but often trading volume drops as participants lose interest or lose confidence.

Technical traders use a variety of indicators to spot a bullish situation:

-

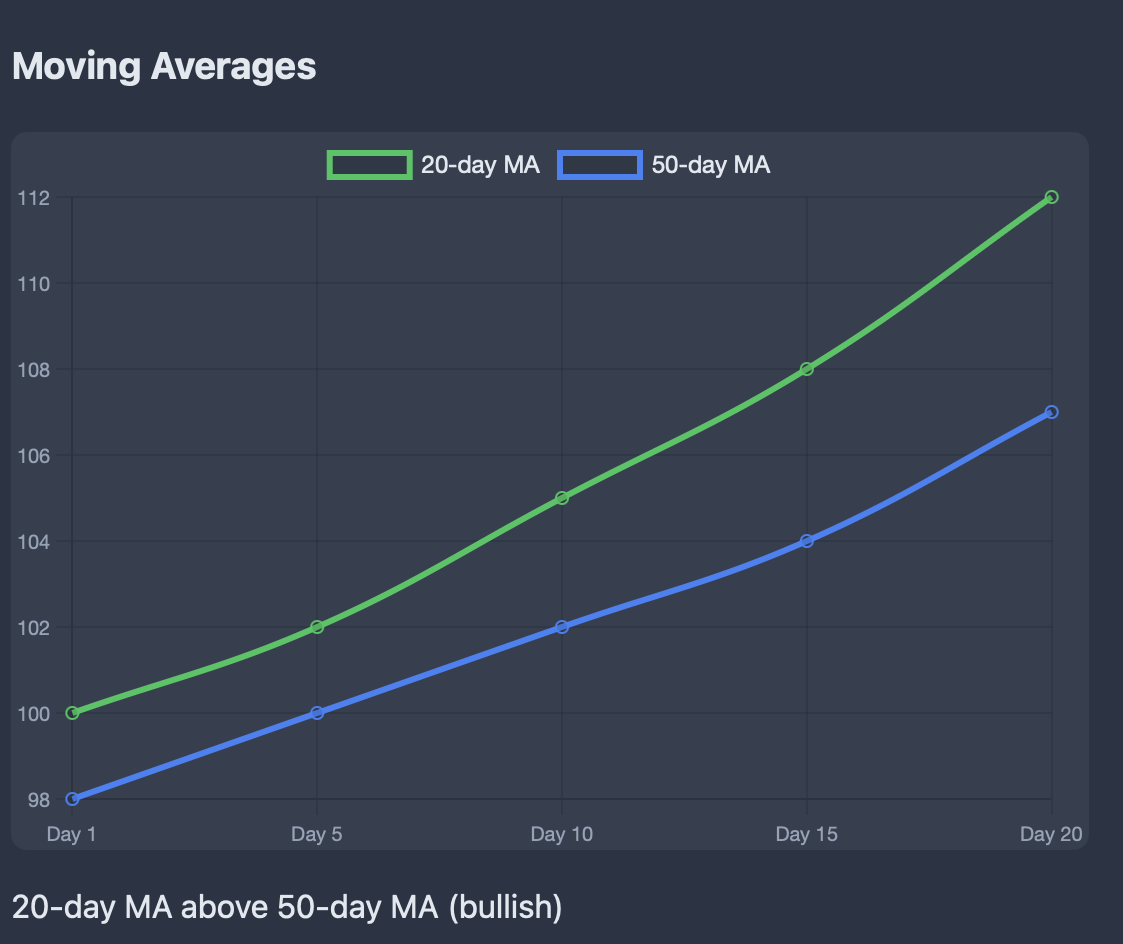

Moving Averages (MA) over time continue to trend upward as well. A strong bullish market would have a 20-day moving average above the 50-day moving average (> both upward trending).

-

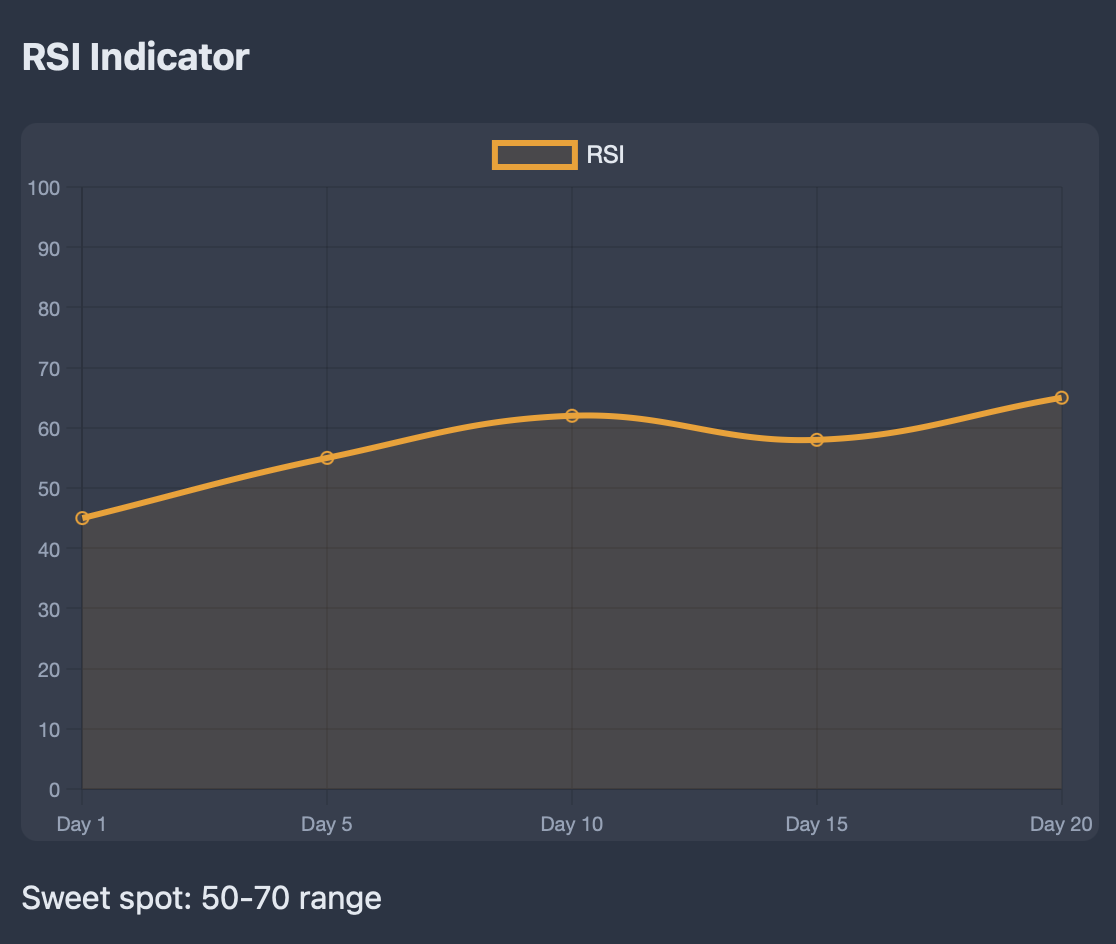

Relative Strength Index (RSI) reading above a value of 50 indicates bullish momentum. The sweet spot would be readings between 50-70, when the market continues to show strength and the market isn't overbought.

-

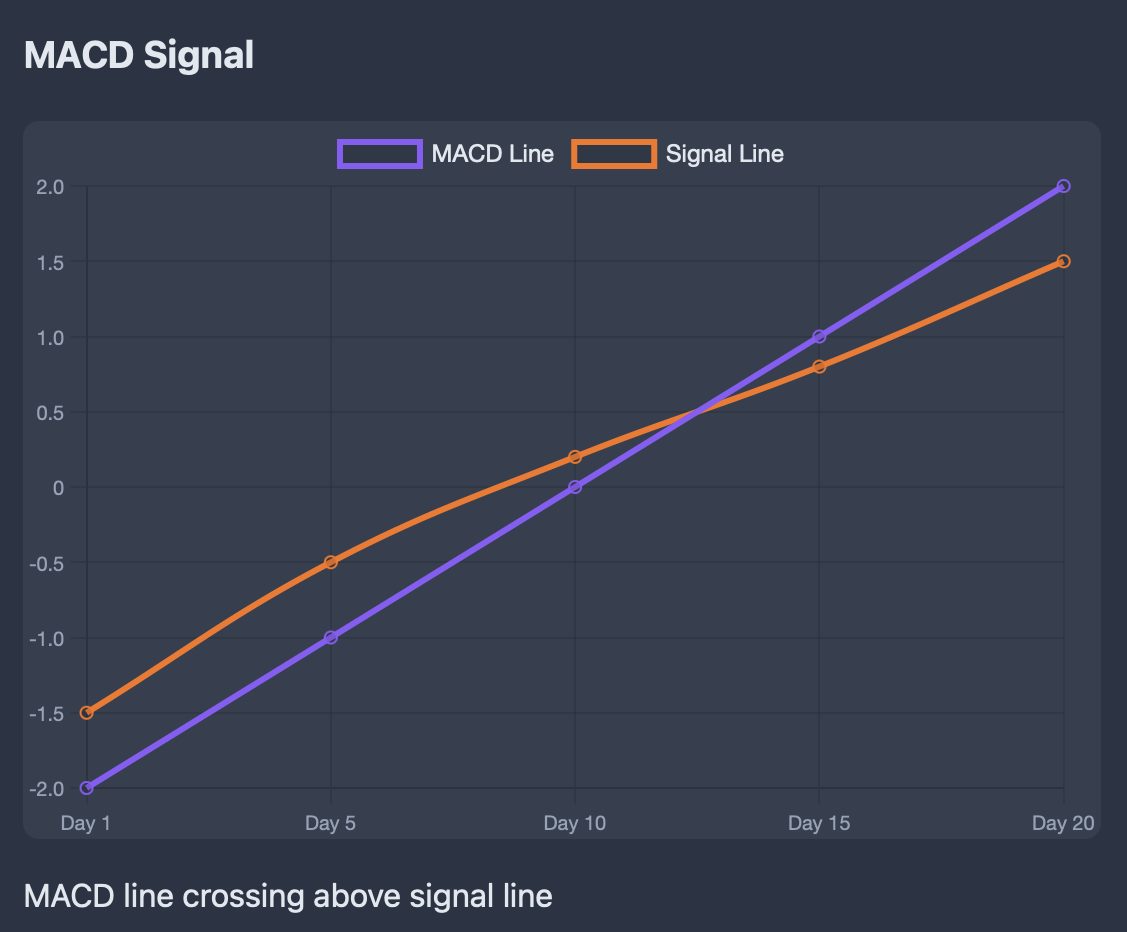

Moving Average Convergence Divergence (MACD) gives bullish signals when the MACD line crosses over the signal line, preferably when both are below zero and both are trending upward.

Now, let's look at a professional example: during approximately six weeks of the BTC/USD trades that increased from $30,000 to ~$38,000 USD, the following market technical aspects were consistent: 20-day moving average was trend upward lines, RSI was moving between 55-65, and MACD gave many bullish signals during the time frame. So taking into consideration that the price movements and technical indicators pointed towards a strong bullish market.

For beginners, think about that video game item again. If its price rises from $50 to $60 to $70 to $80 over consecutive weeks, with more buyers than sellers each day, you're witnessing a bullish market. The pattern is unmistakable once you know what to look for.

The important thing to remember is that a bullish market combines price action with technical confirmation and positive sentiment. It's not just about numbers going up, it's about the overall market environment supporting continued growth.

Different timeframes can show different trends. A market might be bullish on the daily chart but bearish on the weekly chart. Always consider your trading timeframe when identifying market conditions.

Why Prices Rise: Key Drivers Behind a Bullish Market

Knowing why the markets can become bullish allows you to predict opportunities and make better trading decisions. Price movement is not random, instead it has a fundamental reason behind it that changes supply and demand.

The simplest reason is always an imbalance in supply and demand. More buyers than sellers equal higher prices. There can be many reasons for price increases, but whatever the reason there are always more buyers than sellers, and prices move higher.

Macroeconomic drivers are a large component of a bullish trend. Lower interest rates mean lower borrowing costs and a decrease in saving attractiveness, meaning investors will become more adventurous by investing in stocks and crypto. Economic growth or better than expected GDP data indicates that the economy is expanding, and therefore the companies are making more profits. Better jobs data means consumers will likely spend more money, which will also benefit the companies and the market.

Some policy-driven reasons for bullish markets can arise unexpectedly overnight. Central bank easing policies, government stimulus programs, and regulations that affect certain sectors can trigger a period of time where the market trend can go bullish for months. Many times when the Federal Reserve cuts rates or announces quantitative easing, bullish momentum can occur immediately.

Technical factors play a part, too. Resistance breakouts can give rise to algorithmic buying and stop out shorts, further driving the price higher. These breakouts can become self-fulfilling prophecies as more and more traders jump in on the move.

Here is a professional example: BTC/USD went from $25,000 to $40,000 based on news of institutional adoption and improved economic circumstances. The combination of corporate Bitcoin purchases, regulatory clarity, and macroeconomic tailwinds made for a perfect bullish storm.

Think about that video game example in another way. Maybe the game developer announced a massive update, which raised the value of particular items. Or maybe a popular streamer started using the item, which created extra demand. These are two catalysts that could result in the price element rising from $50 to $80, simply because more people wanted to buy the item than sell it.

Sentiment and psychology can exacerbate the underlying fundamental drivers. Positive news creates optimism, which attracts more buying, which pushes the prices up, which creates more positive sentiment, and so on. This cycle can lead to significant bullish markets for months and even years.

The single most important principle is to just be able to recognize when multiple factors align. One individual driver may cause a move, but often several supporting factors working together can cause a sustained bullish market.

Top CFD Trading Strategies to Profit in a Bullish Market

Trading CFDs during a bullish market presents a number of opportunities to profit from buying low and selling high, however, to be successful requires the right strategies in place and disciplined execution. Let's take a look at the best strategies one can employ.

Buy and Hold (Long Position) Strategy: You identify an early uptrend, open a long CFD position, and hold the position open for when prices increase. The goal is to time your entry correctly during pullbacks within the overall uptrend, not after the price has consolidated, and after a significant move up.

Professional example: A trader in their trading platform spots BTC/USD breaking above the 32,000.00 resistance level, on good volume. They open a long CFD position at 32,200.00, entering below 32,000.00, place a stop loss at 30,500.00 (the exit below recent support), and set their take-profit level at 38,000.00 (next significant level of resistance).

When Bitcoin hits the take profit target, the trader locks in a 20% gain on their position. Now for beginners, this can also be used as an example to say you bought that video game item CFD at 55.00 when you saw the uptrend starting. You placed your stop loss at 48.00 (if you lost 12%), and take-profit at 75.00 (you would have gained 36%). When it hit your target, you successfully profited on that item in a bullish market day.

Technical Analysis for Entry Timing significantly increases your success rates. For example, if you use moving averages crossovers to determine whether the trend is strong or weak and the price is pulling back to the 20-day moving average during an uptrend, this is usually a good entry point. If during the pullback the RSI reading in the 30 - 50 range, this means the pullback is healthy and not simply a beginning of a downtrend.

If the MACD bullish cross is below the zero line, this is often a strong buying signal. The more confirmations you can have (use all the indicators you feel appropriate), the better, rather than one or two indicators.

Stop-Loss and Take-Profit Management is what differentiates good vs. either mediocre traders or traders who give back gains. Place stop-losses below principle swing-low or key support levels, not arbitrary percentage levels. This is to stop you on correct market volatility and stop you if the trend actually reverses.

For take-profit targets, look for logical resistance levels, previous highs, or key fibonacci extension levels. Don't be greedy, take profits when the market provides them to you, you can always start again if the trend continues.

Position Sizing and Risk Management is key. Always risk no more than 2-3% of your account on a single trade, no matter how confident you are. Use proper leverage, CFDs provide a certain level of built-in-leverage but don't over-leverage as high leverage can amplify gains and losses.

In Dollar-Cost Averaging in Trends, longer-term bullish markets work best. Instead of deploying all your capital at once, you add to profitable positions as the trend develops, allowing you to build bigger positions while controlling risk.

The most important rule is to let your winners run and cut your losers quickly. Bullish markets can persist much longer than traders ever think possible, so don't get in a hurry to exit profitable positions just because you are making some money.

Bullish Market Psychology: How to Avoid Emotional Traps and Trade with Discipline

Trading psychology is crucial, and especially during bullish market conditions, it is easy to fall trapped into emotional states. The adrenaline builds up with rising prices, and it can become extremely destructive to your trading account, regardless of positive conditions.

During bull markets, greed is the enemy. As prices rise and profits increase, many traders drop their original plan for the day, and begin aggressive trading behavior. They increase position size, leverage excessively, and hold positions for too long with the hope of hitting even bigger prices. This greed-based action will eventually cause bad action when the market inevitably corrects.

Fear of Missing Out (FOMO) leads traders to enter positions after they have already moved too far. They see that the price is moving in their favor or that others are making money and panic about missing the profits that could have been made, or the profits being made now, or the profits that have been made in the past. FOMO leads to poor entries because it detracts from risk management and increases risk by buying extended markets. FOMO trading leads to consistently buying near temporary highs.

Overconfidence develops after winning trades. When in an up cycle of wins, traders often come to believe that they cannot lose. The overconfidence not only leads to sloppy analysis, but also larger positions and not following risk management rules. The market brings about humbling experiences for the overconfident trader, and it often does so quickly.

One example comes from the highly professional world of trading, this storytelling aspect can subtract from the seriousness of much of the trading game, but story telling is an inherent virtue. The trader made 15% on BTC/USD (bitcoin) in two weeks.

Instead of taking profits along the way according to his plan and accepting those profits as gain, greed kicked in. He doubled his position size, took out his stop-loss and crossed his fingers for more gain. After the price of Bitcoin slipped by 8% the account balance of the trader suffered significantly and he had forgone the previous 15% in profit.

The analogy for a green trader could be this: you bought that video game item for $55, it is now valued at $75. Your plan is to sell that item for $75, then you get a signal the price may go to $90. Greed kicks in, you forget about your original target and take the ride. When the item drops to $65, you now have given up most of the profit, which was already a profit, because you succumbed to greed.

Building Trading Discipline essentially involves planning every trade in advance. Prior to entering any trade, write down your entry level and stop loss level, your take profit target and size of position in the trade. This allows you take the emotions out of the decision making process while in trade.

Use automatic stop loss and take profit orders. Avoid trying to manually close your trades as you make decisions based on the emotions experienced in that moment, but let your levels close automatically.

Keep a detailed trading journal. It's important to document your trades, but also how you felt prior to the trade, while in the trade, and after the trade. Recognizing the patterns in your emotional responses will allow you to be aware when you are consciously making decisions based on your feelings and not on the analysis of your system.

Winning Streaks require special attention. When you have won a few times in a row, take a step back and review what you did. Are you following your rules, or has your behavior become sloppy? If you are aware of an increase in overconfidence, you may want to temporarily scale down your position sizes.

The most successful traders operate as if each trade is independent of the previous trade. Winning streaks don't increase the chances of winning again, nor do they guarantee future profits. Conditions can change rapidly and one trade can take away profit from several previous successful trades.

Face it: Pullbacks in bullish markets require discipline. Even the strongest uptrends will undergo corrections, and these corrections can invoke fear and doubt in the participant. Keep in mind that in bullish markets, the pullback is normal and healthy. A pullback usually means an opportunity to enter a position at a better price.

Bullish Case Studies: Real Examples of Profitable CFD trades

Let's look at some examples and see how these strategies are implemented in practice, using real-world scenarios. The case studies show successful trades but also common mistakes. Learning from real market situations is invaluable.

Case Study 1: Bitcoin Bull Market Profit (2020 & 2021)

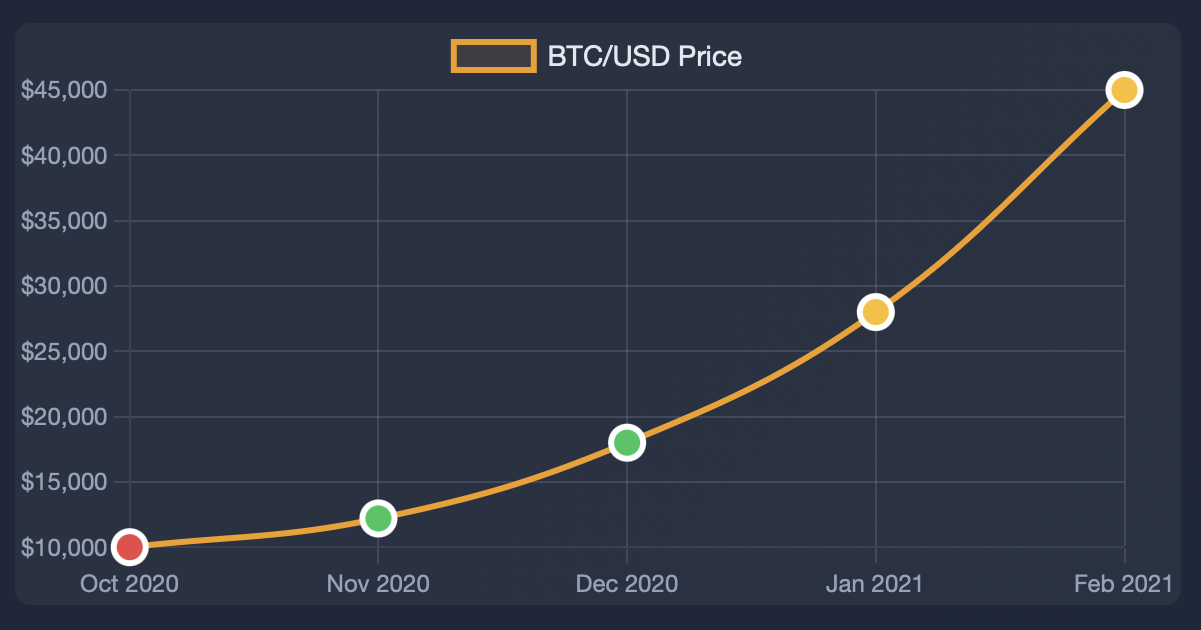

Background: Bitcoin underwent one of the most sympathized bull markets, where it increased its price from around $10,000 to over $60,000 in less than 12 months, which provided many opportunities for trading CFDs.

Strategy: The trader correctly identified the bullish breakout from BTC/USD in October 2020 when it broke above the facial resistance level of $12,000. The technical indicators also executed it perfectly: the 20-day MA crossed above the 50-day MA, the RSI was bullish just over 65, and MACD had a very strong positive divergence.

Execution: Their entry point; $12,200, stop-loss was $10,800 (just below the previous resistance level which is now support), take profit at $18,000 (next major resistance level based on 2017 highs). Size of position: 2% of capital.

Result: The trade reached its take profit target in December 2020 and yielded a 47% return over two months. The trader was able to repeat the process several times during the bull market maintaining their disciplined approach to risk management.

Key Accomplishments: Identifying the early trend and technical confirmation, taking the right size position, and taking profit exactly at where it was predetermined all helped the trader monitor and gain consistent profit during the bullish period.

Case Study 2: S&P 500 Recovery Trade (2020)

Background: After the March 2020 crash, the S&P 500 entered an extremely strong bullish phase, aided significantly by unprecedented fiscal and monetary stimulus.

Strategy: The trader let the panic set in and waited until bullish divergence was identified on the daily chart. The index was making lower lows and the RSI was making higher lows, indicating that the selling pressure was starting to exhaust.

Execution: Entry via S&P 500 CFD at 2,850 points in late April 2020, stop-loss at 2,650 points, take-profit at 3,200 points (previous support level). Position size: 1.5% of account.

Result: The trade completed in June 2020 at take profit and a return of 12% over a six-week period. The trader missed out on some of the upward rally, continuing to maintain discipline to take profits at the predetermined level.

Main takeaways: How to be patient for the proper set-ups, using the technical divergence for timing, and not to be greedy at your target price.

Example 3: Typical Beginner Mistakes

Background: A new trader was attempting to get the same market timing to profit from the Bitcoin bull market, but with several psychological mistakes.

Mistakes made:

-

Entered a long position at $45,000 (after a 300% move) because of FOMO

-

Used 10x leverage vs. appropriate position size

-

Hedged off an 80% stop loss because "Bitcoin only goes up"

-

Used TA indicators and forgot about overbought conditions

Outcome: The trader got margin called at $30,000 when Bitcoin corrected downwards, and lost 80% of their account even though they were correct in their overall bullish thesis.

Main takeaways: The timing of your entry matters, even in bull markets, using excessive leverage amplifies losses, stop losses help to protect your capital, and emotional trading will always lead to making the wrong actions.

Example 4: Video Game Asset Profits

Background: A new trader saw a one-off gaming skin (with steady appreciation) and wanted to trade it with CFD principles.

Strategy: Together they observed that the item broke the $60 price point (previous resistance level) together with the increased growth in daily volume and the prevailing affective sentiment of the gaming forums.

Execution: Simulated CFD entry at $62, mental stop-loss at $55, target at $80. Daily tracking of position and placing discipline.

Outcomes: Item reached $80 in three weeks. The disciple would have made a 29% returns while taking a maximum of 11% risk.

Key takeaways: The same lessons apply, regardless of market complexity. Whether beginner or advanced traders, the same components of trend recognition, timing entry point, risk management and ultimately discipline will determine success.

Analysis Across all Cases:

Common elements among successful trades include early trend recognition, technical confirmation, sizing & position, definition of exit levels in advance, exercise of emotional discipline. Where trades failed we noted the influence of FOMO entries, level of position leverage or risk size, risk management, and lastly, emotional based decision-making.

The market provided bullish opportunities, were up to individual skills in trading and discipline came into play. Even with the overall market favorable for trades, a single element of poor execution leads to loss of returns.

Bullish Market Reflections: Actionable Tips for Success

Success during bullish markets is combination of recognizing the trend, a proven strategy, consistent discipline in executions and exercising emotional control. Let's summarize some key principles, which split the successful traders from the average cash-seekers, in the this favourable time.

Understand the Basics: An up-trending market is indicated by prices continually moving higher through the use of a series of higher highs and higher lows. Technical indicators like moving averages sloping upward, an RSI greater than 50 and a bullish cross-over of the MACD can confirm the trend. You may see a price but until you have a complete picture and understand what else is happening to confirm the price, you should not act.

Find a Good Time: For an up-trending market, use pullbacks in the up-trend to avoid chasing prices too long after a large move has already happened. Rely on basic technical levels (tests of moving averages, oversold readings in the RSI) during pull-backs or corrections to give you an opportune entry. Even the most bullish markets have temporary setbacks that may provide better opportunities.

Risk Management is not Optional: Always use stop-losses below significant support levels; never risk more than 2-3% of your account on a single trade and don't let good runs convince you to increase your position sizes exponentially. While winning percentage and size really do matter, the reality is that markets do turn fast and better to have capital preserved for future opportunities.

Psychology will dictate your ability to sustain profitable trading: Pre-plan every trade, not just the entry but the exit and the position size. Try to impose as much objectivity on your execution as possible meaning you should be using the automatic stop-loss and take-profit levels which completely removes the emotional impact of execution. Journal your trades and you will be able to start seeing patterns in your emotions that lead poor performance. Remember that it is greed that kills more day traders in bull markets than any technical issues.

Keep It Simple And Get Better: Start trading with basic buy and hold strategies in clearly defined bullish environments. As you gain experience, incorporate technical analysis to help with timing. Eliminate distractions by mastering one style of trading before proceeding to more complex strategies. Consistent trading wins over complex trading every single time!

What's the key takeaway? Bull markets translates to opportunities, but there is never a guarantee to profit. Success comes from being able to recognize the trend before the market, enter the market with proper risk management, and manage emotions by maintaining discipline!

The market rewards the traders and investors who are prepared to take advantage of the opportunities when they appear and then execute their rules in a disciplined approach regardless of the excitement around them.

Are You Ready To Trade These Bullish Market Strategies?

Join thousands of profitable traders that trust BTCDana for their CFD trading. Our advanced platform provides the tools, analysis, and support for you to profit from bullish markets.

Get started trading today at btcdana.com and see why smart traders use BTCDana for consistent profits in roaring markets.