What is a Currency Pair? - Let's Talk About Currency Pairs at the Basic Level.

In the forex market, you NEVER trade one currency at one time. Currencies are always traded in currency pairs and a currency pair reflects the exchange rate between two different currencies. Imagine the currencies are placed on a see-saw and one currency will always be measured against the other currency.

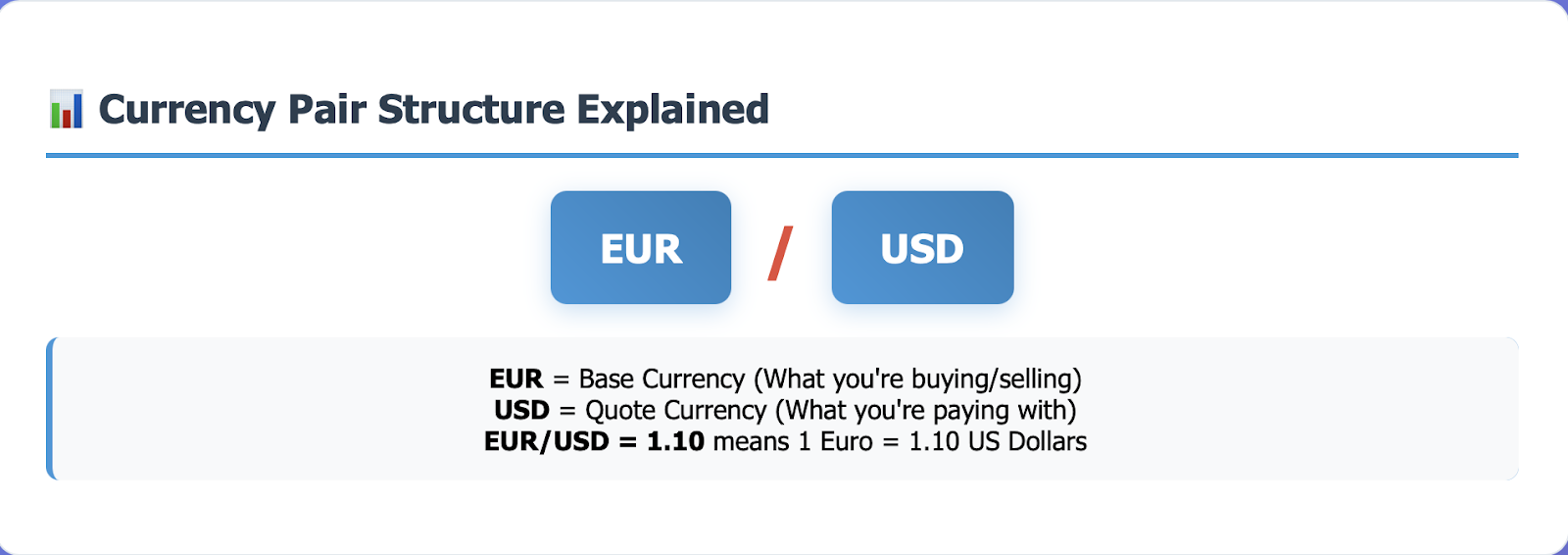

Understanding the Structure: XXX/YYY

Every currency pair is in the same format: XXX/YYY. Where:

-

XXX is the base currency (the first currency in the pair)

-

YYY is the quote currency (the second currency in the pair)

For example, (in EUR/USD):

-

EUR (Euro) is the base currency

-

USD (US Dollar) is the quote currency

Base Currency vs. Quote Currency

When you see EUR/USD = 1.10, this means:

1 Euro = 1.10 US Dollars

-

You need 1.10 US Dollars to buy 1 Euros

-

You are "buying" or "selling" the base currency (EUR)

-

You are "paying" with the quote currency (USD)

Trading Logic: What You Are Actually Buying and Selling?

When trading currency pairs

-

Buying EUR/USD means you are buying Euros and selling US Dollars

-

Selling EUR/USD means you are selling Euros and buying US Dollars

You are betting on whether the Euro will get stronger or weaker compared to the Dollar.

Using a Simple Analogy: The Apple and Orange Change

Think of currency pairs like the fruit exchange:

"1 apple = 2 oranges" is analogous to "EUR/USD = 1.10"

-

If apples become more expensive, you are now going to need 3 oranges for 1 apple

-

If apples become less expensive, you might only pay 1.5 oranges for 1 apple

You only need to remember that you are not trading currencies - you are trading the relationship of two currencies.

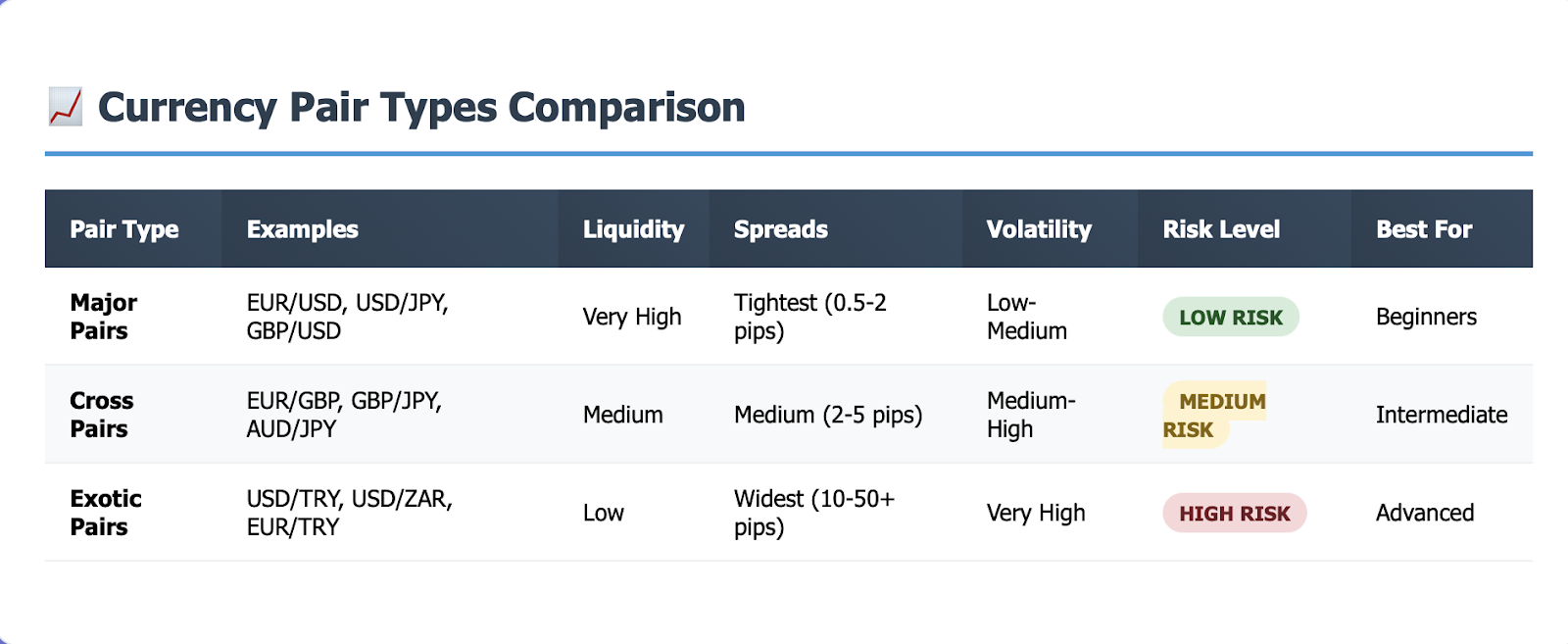

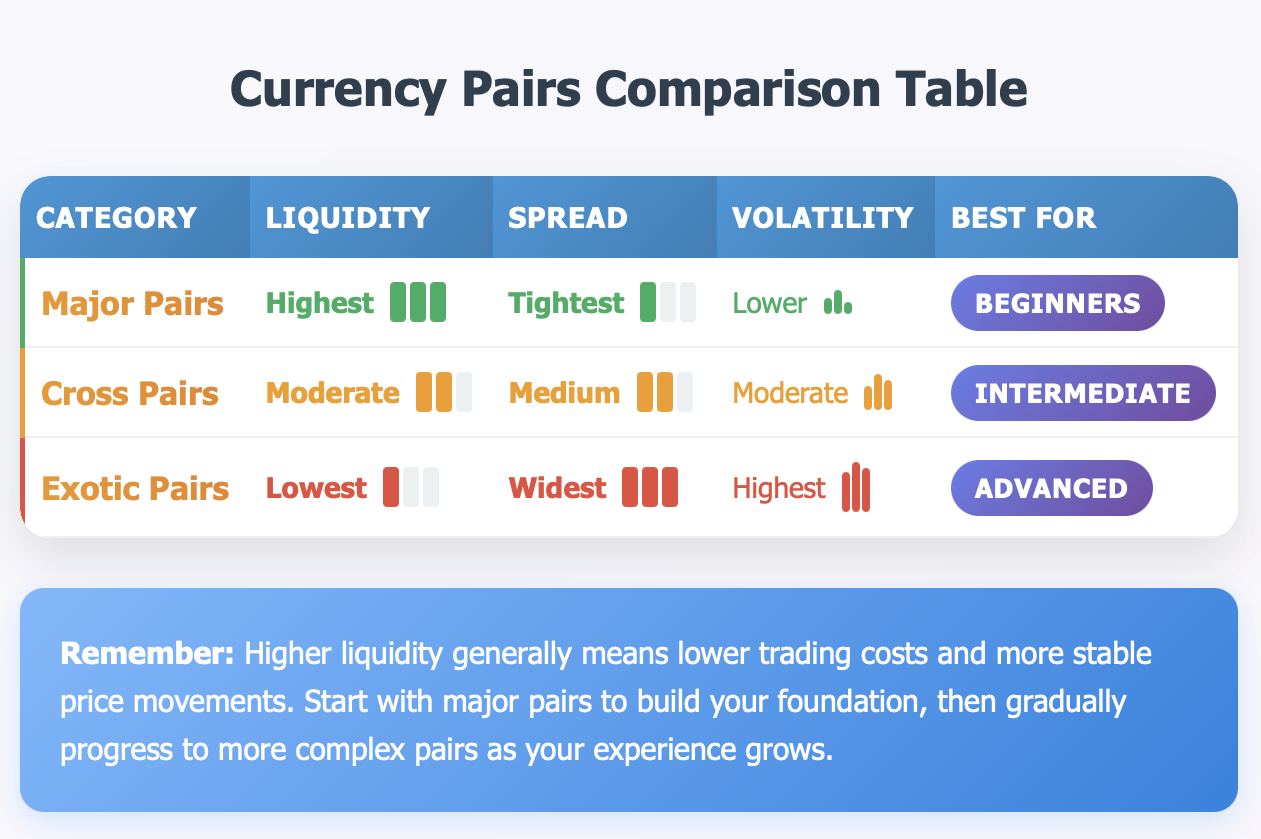

Common Currency Pair Types: Major vs Cross vs Exotic

Currencies are grouped into three primary types by trading volume and liquidity as well as the currencies traded.

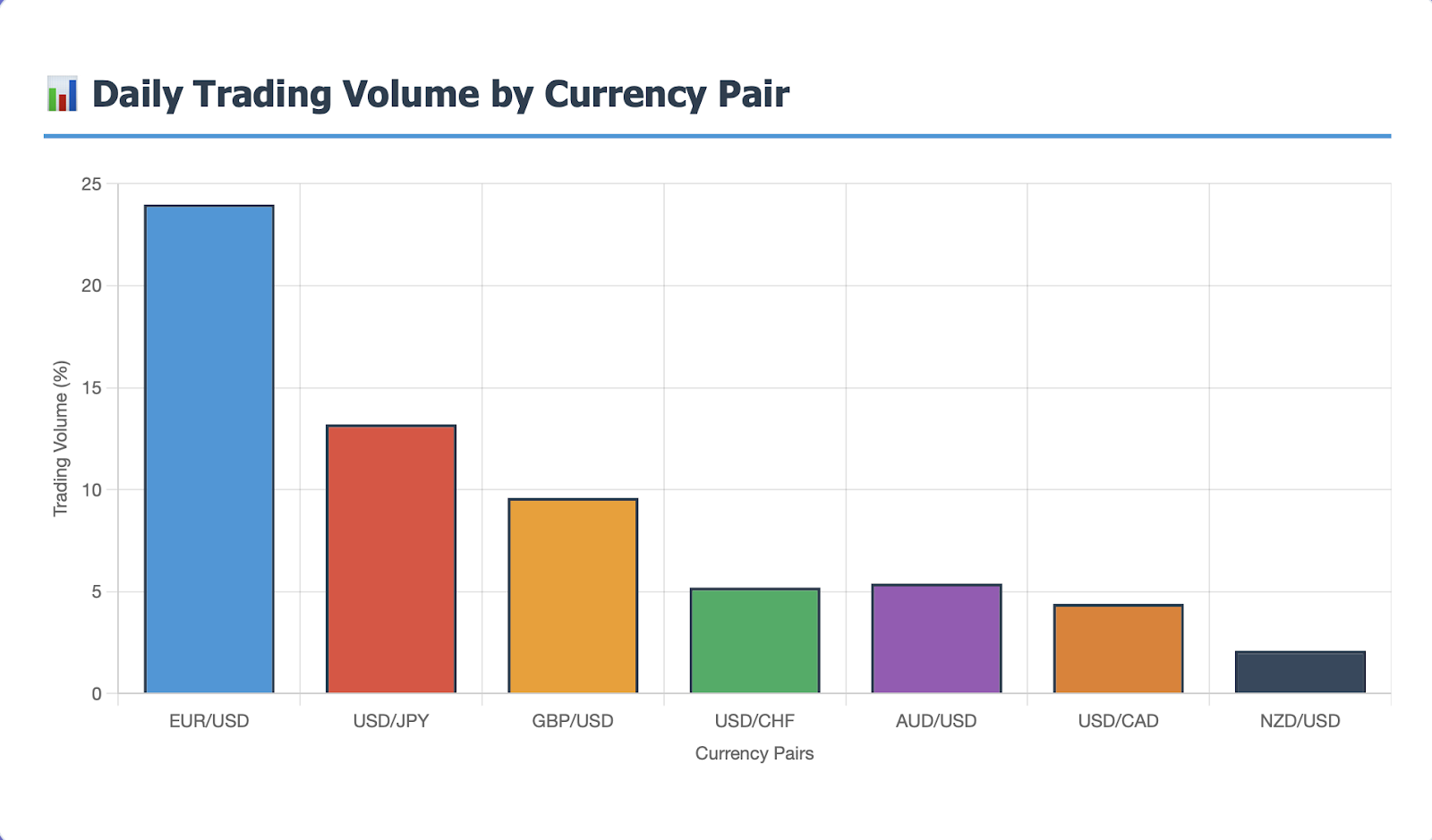

Major Currency Pairs

They always include the US Dollar (USD) and are the most traded:

-

EUR/USD (Euro/US Dollar) – Most traded currency pair in the world

-

USD/JPY (US Dollar/Japanese Yen)

-

GBP/USD (British Pound/US Dollar)

-

USD/CHF (US Dollar/Swiss Franc)

-

AUD/USD (Australian Dollar/US Dollar)

-

USD/CAD (US Dollar/Canadian Dollar)

-

NZD/USD (New Zealand Dollar/US Dollar)

Characteristics:

-

The most liquidity and trading volume

-

Tightest spreads (lowest trading costs)

-

Lower volatility and more dependable price movement

-

They are best for beginners

Cross Currency Pairs (Crosses)

Cross pairs eliminate the US Dollar completely:

-

EUR/GBP (Euro/British Pound)

-

EUR/JPY (Euro/Japanese Yen)

-

GBP/JPY (British Pound/Japanese Yen)

-

AUD/JPY (Australian Dollar/Japanese Yen)

-

CHF/JPY (Swiss Franc/Japanese Yen)

Features:

-

Medium liquidity

-

Wider spreads than majors

-

Can be much more volatile

-

Good for intermediate traders

Exotic Currency

Exotic pairs contain currencies from the developing world, or from smaller economies.

-

USD/TRY (US Dollar/Turkish Lira)

-

USD/ZAR (US Dollar/South Africa Rand)

-

USD/THB (US Dollar/Thai Baht)

-

EUR/TRY (Euro/Turkish Lira)

Features:

-

Lower liquidity

-

Widest spreads (highest transaction costs)

-

High volatility and erratic movements

-

Only suitable for seasoned traders.

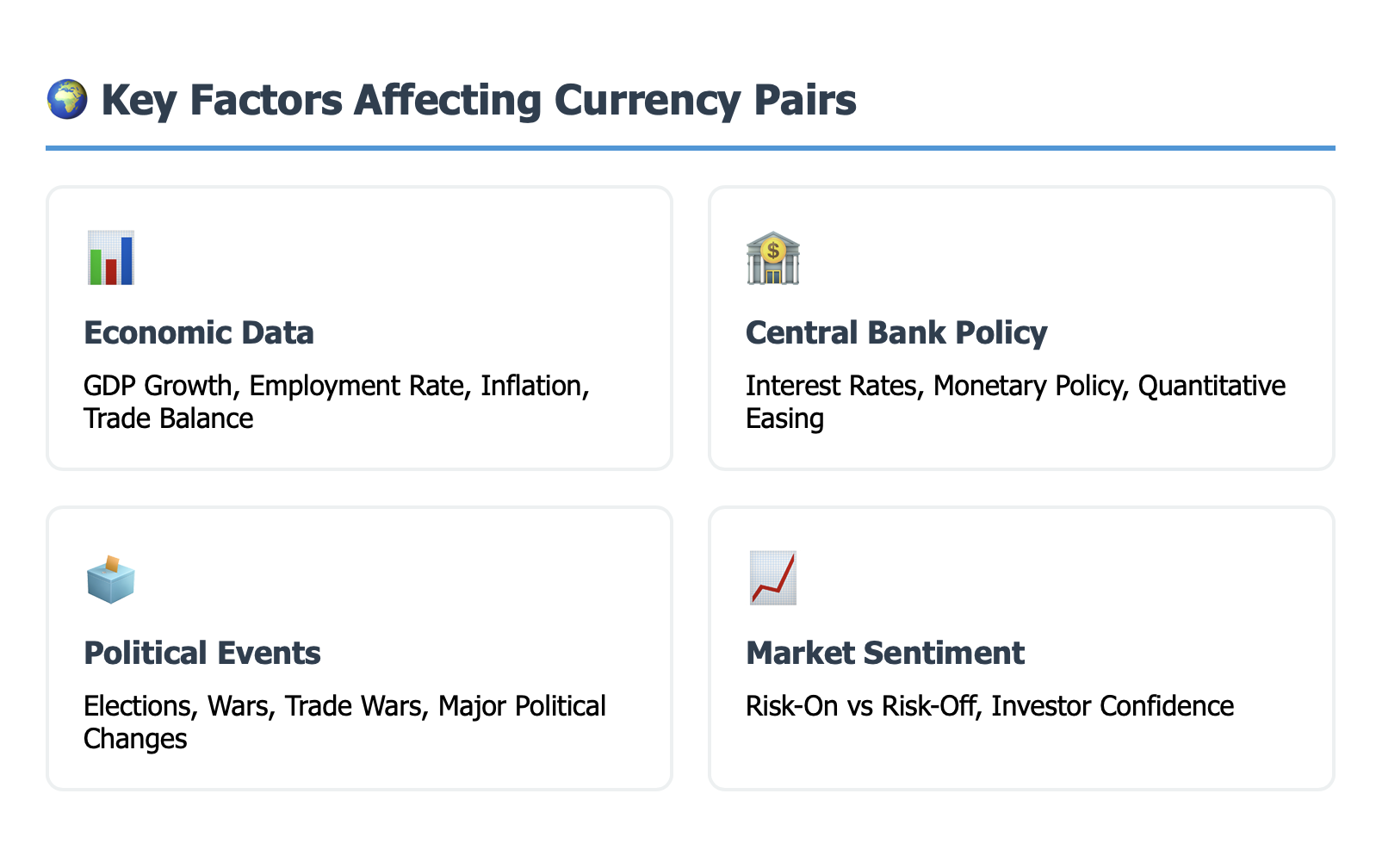

How Are Exchange Rates Created? - Factors That Impact Currency Pair Value

The Foreign Exchange (Forex) market is an Over-the-Counter (OTC) market where there is no central exchange or location. All prices are determined based on the supply and demand, the buyers and sellers, in the markets throughout the world.

Overall Economic Data

- GDP Growth: A strong economy is a positive for a currency

- Employment Rate/Unemployment Rate: Lower unemployment is usually better for currency

- Inflation Data: Moderate inflation usually helps currency valuation

- Trade Balance: Trade surplus obviously helps currency

- International Trade Relations

Central Bank Policy

- Interest Rates: Higher interest rates typically strengthen a currency

- Monetary Policy: Central banks can signal market expectations with hawkish (tighten policy) or dovish (loosen policy) descriptions

- Quantitative Easing: Printing money typically weakens a currency

Political Risk & Geopolitical factors

- Elections: Uncertainty can create volatility

- Wars and Conflict: Conflict usually means money goes to "safe haven" currencies

- Trade Wars: Tariffs and trade disputes decrease currency valuation

- Brexit-type events: Major political changes create significant volatility

Market Sentiment

Risk-On Sentiment: Investors will pursue riskier assets or currencies (AUD, NZD, CAD)

Risk-Off Sentiment: Investors will move to safe haven assets or currencies (USD, JPY, CHF)

Real World Illustrations

Impact of Federal Reserve Rate Hikes: After the Federal Reserve raises interest rates, the USD generally strengthens because:

-

Higher rates often will lead to foreign investments

-

Foreign investors seeking higher yields on assets denominated in USD

-

Consequently, USD/JPY rises and EUR/USD typically declines

Impact of Brexit on GBP/USD: The uncertainty around Brexit created massive volatility in GBP/USD because:

-

Political uncertainties created fears in investors

-

Economic forecasts became unknown

-

Leading to wide swings based on news or negotiations

Take away: Exchange rates reflect the comparative economic health and monetary policies between two countries, they are not random amounts!

How to Choose Which Currency Pairs to Trade – Strategies & Tips

Choosing currency pairs is important for successful trading. Here is how to choose wisely:

Criterion 1: Match Volatility with your Risk-Reward Tolerance

Low Volatility (Conservative):

-

EUR/USD, USD/CHF

-

Not large price swings

-

Lower potential profit downside but lower risk

Medium Volatility (Moderate):

-

GBP/USD, AUD/USD, USD/CAD

-

Good risk-reward ratio

High Volatility (Aggressive):

-

GBP/JPY, EUR/GBP, exotic pairs

-

Large price swings providing more profit but much more risk

Criterion 2: Know and Understand Spreads and Cost

Tightest: EUR/USD, USD/JPY, GBP/USD Medium: Cross pairs; EUR/GBP, AUD.JPY Widest: Exotic pairs; USD/TRY, USD/ZAR

Note: if you are trading frequently at this point it may make sense to consider the spread in choosing your currency pairs.

Criterion 3: Knowing about the Economies

Only trade in pairs when you know both economies:

-

EUR/USD - You need to know the Eurozone economy and the US economy

-

USD/JPY - You need to know the Fed policy and Bank of Japan policy

-

GBP/USD - You need to know the UK economic indicators as well as US indicators

Suggestion- Recommended pairs by level of experience

Beginners

Trade: EUR/USD, USD/JPY Why?

-

These are the most liquid and stable pairs available

-

They have many educational materials freely available for you to study

-

They can be counted on to behave predictably around major news events

-

They have tight spreads so you save on transaction costs

Intermediate Traders

Start trading: GBP/USD, AUD/USD, USD/CAD Why?

-

They have more volatility so you will have more opportunities to make money

-

They will still have great documentation and analyst reports

-

Great way for you to learn more advanced strategies

Advanced Traders

-

Trade: Cross pairs(GBP/JPY, EUR/GBP, etc.) and some select exotics Why?

-

You will get more high volatility trading opportunities for your risk management skill level

-

Less liquid because the finance world is crowded into a few pairs

-

More correlation trading available to you

Trading Style Considerations

Day Trading: Only follow major pairs with tight spreads.

Swing Trading: Consider pairs with lighter volatility.

Position Trading: All pairs, but note long-term fundamentals.

Scalping: Focus on the EUR/USD and the USD/JPY, for fastest execution.

Case Study Examples

Beginner Trader "Sarah":

- Trades EUR/USD

- Trades with knowledge of ECB and Fed announcements

- Practises trades with 0.1 lot sizes

- After mastering one pair, she will move to another

Experienced Trader "Mike":

- Trades GBP/JPY for increased volatility.

- Incorporating correlation pairs to GBP/USD and USD/JPY.

- Trades larger position sizes relative to the beginner trader.

- Don't have one method for trading, incorporates technical analysis and fundamental analysis.

Golden Rule: It is better to master 2-3 pairs rather than trade 10+ pairs without having a clear grasp of it.

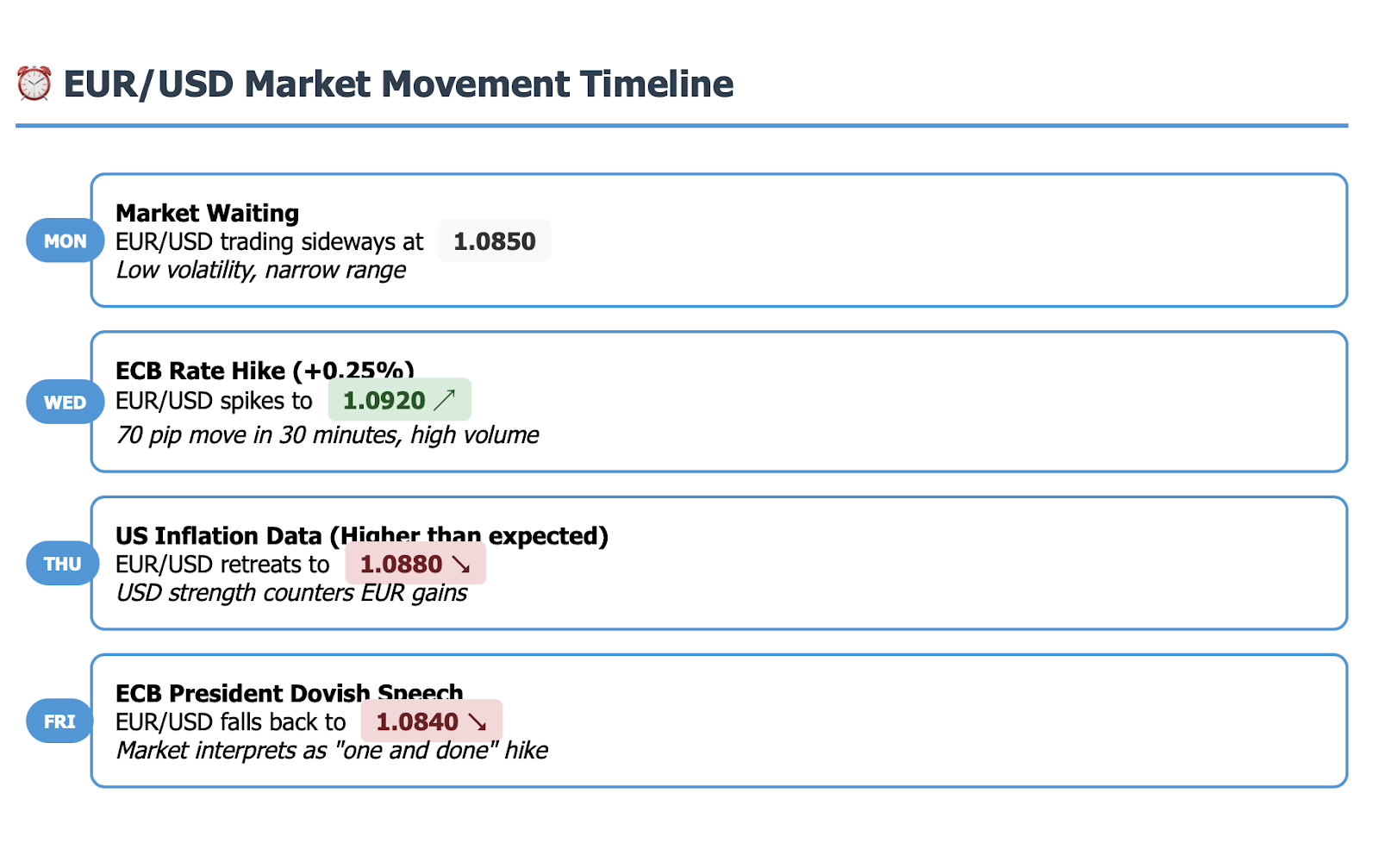

Example of a Live Market

We can follow a recent movement in the EUR/USD market to follow the dynamics of a currency pair.

Example: EUR/USD in an ECB Rate Decision Scenario

Scenario: European Central Bank releases interest rate decision; Timeframe: One trading week; Initial Rate: EUR/USD: (1.0850)

Market Movement Timeline

-

Monday: EUR/USD is flat, trading sideways around 1.0850 - market is waiting for the ECB - Low volatility and a very narrow trading range

-

Wednesday: ECB announces 0.25% hike: EUR/USD spikes back up to 1.0920 - EUR/USD increased in a spike while trading lower - in 30 minutes

The 0.25% hike made the Euro more attractive and not surprisingly trading volume had also increased dramatically

-

Thursday: US inflation data come out (higher than expected): EUR/USD moves back down to 1.0880 Rates remained high but overall STRONG US data was a better story for the USD.

In this example we can clearly see both currencies matter in a currency movement.

-

Friday: ECB President speaks dovishly and EUR/USD retracts to 1.0840. The market interpreted his comments as a "one and done" hike, resulting in the weekly close being at its opening levels again.

Trading Analysis

Profitable Long Trade Example:

-

Entry: 1.0860 (before decision of ECB)

-

Exit: 1.0910 (after spike from rate hike)

Pip profit: 50 pips

Strategy: trading on fundamental analysis whereby I was expecting a rate hike

Risk Management Lesson: Reason why dovish speech was a reminder:

-

Take profits as you hit targets

-

Do not carry through uncertain events

-

Both currencies in the pair are relevant

Key Learning Points

Affect of news: Central bank decisions create instantaneous volatility

Both sides are relevant: EUR strength counteracted by USD strength

Importance of timing: Same news can have different impacts based on market expectation

Risk Management: Even if you have the fundamental analysis correct, you still need a proper exit strategy

Common Mistakes in Understanding Currency Pairs

Don't make these common mistakes when learning about currency pairs:

Mistake 1: Confusing Base and Quote Currencies

Wrong Thought: "USD is strong, so I'm buying USD/JPY" Correct Thought: "USD is strong vs JPY, so USD/JPY should rise"

Tip: Always remember which currency you are actually buying or selling.

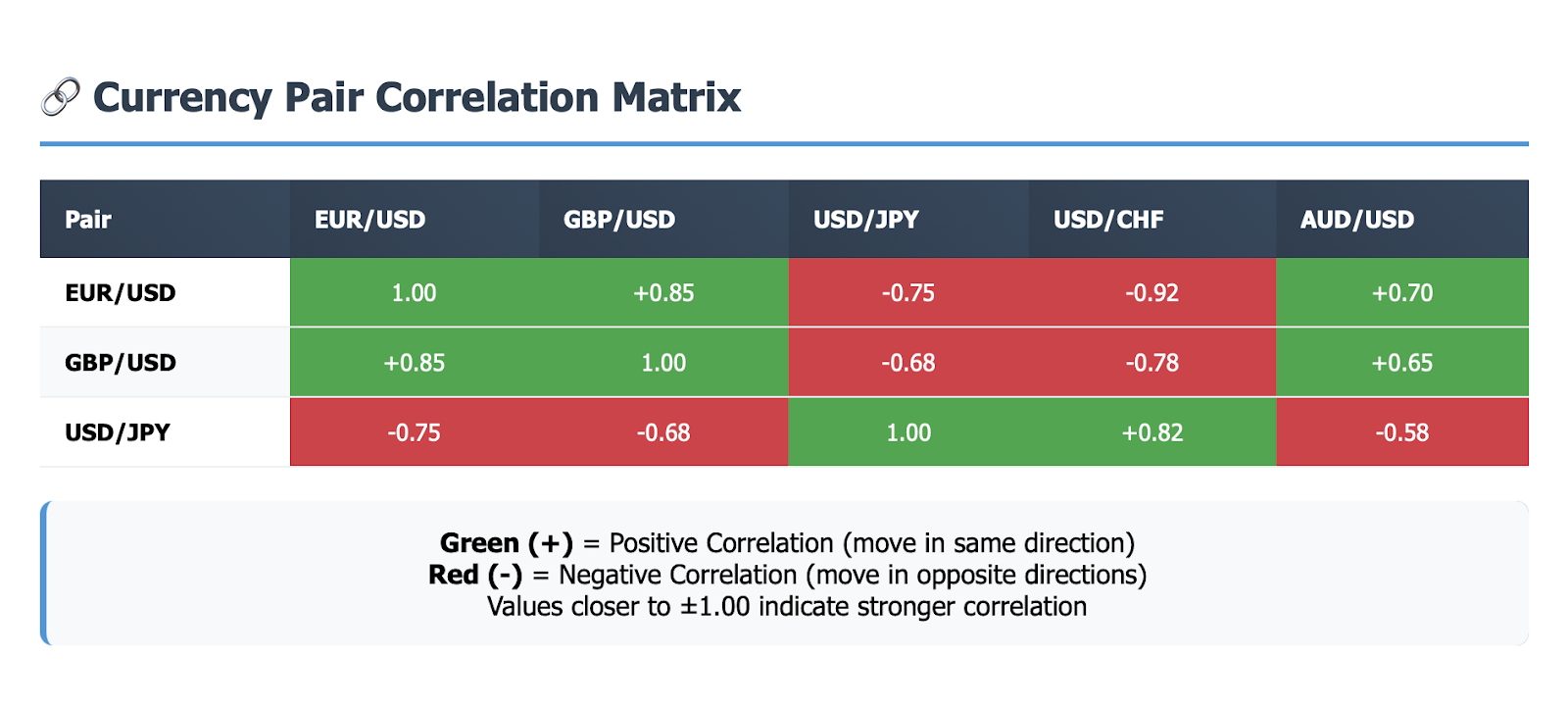

Mistake 2: Ignoring Currency Correlation

Many pairs move in the same direction, for example:

-

EUR/USD & GBP/USD: they often correlate positively (80%+ correlation)

-

USD/JPY & USD/CHF: both trades are USD-positive trades, so they will move in the same direction

-

AUD/USD & NZD/USD: both are commodity pairs / commodity currencies

Problem: You are long both EUR/USD and GBP/USD - you are doubling your exposure to USD weakness

Mistake 3: Not Accounting for Spread

Example Error

-

Pair spread is: 2 pips

-

Trade size is $10,000

You have lost $20 to the spread immediately

Solution: always account for these costs in either your profit target or position sizing.

Mistake 4: Ignoring Volatility Risks

Dangerous Assumption: "All currency pairs behave the same way"

Reality Check:

EUR/USD average daily range: ~50-80 pips

GBP/JPY average daily range: ~150-200 pips

USD/TRY average daily range: ~300-500 pips

Lesson: Scale position sizes accordingly with the volatility of the pair!

Mistake 5: Trading Without Economic Awareness

Incorrect Approach: Trading USD/CAD without knowing oil prices influence CAD

Correct Approach: Knowing Canada is an oil producer, so often oil prices and CAD will move together

Mistake 6: Complicated Pair Selection

Common Mistake: Trading 15+ pairs at the same time

Better Approach: Master 2-3 pairs and develop a deep understanding of their complexities

Important Note: Forex is not gambling – you are trading based on a systematic understanding of currency relationships and economic fundamentals.

Conclusion & Next Steps

To begin to understand currency pairs is to begin to understand successful forex trading. A little recap:

Summary

Currency pairs are not about individual currencies, they illustrate the relationship between two economies.

-

Major pairs are stable with tight spreads, and good for beginners.

-

Cross pairs and exotic pairs are for those with experience and an acceptance of risk.

-

Economic fundamentals leading to long term trends, and sentiment causes short term volatility.

-

Chose pairs that fit your experience level and risk appetite.

Your Next Steps

-

Begin with EUR/USD or USD/JPY – they are the two most liquid pairs, and are a good way to learn the basics.

-

Practice using a demo account so you can get an idea of how pairs move without risking your capital.

-

Stay up to date on economic calendars to see how news affects the pairs you have chosen.

-

Research correlation patterns with the different pairs.

-

Create a plan of trade that is relevant to the currency pairs you select.

Excited to Start Trading?

The intriguing world of fx trading is at your feet. Just a reminder, however, your greatest asset is knowledge. We recommend starting off with some paper trades to practice and learn these concepts without any real risk to you. Then, as you become more comfortable and knowledgable, you can transition to live trades.

To Keep Learning:

-

The concept of spreads and the cost of trading

-

Fundamental analysis of forex

-

Technical analysis of patterns and charts

-

Risk management concepts

-

Learning how to create a forex trading plan

Currency pairs are the foundation of forex. If you understand and can build upon this foundation, you will be greatly equipped to enter into the interesting world of foreign exchange markets.

Remember, forex trading carries a high level of risk and may not be suitable for all investors. Be sure to practice with demo accounts and never risk more than you can afford to lose.